By: BCM Investment Team

The U.S. economy continues its pursuit of “normal” as both the manufacturing and services PMIs ease off their post-pandemic surges into more typical growth territory. Could this signal an easing in inflationary pressures as growth in services prices also decelerates? Banks meanwhile are easing lending standards to give greater access to consumer loans, but will there be high demand after so many used their stimulus payments to dig out of debt? And as JP Morgan publishes a somewhat dour prediction for the equity markets, bond yields around the world have fallen as supply and new issuance remains high—particularly in the high yield market. Meanwhile, in commodities, Bloomberg’s commodity index hit highest level since 2015 as oil prices jump following OPEC’s failure to make a deal on increasing production. Good thing renewables are expanding their market share… Looking globally, not everyone is on the road back to normal as China’s debt could mean they’re primed for a debt-related financial crisis.

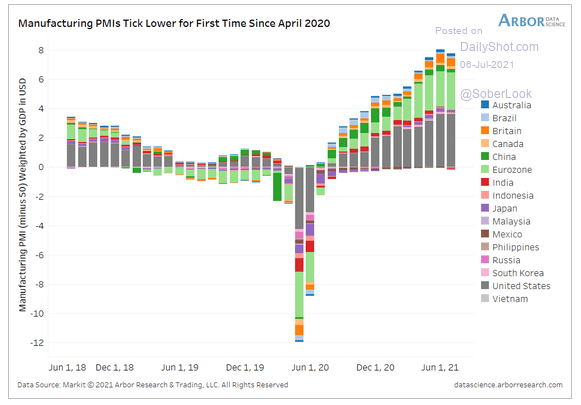

1. Unrealistically high PMI surges post-pandemic are beginning to normalize in solid growth territory:

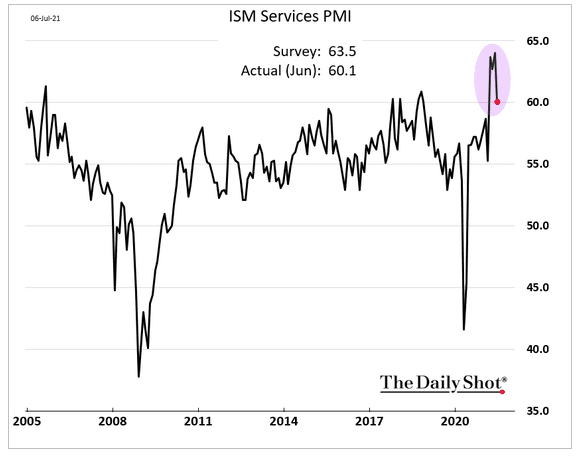

2. “Normalization” continues. Both the record highs following the pandemic lows are not normal. Any reading 50 or higher denotes a growing service economy.

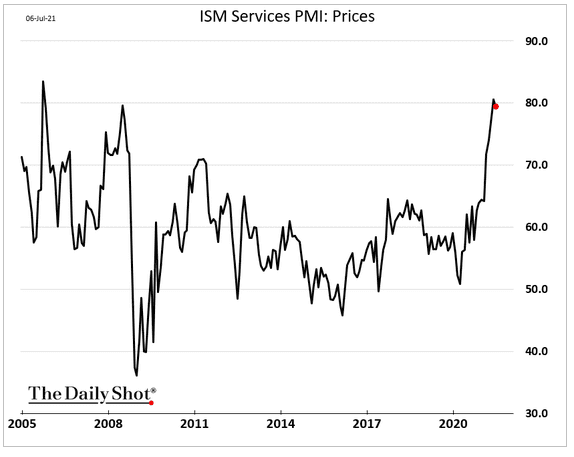

3. Have the inflationary pressures peaked?

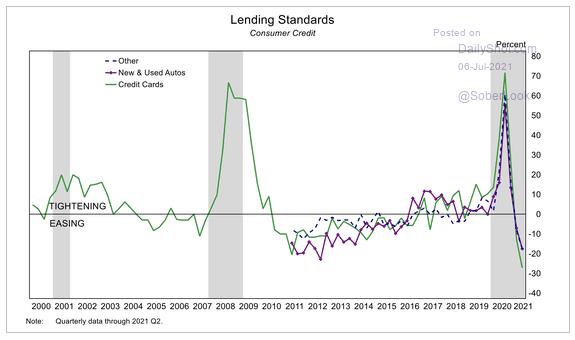

4. Banks, flush with cheap cash, are looking to lend and lowering their lending standards to do so:

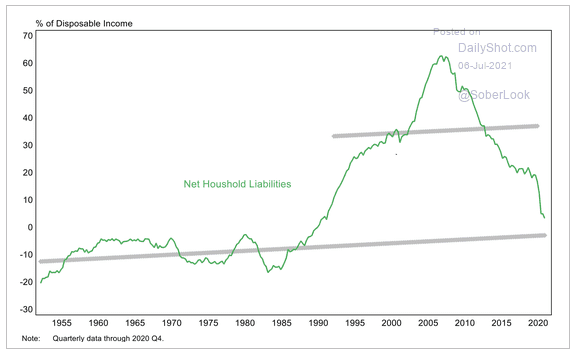

5. Yet many households have taken the government stimulus and savings from the lack of pandemic spending to pay off their debt:

