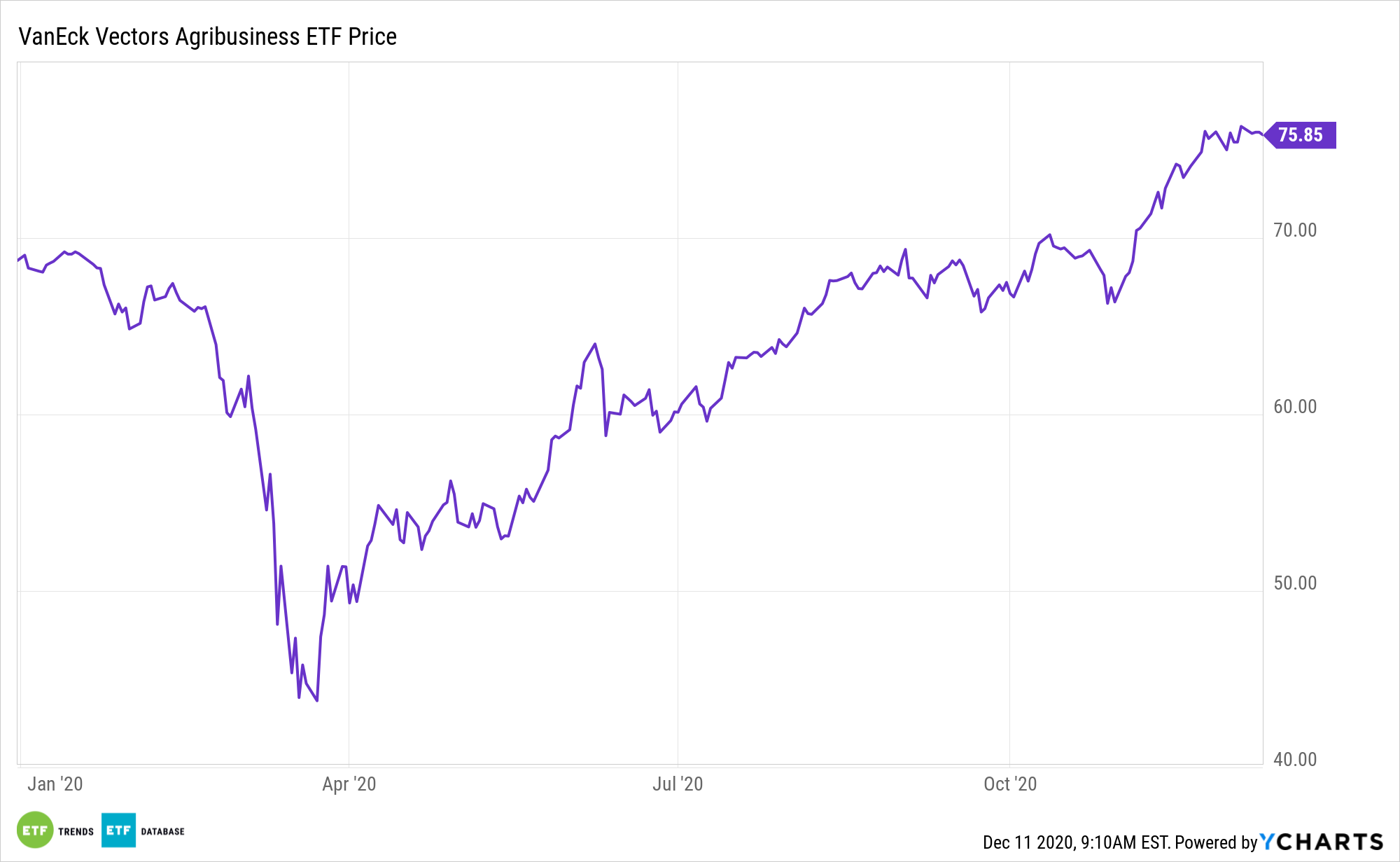

The VanEck Vectors Agribusiness ETF (MOO) is trending higher, confirming its leverage to rising food prices.

MOO seeks to replicate the price and yield performance of the MVIS® Global Agribusiness Index. 50% of the companies included in the index derive their revenues from agri-chemicals, animal health, and fertilizers, seeds, and traits, from farm/irrigation equipment and farm machinery, aquaculture and fishing, livestock, cultivation and plantations, and trading of agricultural products.

MOO’s roster includes farm equipment and machinery makers in addition to fertilizer producers, so it’s a diversified agribusiness play. Still, fertilizer exposure is potentially impactful going forward.

“Fertilizer producers are next in line to benefit from rising crop prices, with farmers poised to plant more acres in 2021,” reports Bloomberg. “For the world’s handful of companies that produce potash — a potassium-rich fertilizer mined underground from evaporated sea beds — it is the light at the end of the tunnel following several volatile years.”

Worldwide Agriculture Outlook for 2021

Although is impressing to end 2020, investors may not have missed out on the upside this fund offers because potash demand is expected to hit record highs next year.

“Optimism follows a challenging couple of years. In 2020, La Nina weather patterns scorched key South American growing regions, a derecho system pummeled crops in the U.S. Midwest, and a global health crisis disrupted food chains. This followed a year of sagging feed demand as China’s African swine fever outbreak created a shortage of pork, the country’s protein staple,” according to Bloomberg.

As the phenomenon known as La Niña disrupts the normal weather patterns, farmers across the world could face unpredictable conditions, limiting the supply of crops and strengthening commodity markets and related exchange traded funds.

Past instances of this phenomenon have contributed to market volatility and higher food prices, and the current round is already lifting prices on crops like corn and cutting supplies of other fruits.

“Alexis Maxwell, Green Markets’ research director, forecasts global demand of potassium chloride — by far the most commonly used form of potash — at 69.7 million metric tons in 2021, up from 68.6 million this year. Bank of Nova Scotia analyst Ben Isaacson sees demand at 68 million next year,” reports Bloomberg.

For more alternative investing ideas, visit our Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.