In addition to the previously mentioned ACWX and ITOT, two more ETFs help us understand this year’s currency impact. DBAW invests in the same international companies as ACWX, but hedges to the U.S. dollar, thus removing the currency impact, and USDU tracks the U.S. dollar’s movements against other major currencies.

In other words, if you happened to own DBAW this year, you could be lagging the U.S. market just slightly due to the currency impact. Note the difference of the returns between ACWX and DBAW is about the total return of USDU.

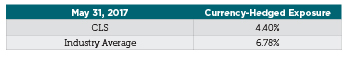

So, does CLS use any of these currency-hedged ETFs? A little, for the purpose of diversification, but not as much as the rest of the industry we compete against, as shown below (thanks to Jackson Lee for the data).

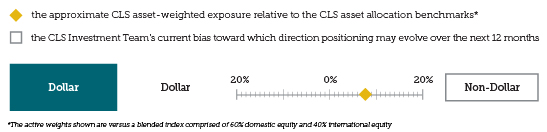

In fact, we have voted as a team to continue to increase our non-dollar exposure and let the currency diversification work in our favor. (See page 4 of the current issue of CLS Monthly Perspectives.)

Reviewing the impact of currencies on performance is always important, and it can often explain the outperformance or underperformance of an international stock market index. At CLS, we like the extra diversification we get from currencies, and we believe they can benefit the investor’s experience over time.

Case Eichenberger, CIMA, is Client Portfolio Manager at CLS Investments, a participant in the ETF Strategist Channel.

2832-CLS-8/10/2017