By David Garff, Accuvest

With all of the computing power at our fingertips, it is natural that we should look to harness that power in creating investment strategies that allow us to evaluate huge amounts of data. Algo X is a use case of that technology. Just to get the definitions out of the way, we define “passive” a capitalization-weighted investment strategy within a particular asset class.

In this case, we’re going to look at equities. According to recent data and market commentary, it’s over for active managers, and passive wins the performance race in a landslide.

As someone who enjoys looking at numbers, I like to read things like the semi-annual SPIVA study (which is very well done) https://us.spindices.com/documents/spiva/spiva-us-mid-year-2017.pdf. When you look at the numbers, they confirm the market’s read on Passive vs. Active. Last week, Barron’s published an article titled “The End of an Active Investing Era.”

Mind you, this is from a periodical whose value proposition is to help investors “From central bank decisions, to tax policy and the Fed—prosper in a pivotal time with the trusted insight and in-depth analysis that has been guiding investors since 1921.”

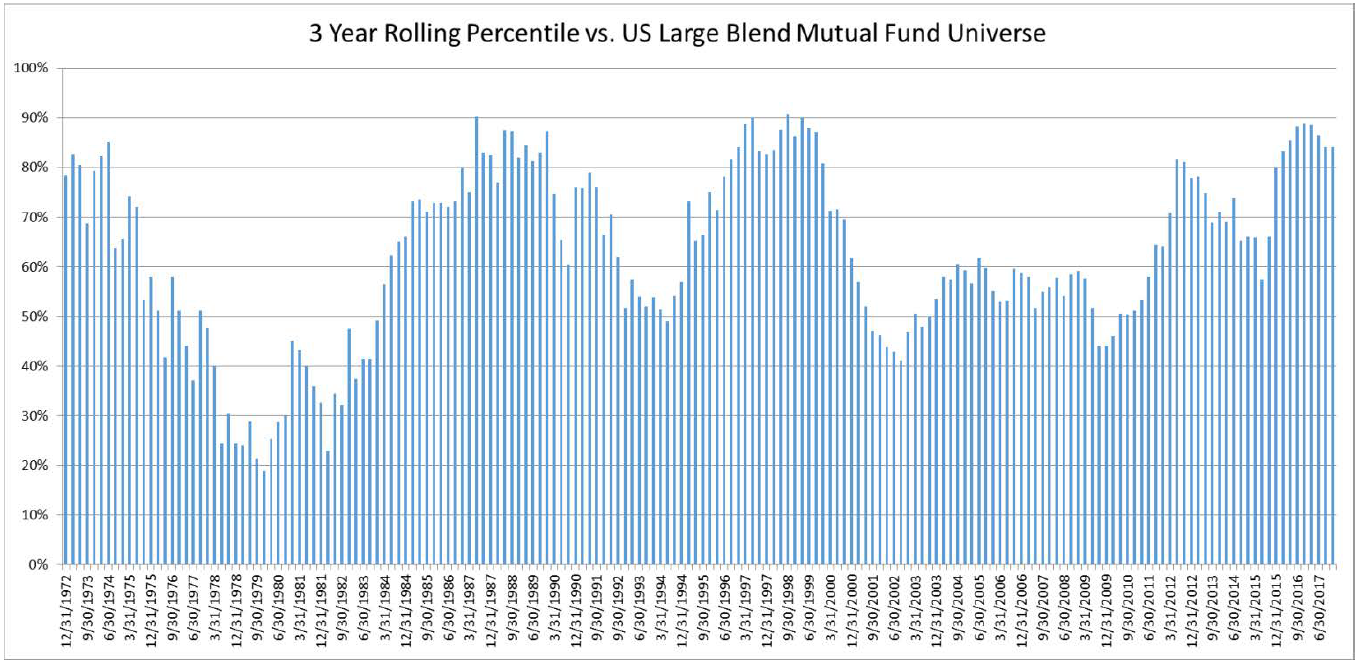

Performance Evaluation In Exhibit 1, we evaluate the 3 year trailing net performance of Algo X vs. a peer group of US Large Blend mutual funds. We have taken the usual precautions to avoid survivorship bias, double share class counting, etc. in the peer group. We have also chosen a 3 year rolling window because that’s what typical Investment Policies call for in reviewing strategies, and frankly it is the longest cycle we have seen where investors will be patient with an underperforming strategy.

![]()

Source: Morningstar

We see pretty persistent outperformance of Algo X. It does tend to be cyclical, but more often than not, the 3 year trailing performance is better than the rest of the universe.

In Exhibit 2, we evaluate the 3 year trailing net performance of Algo X vs. a peer group of US Large Blend Separate Managed Accounts. We have deducted a 0.75% management fee out of these returns, to try and get a more apples-to-apples comparison.