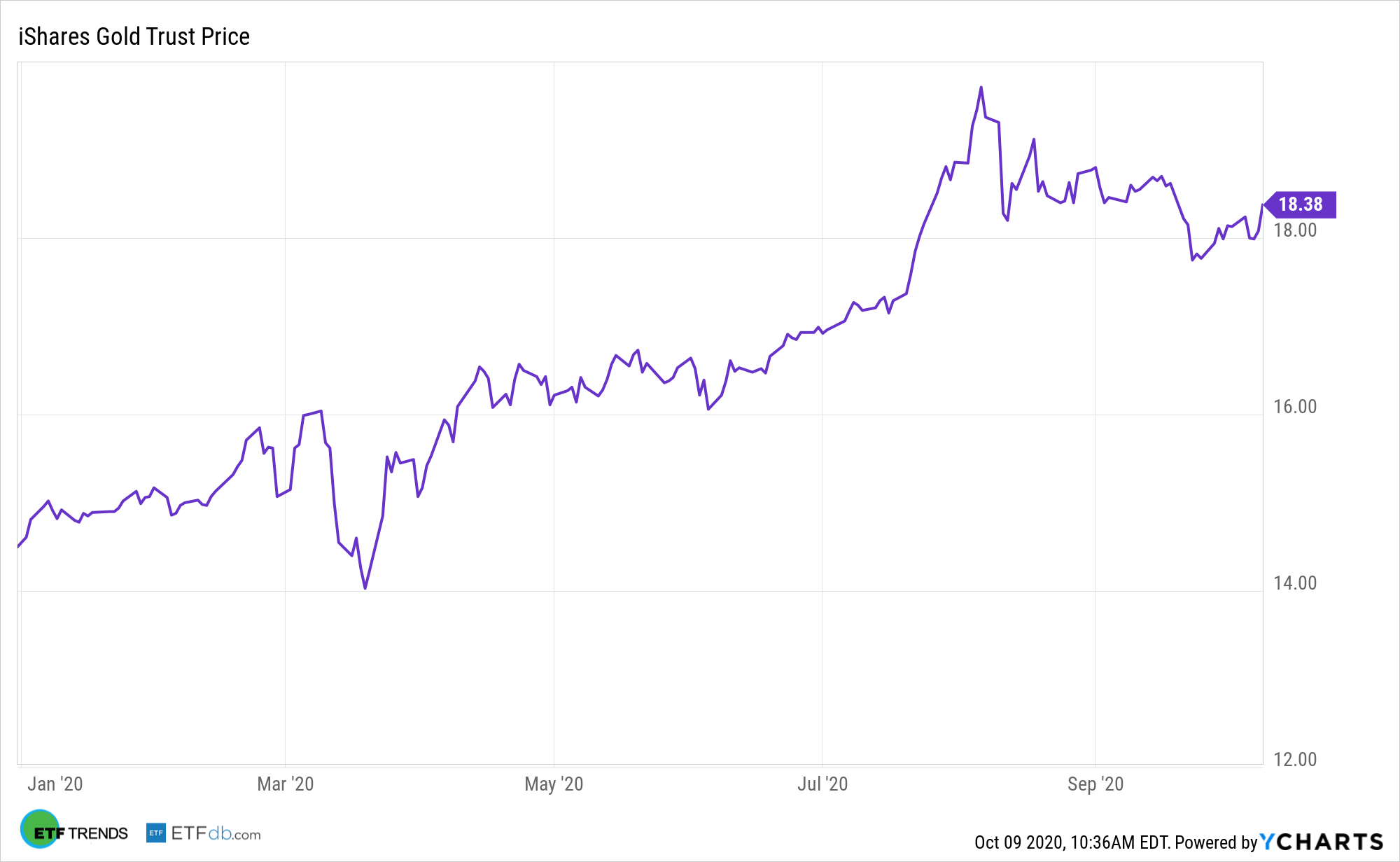

Gold and exchange traded funds such as the iShares Gold Trust (IAU) are often viewed as avenues to diversify into commodities for hedging exposure to riskier assets. However, IAU and friends are increasingly relevant because of low interest rates throughout the world, including here in the U.S.

IAU seeks to reflect generally the performance of the price of gold. The Trust seeks to reflect such performance before payment of the Trust’s expenses and liabilities. The Trust does not engage in any activities designed to obtain a profit from, or to ameliorate losses caused by, changes in the price of gold. The advisor intends to constitute a simple and cost-effective means of making an investment similar to an investment in gold. An investment in physical gold requires expensive and sometimes complicated arrangements in connection with the assay, transportation, warehousing, and insurance of the metal.

This year, gold is displaying a 0.3 beta to stocks, meaning its hedging properties may be decreasing, but its rate sensitivity is still useful.

“This shift in correlations is not unusual for gold. In different economic environments, gold can behave very differently,” notes BlackRock. “One explanation for the recent change is that both gold and equities are increasingly reacting to a common factor: Federal Reserve policy. To the extent investors expect the Fed’s new policy framework to favor easy money and negative real rates, both gold and stocks are responding to the same underlying dynamic. Given the Fed’s newfound commitment to a symmetrical inflation goal, i.e. one that will allow the economy to temporarily ‘run hot’ to compensate for years when inflation was below target, this dynamic is likely to continue.”

Gold In the Fed’s Focus

Even with the sell-offs as of late, it’s good to be gold right now. With more market uncertainty ahead, the precious metal is still topping the list when it comes to exchange-traded fund (ETF) choices, and investors who want gold exposure can look to ETFs to fill that need. Precious metals like gold offer investors an alternative to diversify their holdings, and like other commodities, gold will march to the beat of its own drum compared to the broader market.

Gold has been a popular play for investors to hedge against ongoing volatility, uncertainty, and inflationary risks. The coronavirus pandemic has ravaged economies and fueled heightened uncertainty, which has in turn helped support gold as a safe-haven bet. Meanwhile, the copious amounts of fiscal and monetary stimulus measures have inundated the markets with cash, fueling demand for physical assets like the hold that can help investors maintain their purchasing power.

“The fact that gold may be a less reliable hedge argues against adding to a position. That said the likelihood of a prolonged period of negative real rates supports holding some gold in your portfolio and adding should prices fall significantly from here,” according to BlackRock.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.