Dorsey Wright is responsible for all aspects of portfolio construction and ongoing management, including fund selection and asset allocation decisions. The strategy includes being 100% invested in one of the five ETFs available from its model inventory.

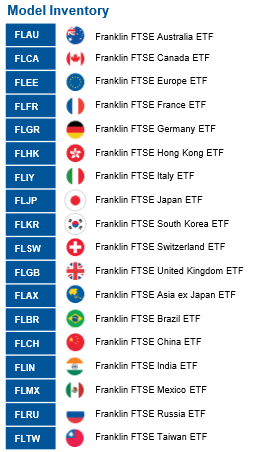

Furthermore, the model is to identify the relative strength of countries and regions in the international equity market space, maintaining exposure to those particular ETFs that are driven by price momentum. The model invests in the top five highest scoring ETFs from the inventory options and will rebalance that exposure only after the scores drop below the median.

“For us at Franklin Templeton, joining forces with providers such as Dorsey Wright is a relatively new initiative,” Caramazza added. “However, in keeping with our client-focus, we saw demand for low cost alternatives to broad passive indexes. We are managing that in-house with our active and smart beta ETFs, and working with outside providers like Dorsey Wright to build guided models using our passive single country and regional suite. These models are a logical extension of those same client demands.”

For more information on Franklin Templeton Investments, click here.

For more market trends, visit ETF Trends.