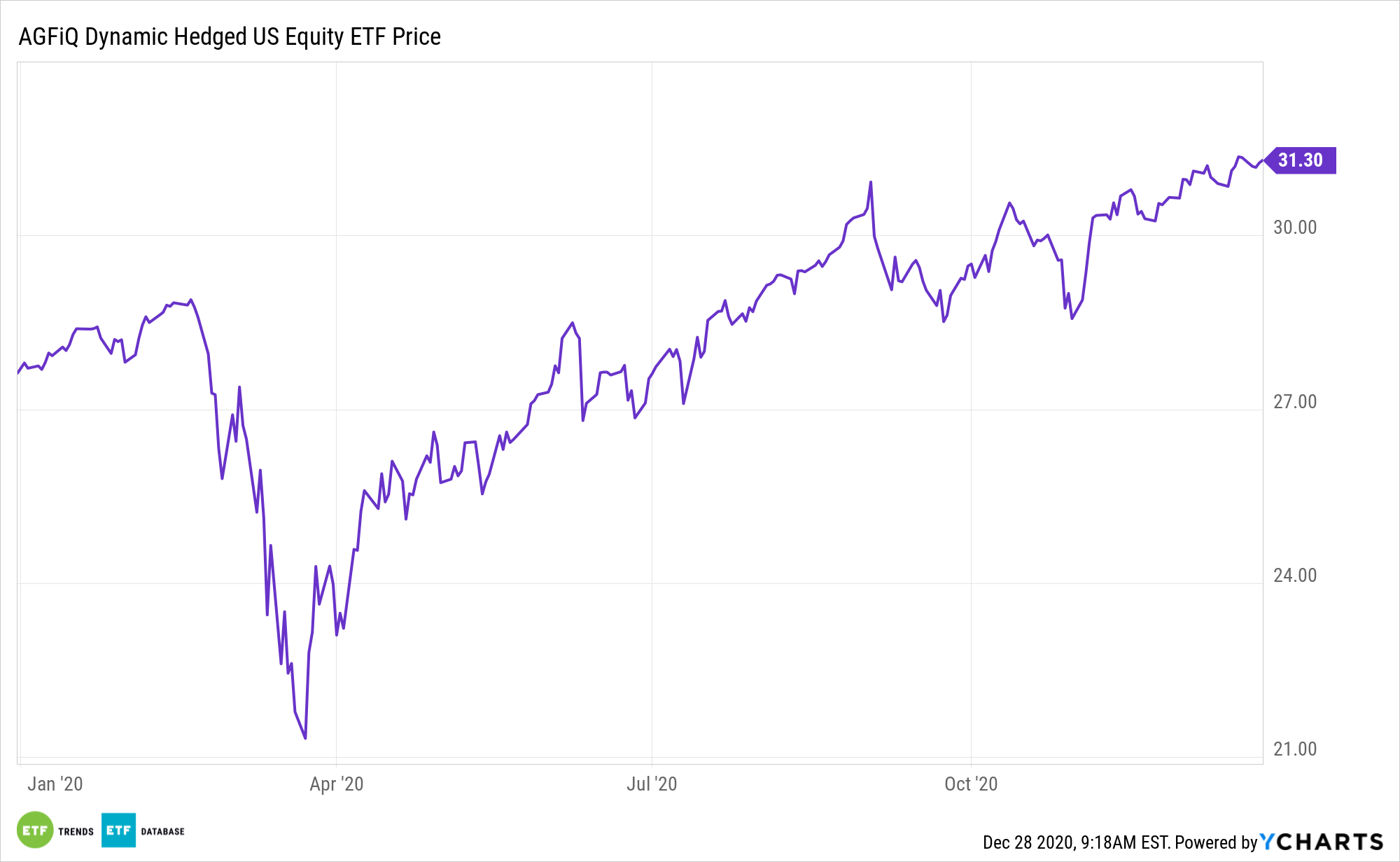

It’s safe to say that 2020 has been a banner year for equities, particularly when taking the March coronavirus tumble into account. However investors may want to evaluate preparation for uneasy times in 2021. Enter the AGFiQ Dynamic Hedged U.S. Equity ETF (USHG).

The AGFiQ Dynamic Hedged U.S. Equity ETF provides exposure to a diversified portfolio of U.S. equities while seeking to provide long-term capital appreciation with lower volatility using embedded downside risk management, which seeks to protect capital. The ETF offers exposure to the long-term growth potential of U.S. equities using a multi-factor approach designed in an effort to have lower volatility and better risk-adjusted returns relative to the market through its use of a dynamic hedging model.

ETFs have enjoyed significant growth over the past decade, largely due to their easy-to-use, low-cost nature. Financial advisors are increasingly shifting their clients toward ETFs to provide them with liquidity, transparency, and a tax-efficient way to invest their capital.

USHG offers traditional long exposure to U.S. stocks, but uses a multi-factor approach aimed at reducing volatility. Additionally, the fund uses “proprietary sector allocation and risk models are evaluated on a daily basis so the portfolio can be responsive to changing market conditions,” according to the issuer.

The Benefits of the USHG ETF

ETF traders who are looking to protect their portfolios from potential pullbacks ahead may consider some exposure to bearish or inverse ETFs to hedge against further falls.

The actively managed USHG operates as a fund-of-funds investment vehicle that invests primarily in sector-based ETFs and other ETFs with U.S. equity exposure. The managers employ proprietary, multi-factor quantitative models that use fundamental factors and market risk measurement techniques to help establish allocation to primary sectors of the S&P 500 Index.

USHG could better address volatility and risk management. Investors should remember that the economy is in the late stages of a normal business cycle. This, like all else, entails potential risk.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.