Russia plays a crucial role with regard to palladium on a global scale, and the ongoing conflict with Ukraine is only putting increased strain on supply, which could keep prices elevated.

“Russia’s invasion of Ukraine has infused massive uncertainty into the global palladium supply chain, pushing the autocatalyst metal to an all-time intraday high of US$3,442 per ounce in early March,” an Investing News report noted. “Positioned as the second largest producer of palladium, Russia’s annual output of the precious metal accounts for 37 percent of primary palladium supply.”

The invasion prompted the London Platinum and Palladium Market (LPPM) to take action. The LPPM de-listed a pair of Russian refiners from its good delivery list in response to the invasion.

“These two refiners will no longer be accepted for LPPM Good Delivery into the London/Zurich Bullion market until further notice,” the LLPM announcement said. “Bars and sponges produced after April 8, 2022, will no longer be regarded as Good Delivery or Sponge Accredited.”

Convenient Palladium Exposure

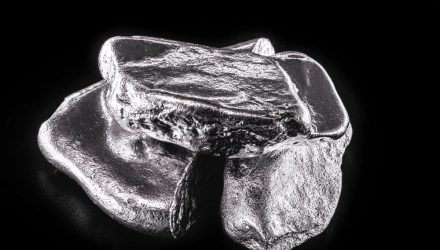

Rather than dealing with the hassle of purchasing then storing palladium, investors can also get access via exchange traded funds (ETFs). In particular, investors can give the Aberdeen Standard Physical Palladium Shares ETF (PALL) a closer look.

The fund seeks to reflect the performance of the price of physical palladium. PALL has been following the broader S&P GSCI Palladium Index closely within the last five years, providing an opportunity for investors to reap the long-term benefits of investing in palladium.

Key features of PALL as presented on a fact sheet:

- Physically-backed: Cost-effective and convenient access to physical palladium.

- Transparency: The metal is held in allocated bars, and a bar list is posted daily on abrdn.com/usa/etf.

- Pricing: The metal is priced off the LPPM’s specifications for Good Delivery, which is an internationally recognized and transparent benchmark for pricing physical palladium.

- Vault location: Metal is held in London, United Kingdom, at a secured vault of J.P. Morgan Chase Bank, N.A.

- Vault inspection: Inspectorate International, a leading physical commodity auditor, inspects the vault twice per year (including once at random).

For more news, information, and strategy, visit the Alternatives Channel.