Exchange traded fund investors who are interested in a growth opportunity can focus on the future of the internet and how a portfolio of these innovators can help drive return and diversify a portfolio.

In the recent webcast, Beyond FAANG: The Internet’s Next-Gen Companies, James Wang, Analyst, ARK Invest; Nicholas Grous, Analyst, ARK Invest; and Rebecca Burke, VP, National ETF Sales, Resolute Investment Managers, highlighted the opportunities in the next generation of innovative companies and how investors should reconsider their portfolio allocations to better gain exposure to this new group of market giants. ARK Invest projects that over the next 10 years, about 50% of S&P 500 companies will be replaced by fast-growing innovators that are able to adapt to a quickly changing market environment.

Specifically, the strategists argued that areas like deep learning, or software that is able to be trained, will power the next generation of computing platforms. For example, conversational computers or smart speakers responded to 100 billion commands and questions in 2019 and the number increased 50% in just one year. Self-driving vehicles are quickly developing, with Waymo vehicles traveling more than 20 million fully autonomous miles. Additionally, consumer apps like TikTok use deep learning for video recommendations and is growing its user base 10x faster than is Snapchat.

Looking ahead, ARK Invest projects that artificial intelligence software should create a $18 billion market for A.I. hardware. AI accelerator chips, which optimize deep learning workloads, generated $4 billion in revenue last year, and ARK believes it should grow 36% at a compound annual growth rate to $18 billion by 2024.

“The slowdown in Moore’s Law means no more ‘free’ performance upgrades every two years. As a result, the server industry will have to invest in more computing hardware,” the strategists said.

The strategists also argued that deep learning could create more economic value than the Internet. In just two decades, the Internet added roughly $10 trillion to the global equity market cap. Since 2012, deep learning created $1 trillion in market capitalization, and ARK believes it will add $30 trillion by 2037.

A.I. is also expanding from vision to language. ARK believes that 2019 was the year of conversational A.I., with systems now able to understand and generate language with human-like accuracy. This new segment could also fuel indirect growth in other technology sectors since conversational AI requires 10 times the computing resources of computer vision and should spur large investments in the coming years.

Furthermore, the strategists highlighted five ongoing trends that could further support the case for the internet’s next generation of innovative companies: Firstly, the future of content distribution will come in the form of digital streaming services. Secondly, we are seeing an expansion in online gaming, especially in a post-coronavirus environment where everyone has been seeking more convenient entertainment avenues when stuck at home. Speaking of which, remote work could become the new normal. Meanwhile, there has been increased demand for zero-contact services like those that provide quick deliveries. Lastly, social commerce has quickly grown and is projected to reach about $3 trillion by 2025.

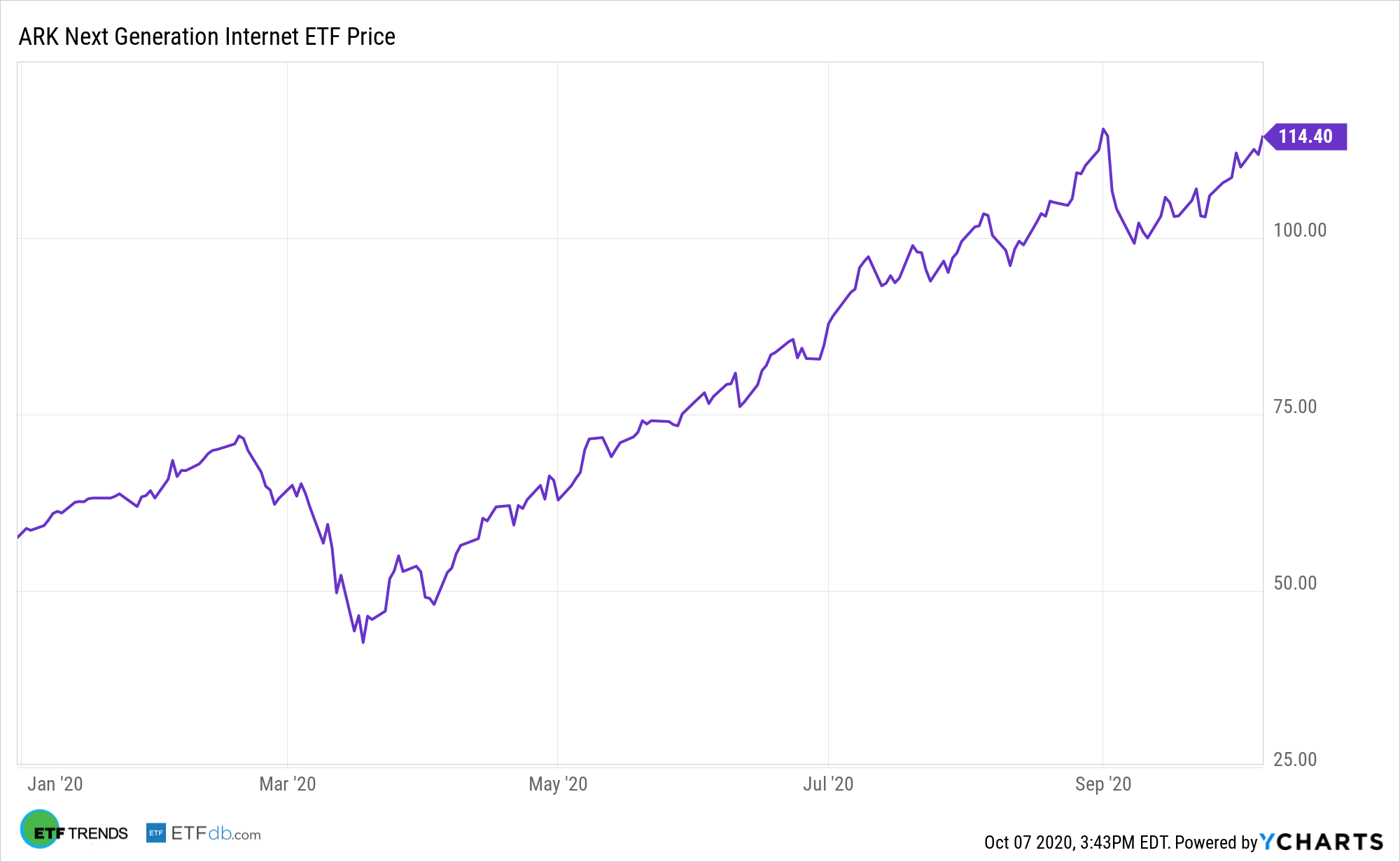

As a way to help investors capture this next generation of internet names, investors can look to the ARK Web x.0 ETF (NYSEArca: ARKW), an actively managed ETF strategy that is focused on and expected to benefit from shifting the bases of technology infrastructure to the cloud, enabling mobile, new and local services, such as companies that rely on or benefit from the increased use of shared technology, infrastructure and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media.

ARK Invest believes that ARKW can help investors access thematic multi-cap exposure to innovative internet technologies including cloud computing, big data, digital media, streaming, e-commerce, bitcoin and blockchain technologies, and the Internet of Things (IoT). The ETF aims to capture long-term growth with low correlation of relative returns to traditional growth strategies and negative correlation to value strategies, and it is a tool for diversification due to little overlap with traditional indices. The actively managed strategy combines top-down and bottom-up research in its portfolio management to identify innovative companies and convergence across markets, and this active strategy comes in the low-cost and efficient ETF wrapper.

Financial advisors who are interested in learning more about the innovative internet segment can watch the webcast here on demand.