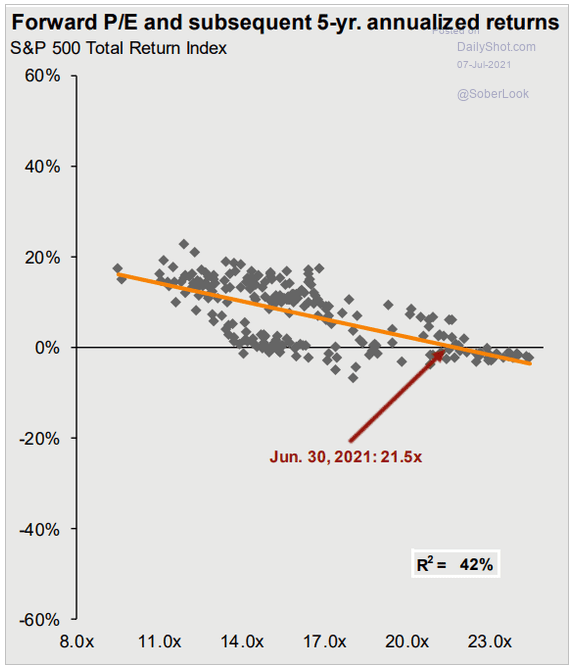

6. JP Morgan sees equity returns flat to down for the next five years. The question is “How?” Slow growth or a doozy of a correction around some good years…

7. Bond yields are also seeking “normal” and are now at the bottom of the rising channel:

8. Market demand and Treasury supply has been remarkable:

9. Record low rates and spreads have been a boon for junk bond issuance:

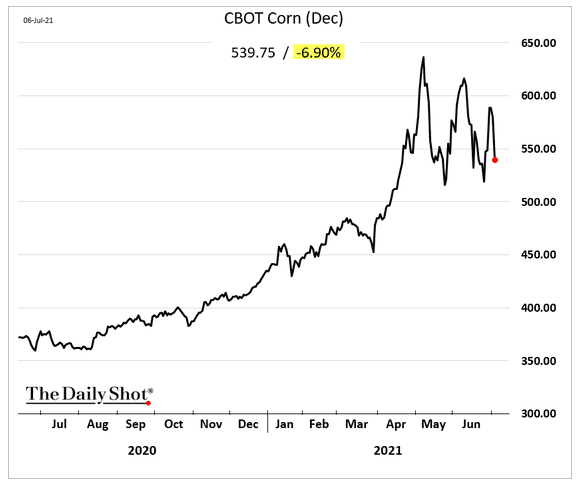

10. Commodities are also seeking “normal”. Corn has been volatile but is in the trend channel:

11. Energy and aluminum price surges have extended the overall commodity price rally:

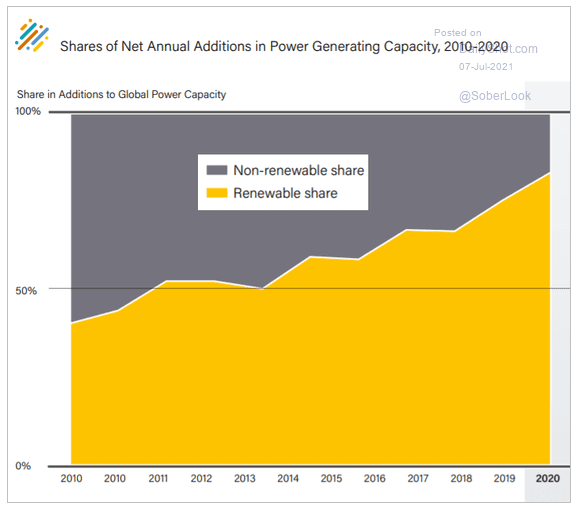

12. While energy prices continue to rise, the majority of new electricity generation is from renewables:

13. Is China setting up their own debt-related financial crisis?

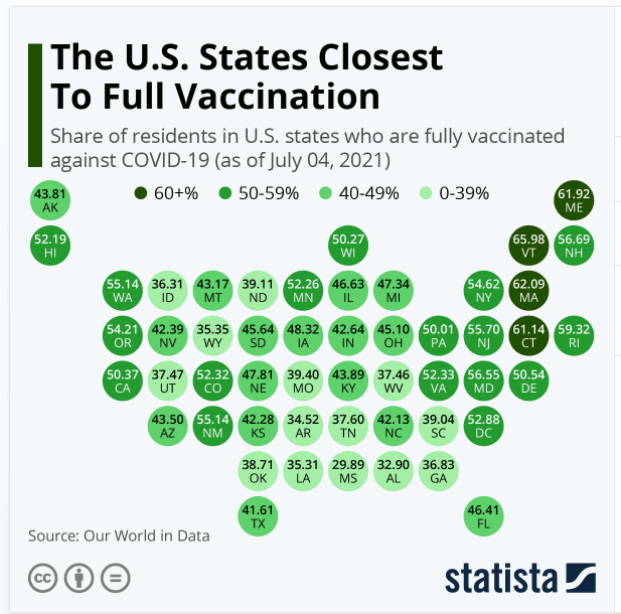

14. How safe are you?

This article was contributed by Beaumont Capital Management Investment Team, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.