By Head of Global Benchmark Indexes Advancement for Indexology Blog

As we enter the 2020s with interest in worldwide geopolitical volatility, here are some key points about volatility and the performance of options-related indexes the 2010s.

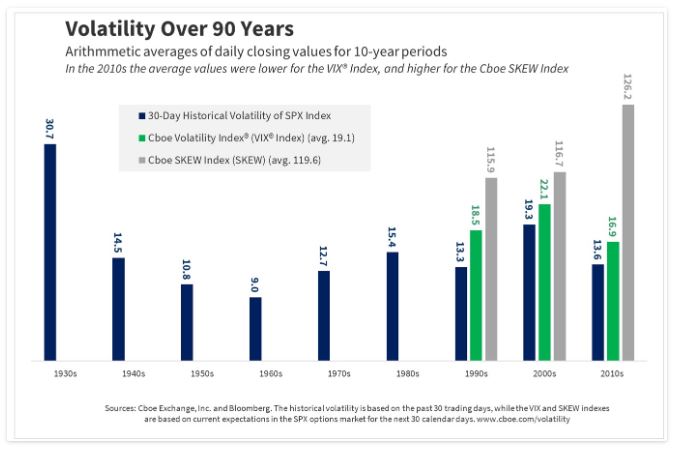

How Did Equity Volatility in the 2010s Compare to Volatility in Previous Decades?

The average of the daily closing values of the VIX® Index in the 2010s was 16.9 (24% below the 22.1 average for the previous decade). In recent years some observers have questioned whether there was too much complacency in the markets, and if the VIX Index was unusually low in light of trade wars and geopolitical uncertainties. In answer to these questions, one could note that:

(1) The average of the daily closing values for the S&P 500® Index 30-day historical volatility was only 13.6 in the 2010s, but 16.2 over the past 90 years, (and the VIX Index arguably was not “low” when compared with historical volatility in the 2010s), and

(2) In the 2010s the average of the daily closing values of the Cboe® SKEW Index was 126.2 (about 8% higher than the previous two decades). The SKEW Index is a measure of the relative demand for tail risk protection. With the relatively high levels of the SKEW Index in recent years, it could be argued that there has not been too much market complacency regarding demand for tail risk protection.

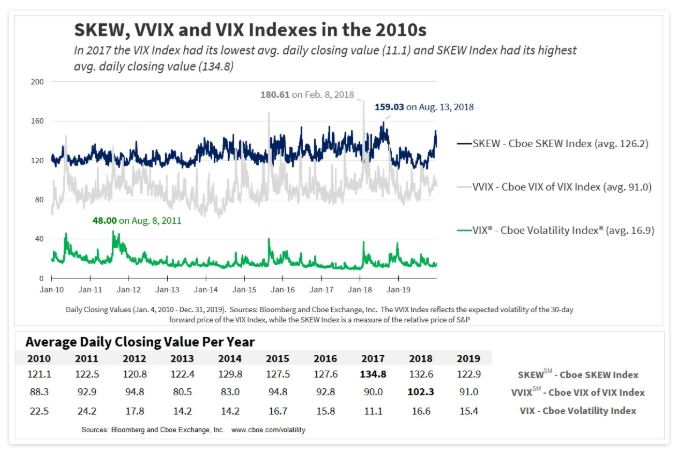

SKEW, VVIX and VIX Indexes in the 2010s

In 2017 the VIX Index had its lowest average daily closing value for a year (11.1), but the SKEW Index had its highest average daily closing value for a year (134.8), with growth in the relative demand for tail risk protection.

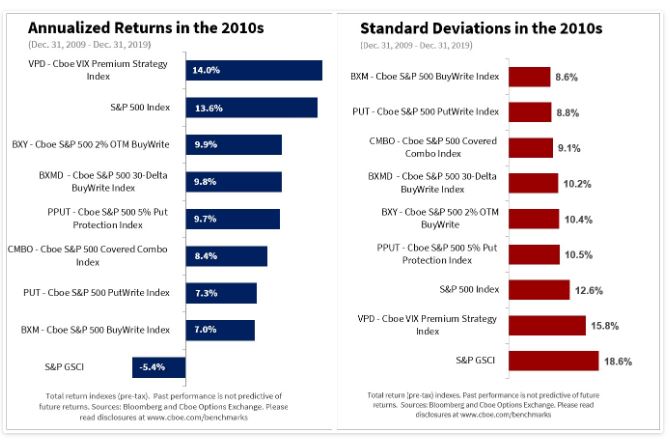

Benchmark Indexes Over Ten Years

In the 2010s the VPDSM Index rose 271%, and the S&P 500 Index rose 257%.

Six indexes that use S&P 500 (SPX) options had the lowest standard deviations in the Standard Deviations chart below.

While the 2010s generally saw higher-than-average equity growth and lower-than-average equity volatility, a number of analysts have suggested that in the 2020s there may be less growth and more overall volatility. Some indexes had less volatility in the 2010s, and this information may be useful to investors who are exploring ways to dampen their own portfolio volatility.