The U.S. stock market has been the default go-to investor play as the bull market enters into the latter stages of its market cycle, while emerging markets have been roiled by ongoing trade wars, especially between the United States and China.

However, opportunities could be presenting themselves abroad, allowing for a possible emerging markets comeback as the capital markets head into the fourth and final quarter of 2018.

As such, one ETF to watch is the Nationwide Maximum Diversification Emerging Markets Core Equity ETF (NYSEArca: MDXE). MDXE specifically seeks to replicate the investment performance of the TOBAM Maximum Diversification® Emerging Markets Index.

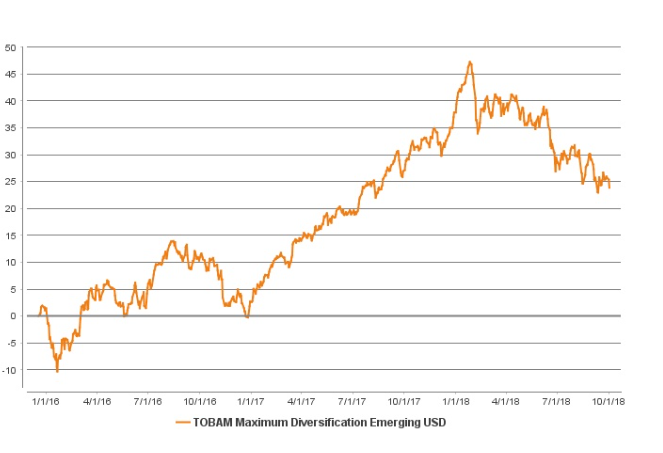

From a chart perspective, the index is indicative of the rise in emerging markets in 2017 followed by its subsequent correction thus far this year. This has been evident in other emerging market ETFs, such as the Vanguard FTSE Emerging Markets ETF (NYSEArca: VWO)–down 7.67% YTD, iShares Core MSCI Emerging Markets ETF (NYSEArca: IEMG)–down 7.3% YTD and iShares MSCI Emerging Markets ETF (NYSEArca: EEM)–down 7.78% YTD.

![]()

While the majority of investors might be hesitant by the red prices seen in emerging markets ETFs, they should be looked at as being substantial markdowns, espcially if trade negotiations between the U.S. and China result into something materially positive. This week, markets got a boost after Canada successfully agreed to revamp the North American Free Trade Agreement with the U.S. and Mexico, giving hope to emerging markets that trade wars can be further averted.

Investing giant BlackRock is already noticing opportunities arise in emerging markets as 2018 winds down.