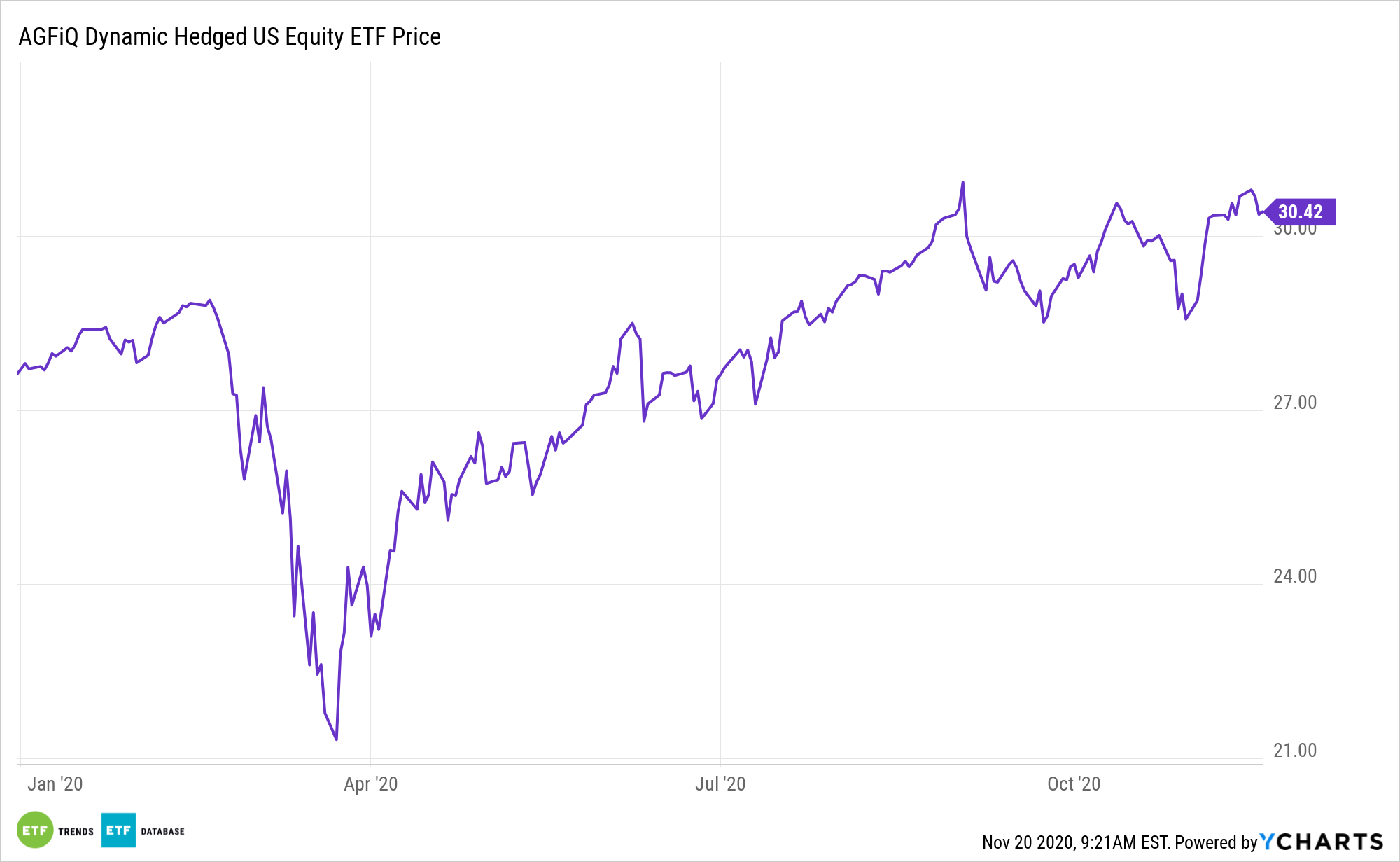

Equity markets are proving resilient in the back end of 2020, moving higher amid a contentious political season and rising COVID cases. Funds like the AGFiQ Dynamic Hedged U.S. Equity ETF (USHG) are still thriving.

The AGFiQ Dynamic Hedged U.S. Equity ETF provides exposure to a diversified portfolio of U.S. equities while seeking to provide long-term capital appreciation with lower volatility using embedded downside risk management, which seeks to protect capital. The ETF offers exposure to the long-term growth potential of U.S. equities using a multi-factor approach designed in an effort to have lower volatility and better risk-adjusted returns relative to the market through its use of a dynamic hedging model.

Meanwhile, negotiations between Democrats and the White House for another economic stimulus bill may add further volatility at a time when the S&P 500 is at its highest valuations since the late 1990s tech boom, according to Sam Stovall, Chief Investment Strategist at CFRA.

Reducing Volatility with the USHG ETF

USHG offers traditional long exposure to U.S. stocks, but uses a multi-factor approach aimed at reducing volatility. Additionally, the fund uses “proprietary sector allocation and risk models are evaluated on a daily basis so the portfolio can be responsive to changing market conditions,” according to the issuer.

U.S. stocks have rebounded and are heading toward new record highs, but some investors are already worried about the potential negative ramifications of the pandemic. ETF investors can consider alternative strategies to hedge against further market volatility ahead.

Pandemic fears only add to existing concerns over a weak economy with millions still unemployed, increasing coronavirus cases, and uncertainty over a stalled coronavirus stimulus package. Consequently, some are already looking at alternative investments to hedge market risks.

The actively managed USHG operates as a fund-of-funds investment vehicle that invests primarily in sector-based ETFs and other ETFs with U.S. equity exposure. The managers employ proprietary, multi-factor quantitative models that use fundamental factors and market risk measurement techniques to help establish allocation to primary sectors of the S&P 500 Index.

USHG could better address volatility and risk management. Investors should remember that the economy is in the late stages of a normal business cycle. This, like all else, entails potential risk.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.