Mortgage interest payments as well as non—mortgage interest payments are costing consumers more and more of their disposable income. Consider the non-mortgage variety. Personal interest payments have already recovered levels not seen since the financial crisis.

![]()

To be sure, interest payments are not the only thing taking a bite out of the cost of living. Oil prices have moved meaningfully higher. According to a 2005 study by the Federal Reserve, oil price increases adversely affect aggregate consumer spending.

Is it possible that consumers will ratchet up borrowing to keep up the brisk pace of consumption? Perhaps. Yet loan growth is not only slowing, it’s rolling over.

Granted, recent tax cuts place more dollars in the pockets of Americans. Higher wages do the same. On the flip side, there is plenty of evidence to show that inflation is eroding the purchasing power of those dollars.

Related: 6 Ultra Short Term Bond ETFs as Cash Alternatives

For example, the New York Fed’s Underlying Inflation Gauge (UIG) hit 3.2% in April. UIG has not been this high since the summer of 2006.

When Federal Reserve monetary policy is stimulative, it may be reasonable to ignore signs of economic wear and tear. Right now, however, the Fed is doggedly determined to push borrowing costs higher. The central bank of the United States is simultaneously raising its overnight lending rate and reducing its balance sheet via quantitative tightening (QT).

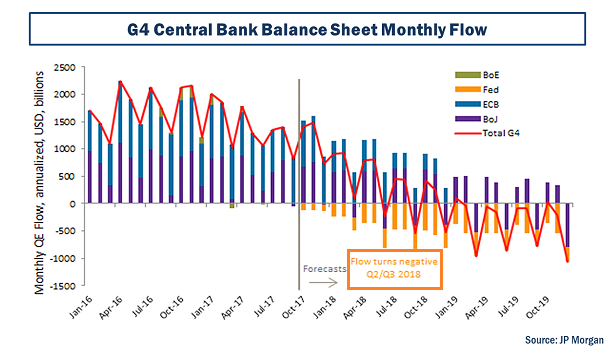

If central banks around the world were electronically creating credits to buy assets (a.k.a. “quantitative easing” or “QE”) at the same rate as they had in the past, then tightening stateside might not be so precarious. Yet foreign central banks are slowing down their stimulus trains as well.

In fact, developed market central banks shifted from an annualized pace of $2 trillion in monetary support in Q2 of 2016 down to roughly $1 trillion by October of 2017. By July of 2018, monthly monetary support will likely turn negative.

Will our stimulus addicted world actually be able to stand on its own? We are about to find out.

One way or another, investors are starting to recognize that stocks and higher-yielding bonds are risk-bearing assets. Not only is the emergence of a premium for risk visiting center stage, but market participants are reacquainting themselves with alternatives.