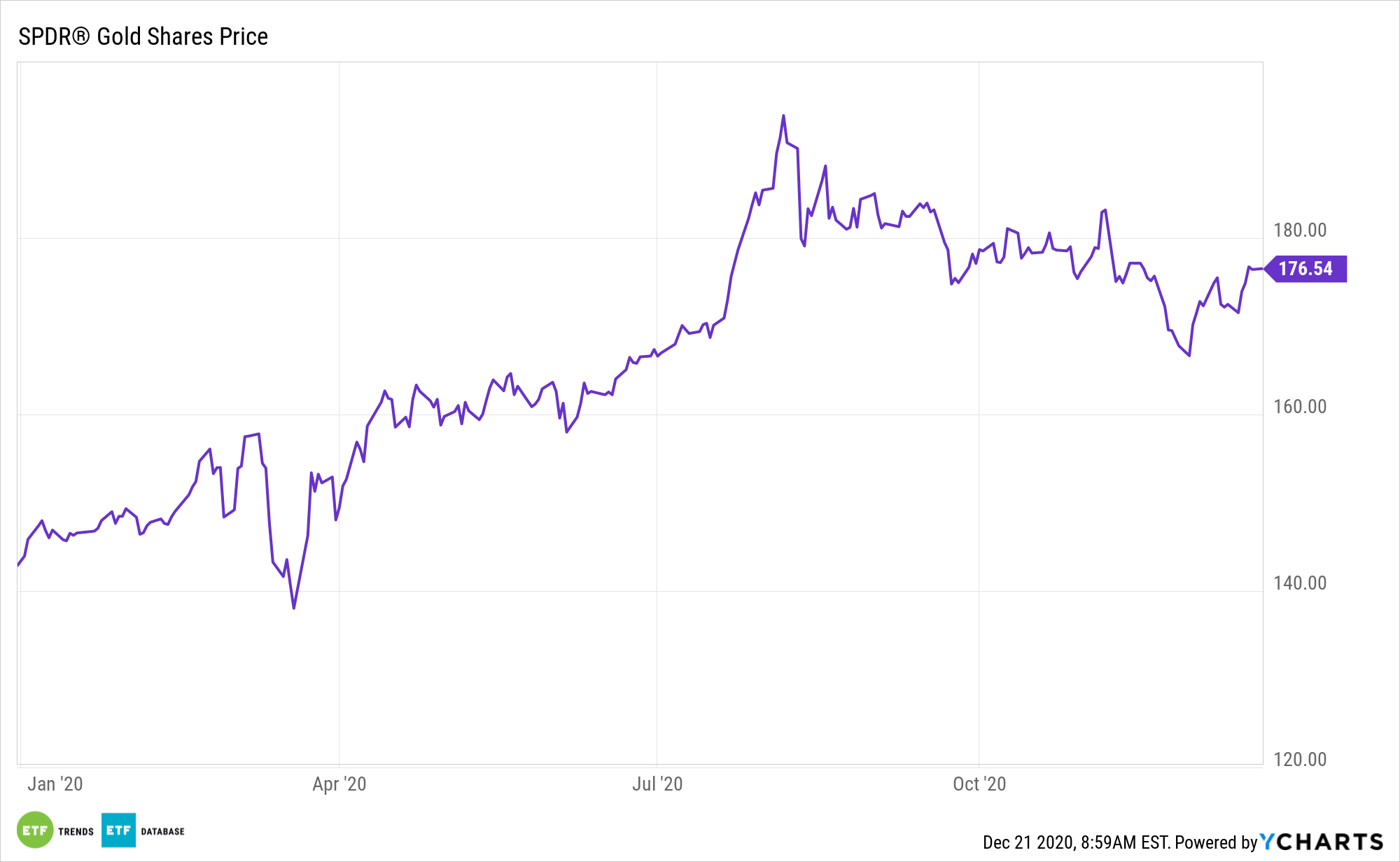

Gold exchange traded funds such as the SPDR Gold Shares (NYSEArca: GLD) and the SPDR Gold MiniShares (NYSEArca: GLDM) enjoyed some solid performances this year and more of the same could be in store for gold bullion in 2021.

Even after this year’s rally, the spot gold price is still below historical all-time highs when adjusted for inflation, and the precious metal has historically outperformed during periods of high inflation. The price gains have been supported by strong growth in global investment that partially offset weakness elsewhere amid ongoing Covid-19 disruptions. Additionally, the lower demand for jewelry has shown signs of recovery, which may add another layer of demand ahead. Meanwhile, year-to-date inflows into gold-backed ETFs have hit record levels.

“Next year will lay out a path for a new normal as COVID-19 vaccines are distributed and the economic recovery gets underway. But where does this leave gold, especially considering that the global monetary policy remains very accommodative?” reports Anna Golubova for Kitco News.

The GLD and GLDM ETFs Still Have Their Luster

Looking ahead, we can expect the Federal Reserve’s monetary policy to affect ongoing gold demand. Real interest rates have historically created an accommodative environment for gold bullion. Gold returns during periods of negative real rates have been double their historic average.

“If you take the optimistic side and imagine that many people do get vaccinated and the vaccine works, then the economy should take off in a serious way in the second half of next year. The inflationary scenario becomes a real possibility, which is positive for metals,” Kitco Metals global trading director Peter Hug said.

It’s no secret that gold has been a major beneficiary during the coronavirus pandemic as a viable safe haven asset amid all the uncertainty in the capital markets.

GLD is one of the most popular ETFs in the world, offering exposure to an asset class that has become increasingly important to the asset allocation process in recent years. GLD can be used in several different ways; some may establish short-term positions as a way of hedging against equity market volatility, dollar weakness, or inflation. Others may wish to include gold exposure as part of a long-term investment strategy. GLD is a relatively straightforward product: the underlying assets consist of gold bullion stored in secure vaults. As such, the price of this ETF can be expected to move in lockstep with spot gold prices.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.