Key Takeaways

iShares Broad USD High Yield Corporate Bond ETF (USHY) earns a CFRA five-star rating based on its strong performance record, appealing holdings and its modest expense ratio.

iShares Broad USD High Yield Corporate Bond ETF (USHY) earns a CFRA five-star rating based on its strong performance record, appealing holdings and its modest expense ratio.- The fund sports a higher 30-day SEC yield than its larger peers while incurring a similar credit profile and charging a lower expense ratio.

- CFRA expects USHY to outperform its U.S. equity ETF peers over the next 9 months.

Fundamental Context

The CFRA Focus ETF for December is iShares Broad USD High Yield Corporate Bond ETF (USHY). The fund earns a five-star ETF rating from CFRA, based on a combination of its risk, reward, and cost attributes as well as using portfolio-level and fund-specific analysis. Rather than solely relying on past performance to offer a star rating for fixed income ETFs, CFRA also offers an assessment of the risk and reward of the portfolio and the fund’s costs. While the fund incurs elevated credit risk, we believe it is positioned to outperform the broader fixed income category in the nine months ahead. In contrast, USHY is rated a four-star by Morningstar, relying solely on past performance.

iShares iBoxx $ High Yield Corporate Bond ETF (HYG) remains the largest U.S. listed high yield bond with $18 billion in assets, but younger sibling USHY has been moving up the leader board with $8.3 billion and is approaching $8.7 billion SPDR Bloomberg Barclays High Yield Corporate Bond ETF (JNK) as the second-largest offering. Year-to-date through November 26, USHY gathered $1.0 billion of net ETF inflows, according to CFRA ETF data, while HYG had $1.4 billion of net outflows and JNK pulled in just $290 million of new money. USHY has appealed to more cost-conscious investors with its minuscule 0.15% fee that is one-third the price of HYG (0.48%) and less than half of JNK (0.40%). In addition, USHY provides broader diversification with more than 2,000 issues and has generated relatively robust performance.

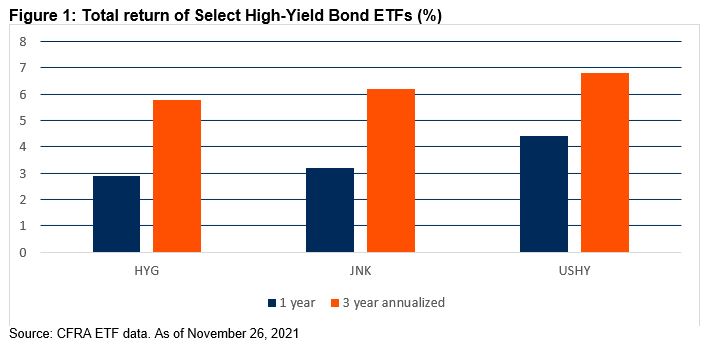

In the one-year ended November 26, USHY’s 4.39% gain was stronger than JNK (3.21%) and HYG (2.09%), while in the three-year period our focus ETF rose 6.84%, beating its peers by 66 basis points and 104 basis points, respectively.

USHY sports a higher 4.26% 30-day SEC yield versus JNK (4.06%) and HYG (3.69%), without taking on much additional risk. Looking to ETF holdings, USHY recently had 51% of its assets in BB-rated bonds (HYG and JNK had 54% and 49%, respectively) and just 12% in CCC- or below rated bonds (11% and 12%). Given the current low-interest rate environment, CFRA thinks investors will continue to be rewarded by taking on credit risk in 2022. USHY incurs slightly more interest-rate sensitivity with an average duration of 4.4 years (4.1 and 3.9), but we believe this has limited impact on its prospects.

USHY traded on average 1.7 million shares over the last 30 days. Though this is much less than the 25 million for HYG, investors are not being penalized. USHY’s median bid/ask spread over the past month was 0.02%, nearly in line with HYG’s 0.01%. Meanwhile, as of November 26, on all but two days in 2021, USHY traded with a premium or discount to net asset value of less than 0.50%, with a high of 0.56%. Unlike mutual funds, ETFs can be bought or sold for more than the value of the securities inside, so investors need to ensure they are not unknowingly paying a high premium with an illiquid ETF.

We believe USHY is positioned to outperform the fixed income ETF category in the nine months ahead due to its strong reward potential. While HYG and JNK also earn a top rating from CFRA, we think the USHY is a strong alternative for cost-conscious investors that do not need the elevated liquidity offered by peers.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.