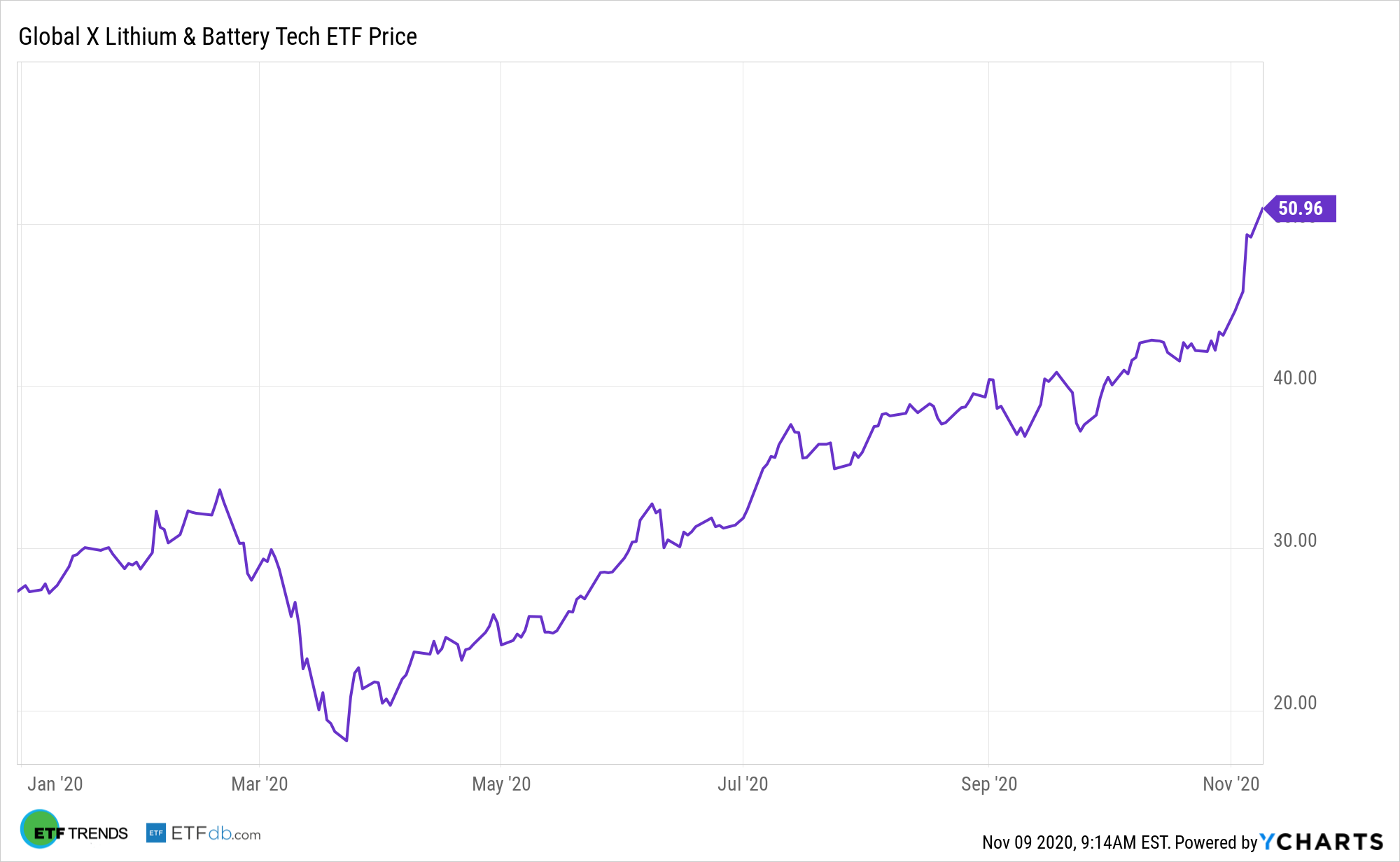

The Global X Lithium & Battery Tech ETF (NYSEArca: LIT), the original exchange traded fund dedicated to lithium equities, could be poised for upside under Joe Biden’s presidency.

LIT tracks the Solactive Global Lithium Index. The underlying index is designed to measure broad-based equity market performance of global companies involved in the lithium industry.

“The lithium market would benefit from a Joe Biden victory in U.S. presidential elections, according to the biggest producer of the key ingredient in batteries for electric vehicles,” reports Yvonne Li for Bloomberg. “Biden, who is tightening his hold on the race for the White House, unveiled plans to spend $2 trillion on a clean energy economy, calling for more public investment in charging infrastructure and fresh tax credits to help throttle U.S. greenhouse gas emissions driving climate change.”

Opportunity for LIT in a Changing Energy Landscape

As the world looks to decarbonize and rely less on fossil fuels, it will turn to alternative energy sources like electricity. That, in turn, will fuel more growth in lithium-ion cell manufacturing, which is expected to quadruple by the year 2030, according to a new report by Wood Mackenzie.

LIT invests at least 80% of its total assets in the securities of the underlying index and in American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”) based on the securities in the underlying index. The underlying index is designed to measure broad-based equity market performance of global companies involved in the lithium industry.

“A Biden presidency could also mean less friction around trade, and a less antagonistic approach with China, which could help the lithium-ion battery supply chain a little,” according to Bloomberg.

Lithium-ion battery capacity is vital because one of the primary factors car buyers consider when evaluating electric vehicles is how long those vehicles can run on a single charge. Tesla’s dominance in the booming electric vehicle market will also move the demand for lithium.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.