WisdomTree has debuted its new WisdomTree 90/60 U.S. Balanced Fund (NYSEArca: NTSX), which incorporates an asset allocation strategy comprised of investments in large-cap U.S. equities and U.S. Treasury futures contracts. NTSX represents WisdomTree’s second asset allocation ETF and joins an expansive lineup of ETF products with varying degrees of focus, such as emerging markets, volatility, currency hedging, and dividend growth.

With respect to providing investors exposure to large-cap U.S. equities, the ETF invests approximately 90% of assets in a representative basket of U.S. equity securities of large-capitalization companies generally weighted according to market capitalization. As for U.S. Treasury futures contracts, 10% of capital will be allocated towards short-term fixed income securities that collateralize a targeted 60% notional exposure to U.S. Treasury futures.

If the ETF happens to deviate from the targeted 90% equity and 60% U.S. Treasury future allocations by 5% or greater, it is anticipated that the fund will be rebalanced to more better align itself with projected target allocations.

“NTSX offers a new and disruptive approach to asset allocation, which has traditionally been through 60/40 equity/bond portfolios that tend to be highly correlated to the equity market,” said Jeremy Schwartz, WisdomTree Director of Research. “In contrast to these more traditional portfolios, NTSX seeks to provide a more efficient way for investors to deploy their capital, resulting in the potential for enhanced total returns, reduced volatility and increased tax efficiency.”

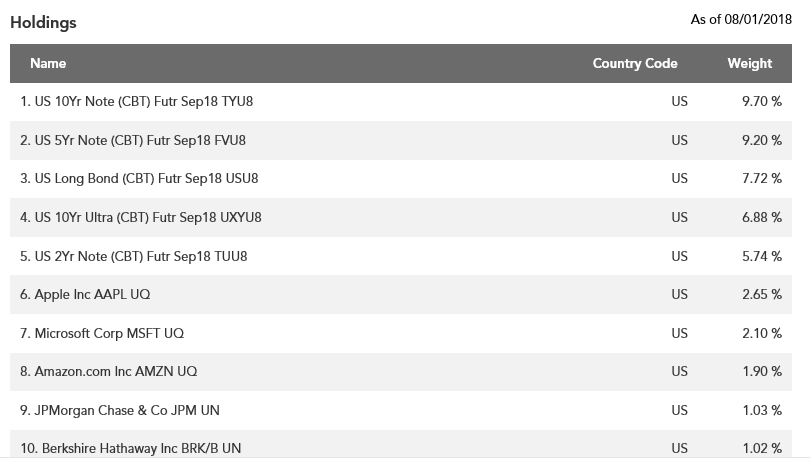

Pertinent fund details include an expense ratio of 0.20% Its current top ten holdings as of today include a mix of benchmark Treasury notes, as well as large-capitalization equities, such as Apple Inc. and Amazon.

![]()

For more ETF launches, visit the New ETFs category

For more ETF launches, visit the New ETFs category

To get more insight on disruptive ETFs, sign up for the Disruptive ETF Virtual Summit set to take place this fall.