Chinese stocks are among the worst emerging markets performers this year and Internet and technology names from the world’s second-largest economy are among the most egregious offenders. Just look at the iShares MSCI China ETF (NASDAQ: MCHI).

While MCHI, which tracks the MSCI China Index, is not a dedicated China technology fund, the exchange traded fund does devote over 47% of its combined weight to communication, consumer discretionary and technology issues. MCHI is down more than 18% year-to-date, but some market observers believe the time is right to revisit Chinese technology names.

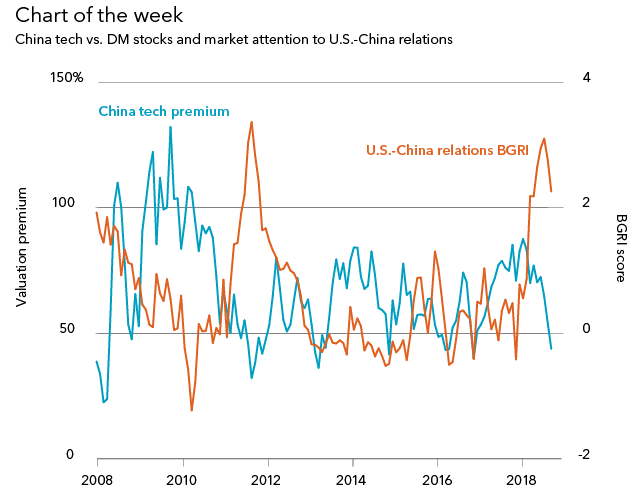

“Chinese tech stocks typically trade at a premium to developed market stocks or peers given their greater growth potential,” said BlackRock in a recent note. “But that premium (the blue line) has come down sharply this year, while market attention to the U.S.-China relations risk, as measured by our BlackRock Geopolitical Risk Indicator (BGRI), has increased (the orange line). Our outlook for global technology stocks broadly is positive, and we believe the door may be open for global investors to diversify their exposure and step into a long-term opportunity in Chinese tech.”

Chart Courtesy: BlackRock

Help From Beijing

Chinese policymakers are taking steps to support markets there.

The People’s Bank of China removed its pledge to allow “market supply and demand to play a bigger role in deciding the exchange rate” from a section on future tasks in its third-quarter monetary report, taking steps to ensure the yuan currency is stable at reasonable and balanced levels, Bloomberg reports.