With clean energy on the rise and coal seemingly on its last legs, there’s plenty of talk about the power sources of the future. Uranium and the Global X Uranium ETF (URA) want to take part in that conversation.

URA seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Uranium & Nuclear Components Total Return Index. The fund invests at least 80% of its total assets in the securities of the underlying index and in American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”) based on the securities in the underlying index.

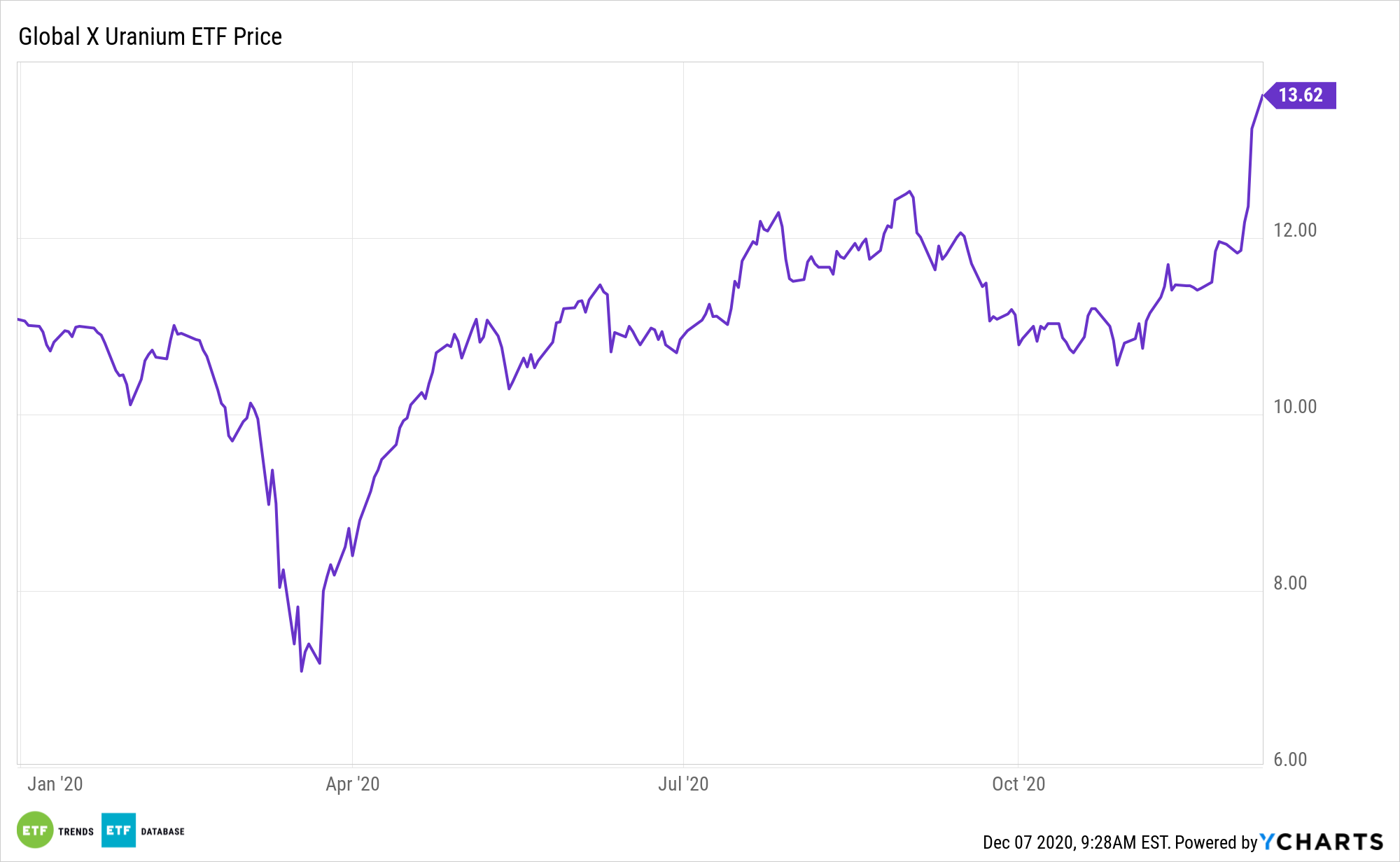

Investors are starting to embrace the URA story. Last Friday, the fund surged 7.12% on volume that was more than quadruple the daily average.

“Uranium stocks soared on Friday after House and Senate lawmakers revealed a compromise version of the annual National Defense Authorization Act. According to S&P Global, the bill effectively provides for the military to continue a policy under President-elect Joe Biden that classifies the domestic supplies of certain minerals such as uranium, graphite and lithium as vital to national security,” reports ZeroHedge.

Global X URA ETF Coming Into Its Own

As the world’s thirst for 24/7, emissions-free sources of alternative energy continue to grow, nuclear power is coming into its own. According to the World Nuclear Association’s most recent Nuclear Fuel Report there are 444 operating nuclear reactors, with 54 under construction, 111 planned, and 349 proposed.

“The space is so small and it makes so much sense. However, it would really be nice to see the spot U price catch a sustainable bid here,” writes Larry McDonald of the Bear Traps Report. “I am looking for a turn of the year trade in U, if not sooner. We need to see some utility to ink a relatively good sized contract to get things moving. That would be big. I am also looking for financial players to get more serious about throwing weight around in this sector. A group with decent capital at a multi-strat HF or a medium sized fund could allocate a few hundred mill and create their own reality in this sector, IMO. The order of operations would be to buy up positions in call option like U miners, then buy the U trusts trading at discounts and then hit the spot market hard. I think you would make money on all legs of that if you committed a few hundred mill to it.”

The uranium market has been supported by significant production cuts, reductions in producer inventories, and an increase in demand. Investors may be looking at the battered uranium miner space as a value play, given the improved strength in the sector.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.