As many try to seek out the next big growth idea, investors may consider an exchange traded fund that provides exposure to far-reaching software developments in deep learning.

On the recent webcast, Understanding the Investment Opportunity of Deep Learning, Catherine Wood, Chief Investment Officer and CEO ARK Invest, argued that innovation is the key to growth and investors should invest in leaders, enablers and beneficiaries of disruptive technologies.

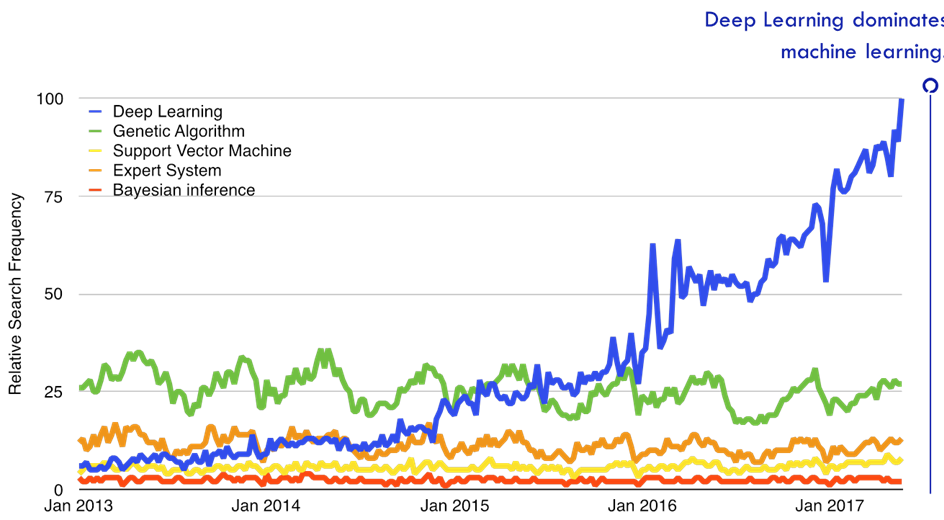

James Wang, Next Generation Internet Analyst at ARK Invest, explained that many are acquainted with classic artificial intelligence as based on deductive logic where rules are based on human ingenuity. As the space evolves, we now have machine learning, which is based on statistical inference or rules are inferred from data.

Deep learning is seen as a type of machine learning inspired by the biological brain. For example, services like AlphaGo, Sky translator and Tesla auto pilot can be categorized as deep learning. As the world grows more integrated, deep learning is also finding its way into various industries, such as transportation, robotics, radiology, semiconductors and retail.

Looking ahead, ARK projects deep learning could generate $6 trillion in revenue by 2027, Wang said. Globally, deep learning could approach a $17 trillion market cap in 20 years, or the equivalent of 35 Amazon-sized companies.