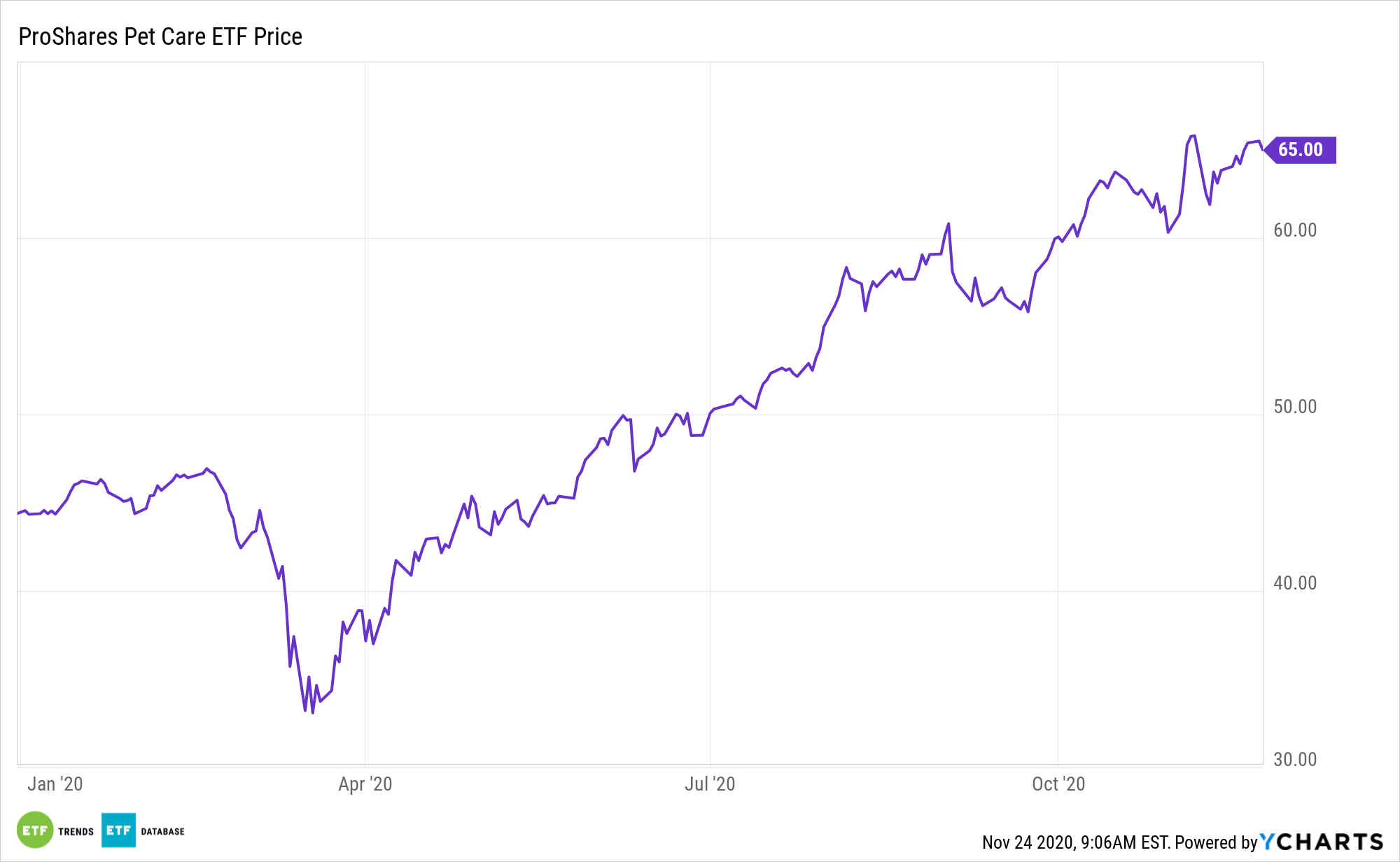

It’s not a bona fide retail exchange traded fund, but the ProShares Pet Care ETF (CBOE: PAWZ) is a credible play this holiday shopping season.

PAWZ, the first and only dedicated pet care, and retail ETF seek investment results, before fees and expenses, that track the performance of the FactSet Pet Care Index. The fund seeks to invest substantially all of its assets in the securities included in the index. Under normal circumstances, the fund will invest at least 80% of its total assets in the component securities of the index. The index consists of U.S. and non-U.S. companies that potentially stand to benefit from interest in, and resources spent on, pet ownership.

“Pet spending was already on the rise, and the $53 billion US pet supply industry is expected to reach $64 billion within four years, CNBC reported. During recessions in 2001 and 2009, pet spending grew by double digits, according to the National Retail Federation,” reports Business Insider.

Treat Your Pets, Treat Your Wallet: PAWZ Has Holiday Potential

PAWZ includes sectors such as veterinary pharmaceuticals, diagnostics, services, and product distributors; pet and pet supply stores, and pet food and supply manufacturing. Healthcare and retail stocks make up a significant portion of the PAWZ roster and the ProShares ETF has the potential to outperform traditional funds tracking those sectors.

PAWZ provides investors with the opportunity to gain broad exposure to public companies in the global pet care industry. It tracks the FactSet Pet Care Index, which is comprised of 24 companies that provide exposure to potential growth within the pet care industry.

“Nearly half of consumers who plan to buy pet supplies told Deloitte that they prefer to shop at pet stores. Online pet retailer Chewy has benefitted from the growth in both pets and e-commerce, putting together holiday gift guides for dogs, cats, and ‘pet parents.’ In Q2, Chewy’s sales grew 47% year over year, and its market value increased to $28.9 billion.” according to Business Insider.

PAWZ is one of the ETF’s with the largest allocations to Chewy.

More people are treating their pets like family, indicating that regardless of the economy, people spend money on their pets. A recent Harris Poll reports that 95% of owners consider their pets part of the family. They want their pets’ lives to be as happy, healthy and fulfilling as their own. They will spare little expense to ensure it.

Adding to this, pet owners are spending billions on premium-quality foods, state-of-the-art health care, insurance policies, luxury services, and more. In the United States, the pet care industry has seen twice the percentage growth of GDP since 2007, increasing even during the Great Recession.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.