In an ultra-low yield environment, income investors should go beyond bonds and common stocks. Asset classes to embrace include preferred stocks, which are accessible via exchange traded funds, including the Global X U.S. Preferred ETF (Cboe: PFFD).

PFFD, which debuted in September 2017, tracks the ICE BofAML Diversified Core U.S. Preferred Securities Index. The $947.3 million fund has a 30-day SEC yield of 5.13%.

Preferred stocks are a type of hybrid security that show bond- and equity-like characteristics. The shares are issued by financial institutions, utilities, and telecom companies, among others. Within the securities hierarchy, preferreds are senior to common stocks but junior to corporate bonds. Additionally, preferred stocks issue dividends on a regular basis, but investors don’t usually enjoy capital appreciation on par with common shares.

“Due to their relatively small size, preferreds can often be overlooked by portfolio managers. But preferreds have unique characteristics, often contributing yield, potential tax benefits, and diversification to investors,” writes Global X analyst Rohan Reddy. “For example, fixed rate preferreds currently yield 4.58%, higher than REITs and emerging market (EM) bonds.”

The Suite of Global X Preferred ETFs

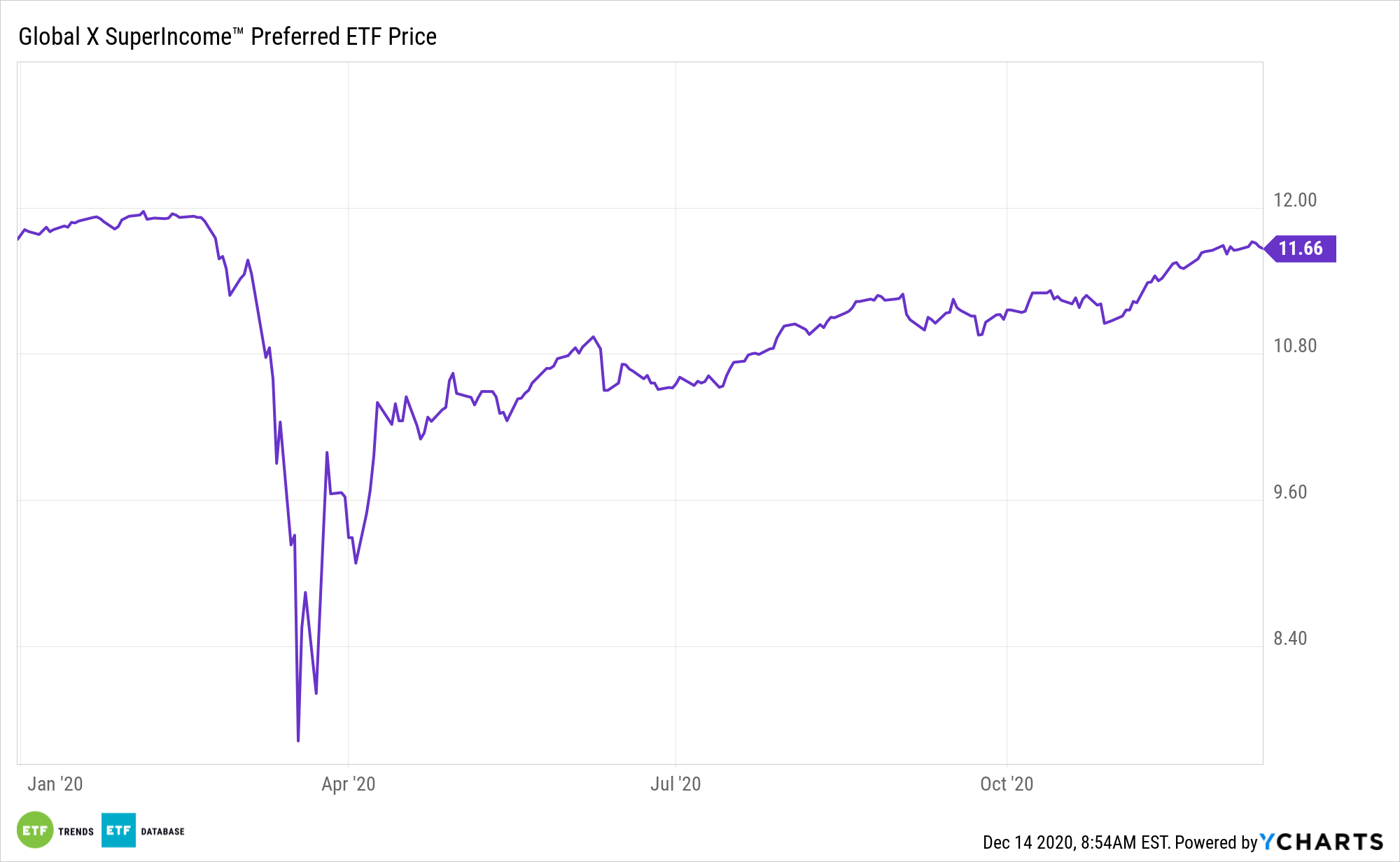

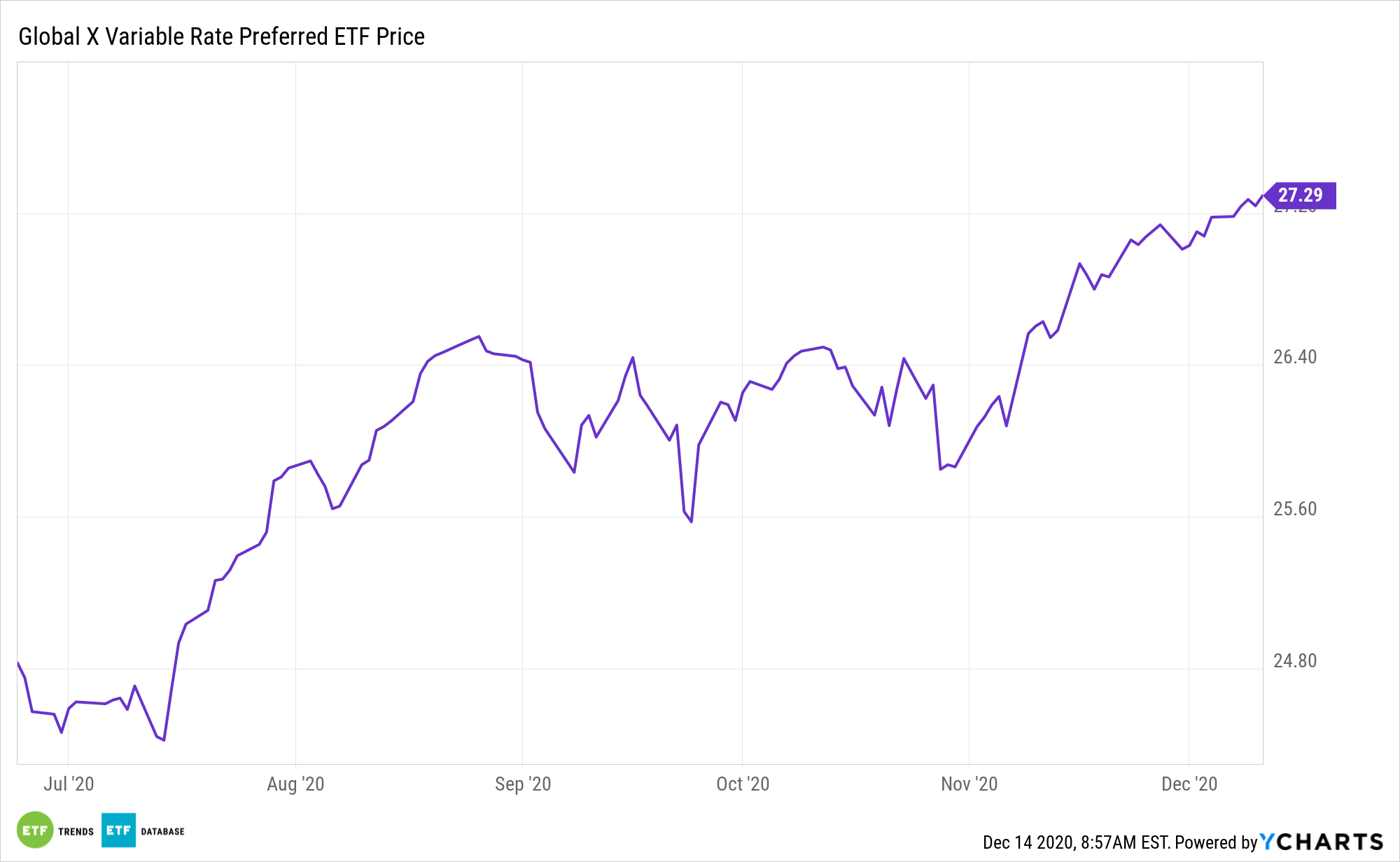

Global X also sponsors the Global X Variable Rate Preferred ETF (PFFV) and the high yielding SuperIncome™ Preferred ETF (SPFF).

With PFFV, which debuted in June, investors can efficiently access the traditionally shorter-duration variable rate segment of the preferred stock space. Variable rate preferreds can include securities that offer fixed-to-floating rate coupons or those that offer floating rate coupons for the entire life of the issuance. By allocating to securities with variable coupon payments, investors may utilize PFFV to lower the duration, or interest rate risk, of their portfolios, while potentially achieving the higher yields typically associated with the preferred stock asset class. PFFV comes with an expense ratio of 0.25%, which is half of the industry average.

While investors can own individual preferreds or actively managed funds addressing the asset class, there are some benefits to the passive ETF wrapper.

“Mutual funds are composed of 60% $1000 par preferreds, on average, compared to just 31% in passive ETFs,” notes Global X’s Reddy. “$1000 par securities are typically traded over-the-counter (OTC) and their coupons are more often variable rather than fixed. Because of these variable coupons, they often exhibit lower duration than $25 par securities, which are far more common, are mainly exchange-traded, and typically pay fixed coupons. ETFs tend to be more heavily weighted in $25 par securities.”

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.