Oil exchange traded fund investors shouldn’t expect a quick rebound any time soon as U.S. crude is on pace for its worst year since 2003 with the coronavirus pandemic dragging on demand and ample supply flooding the market.

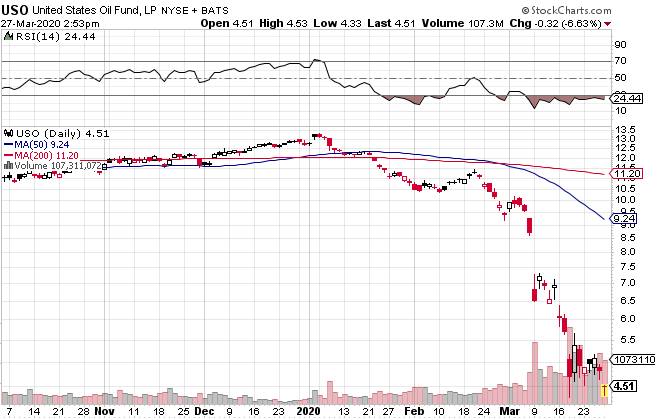

Crude oil prices continued to plunge on Friday. The United States Oil Fund (NYSEArca: USO), which tracks West Texas Intermediate crude oil futures, and the United States Brent Oil Fund (NYSEArca: BNO), which tracks Brent crude oil futures, declined 6.6% and 4.2%, respectively while WTI crude oil futures were down 3.7% to $21.8 per barrel and Brent crude was 4.7% lower to $25.1 per barrel.

According to major bank expectations, West Texas Intermediate futures, the main U.S. benchmark, is expected to trade at an average of $34.95 a barrel in 2020, the Wall Street Journal reports. Meanwhile, Brent crude, the global benchmark, will average $38.12 this year, its lowest since 2004.

Crude oil markets remained depressed as governments around the world imposed lockdowns on citizens and industries to contain the coronavirus or COVID-19 pandemic, which has severely damped demand for energy.

“Any producer action is rendered mute as long as demand estimates keep getting revised lower,” Harry Tchilinguirian, global head of commodity markets strategy at BNP Paribas, told the WSJ.

Meanwhile, talks between Saudi Arabia and Russia, two of the world’s largest oil producers, have deteriorated, with the Organization of Petroleum Exporting Countries maintaining steady supply to push out less efficient producers that are suffering from steeper losses and to capture greater market share.

“Demand destruction exacerbates the shock of a massive amount of barrels hitting the market,” Peter McGinn, market strategist at RJ O’Brien & Associates LLC, told Bloomberg. “OPEC needs to get back to the negotiation table and hammer out an agreement.”

The heads of both the International Energy Agency and Vitol Group, one of the world’s largest independent oil traders, warned that global oil demand could fall off by 20 million barrels a day, or 20%, in the weeks ahead. Additionally, Goldman Sachs Group Inc. calculated demand will dip by 18.7 million barrels a day in April.

United States Oil Fund