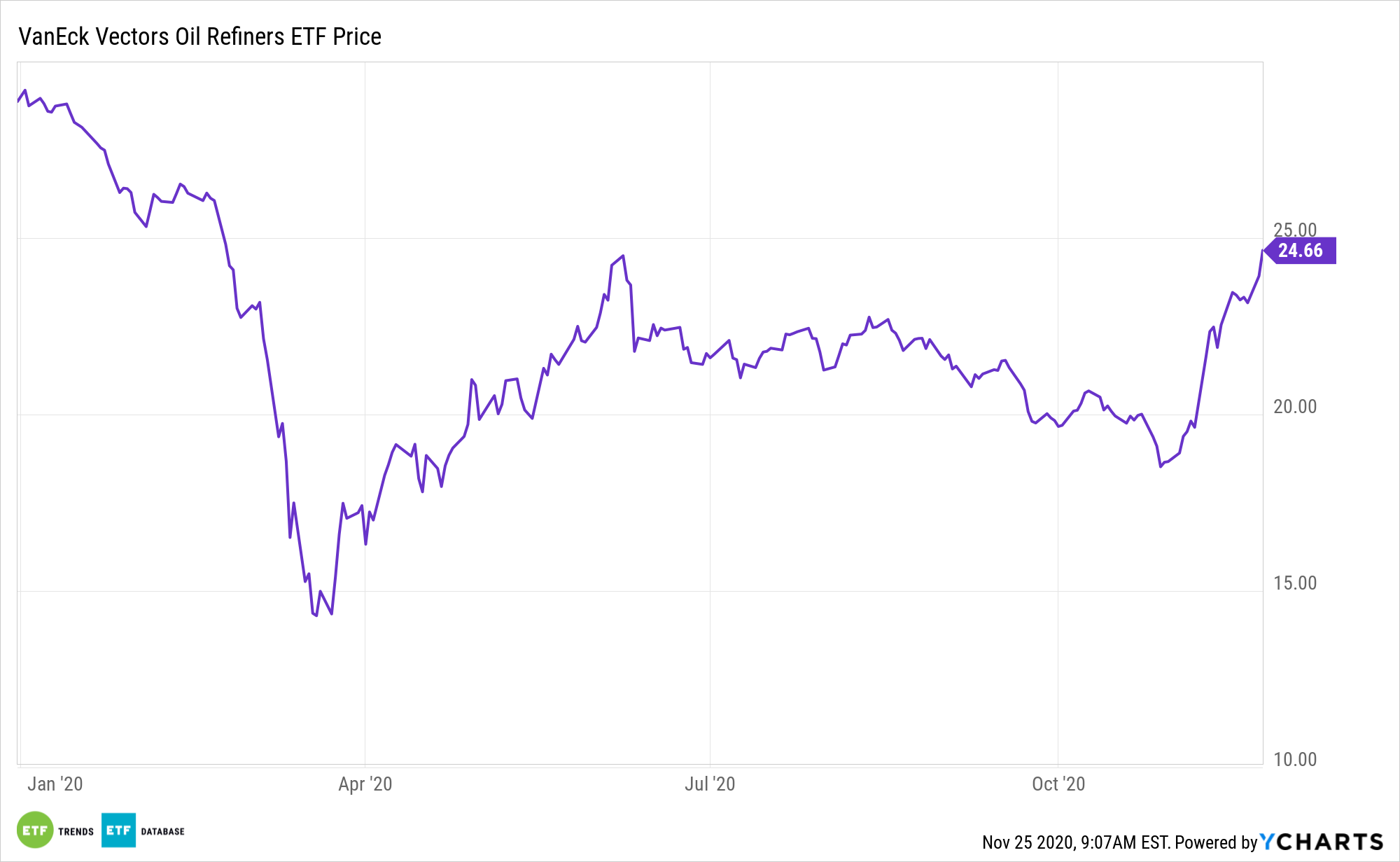

Energy stocks and related exchange traded funds suffered though much of this year, but encouraging news relating to a coronavirus vaccine and a rally for cyclical stocks is bolstering assets such as the VanEck Vectors Oil Refiners ETF (NYSEArca: CRAK).

CRAK tracks the MVIS Global Oil Refiners Index. That index “is a rules-based, modified capitalization-weighted index intended to give investors a means of tracking the overall performance of companies involved in crude oil refining which may include: gasoline, diesel, jet fuel, fuel oil, naphtha, and other petrochemicals,” according to VanEck.

Data confirm some investors embraced refining equities, including CRAK components, in the third quarter.

“Large institutional investors were net buyers of U.S. oil refining stocks in the third quarter, despite the challenges the industry continues to face from the coronavirus pandemic,” according to S&P Global Market Intelligence. “While investors generally preferred large-cap companies with investment-grade debt, BlackRock Inc. bucked that trend. The investment manager was among the top buyers of four oil refining stocks in the third quarter as it continued to juggle its U.S. refining holdings.”

The Outlook for Oil Stocks and ETFs

CRAK and refiner equities don’t necessarily need oil prices to rally; they need demand and price stability. The U.S. refining sub-sector has been one of the most profitable sectors in the U.S. economy over the past five years. Refiners their took steps to mitigate the impact of the COVID-19 crisis.

There’s also high-level appetite for some of the marquee names in the VanEck fund.

“BlackRock also acquired 3.4 million shares of Marathon Petroleum Corp. in the third quarter, increasing its stake in the integrated refining company to almost 11.3%. Marathon expects $16.5 billion in net proceeds from the pending sale of its Speedway convenience store business, a substantial portion of which it plans to return to shareholders,” reports S&P Global. “But paying down debt is a competing use of that cash, and Marathon’s executives are still weighing how much of and in what form that cash would be returned to shareholders.”

Vanguard has also been gobbling up shares of Valero and Phillips 66, two other prominent CRAK holdings.

“Vanguard also increased its total stake in Phillips 66 to roughly 10.2%. The refining and chemical company’s CEO said Oct. 30 the company remains “committed” to dividend growth through the market downturn,” notes S&P Global.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.