Investors were clearly put to the test in 2018, but there’s been one identifiable trend–a behavioral divergence of exchange-traded fund (ETF) and mutual fund investors.

One would assume that outflows from U.S. equities in 2018 would also be evident in ETFs that have been purchasing the downtrodden shares in the three major indexes. However, that hasn’t been the case as ETFs received $314 billion worth of inflows despite a challenging 2018–a drop from the $466 billion the previous year, but given the challenges of 2018, an impressive figure nonetheless.

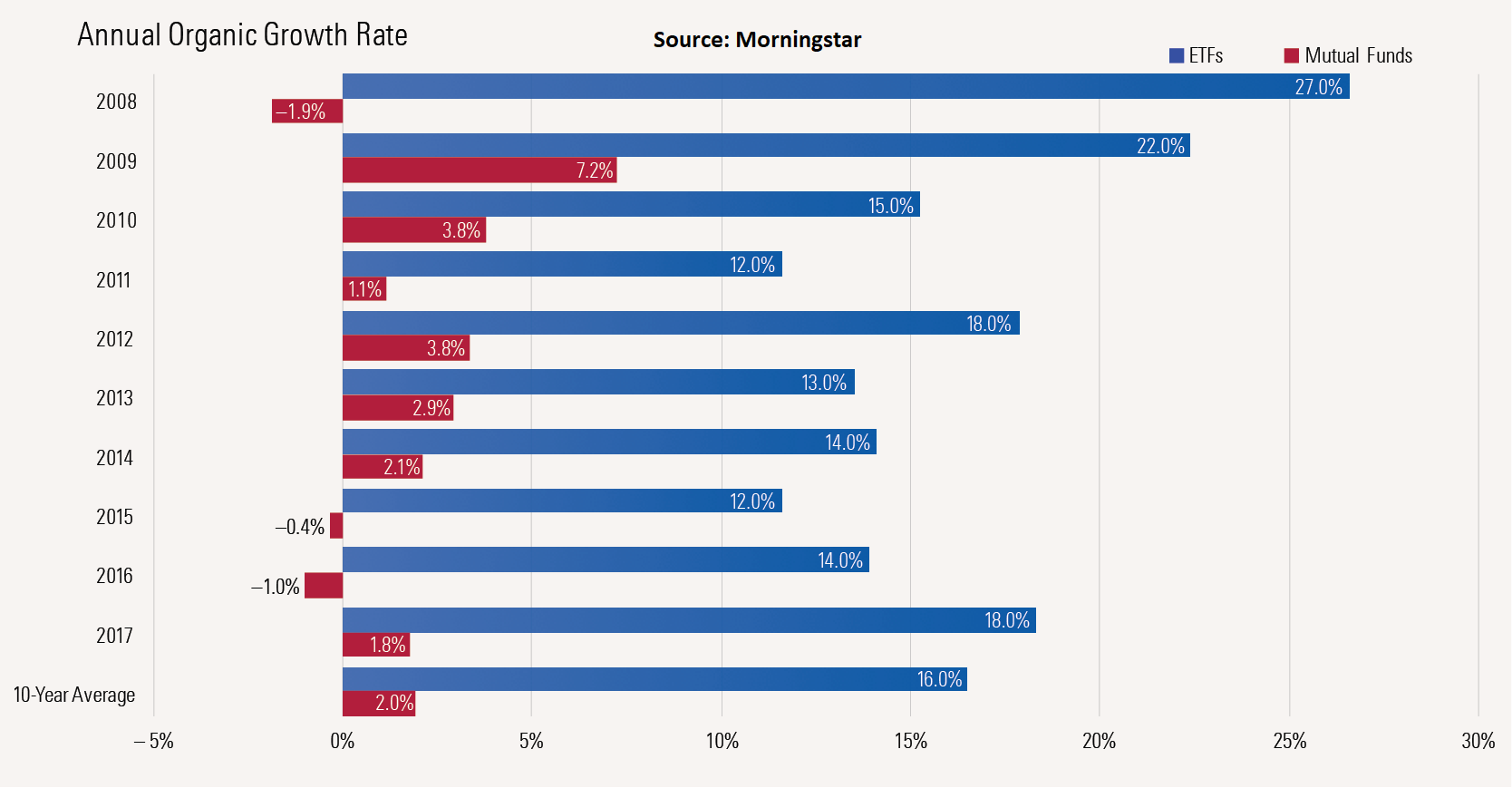

Compare that to mutual funds, which have been trailing ETFs in terms of organic growth rate, the estimated net flow over a period divided by beginning net assets, within the last 10 years according to Morningstar. In fact, the average 10-year growth rate over ETFs is 16 percent versus the paltry 2 percent for mutual funds.

It’s a trend that will likely persist, and one that highlights this behavioral divergence of ETF investors and mutual fund investors. Just as markets were getting roiled in 2018, money continued to flow into ETFs, but what is fueling this divergence?

The answer lies in the inherent benefits of ETFs compared to mutual funds as a prime motivator– a confluence of the investment vehicle’s simplicity, liquidity, tax efficiency, a plethora of choices with over 2,000 ETF products, and much more.

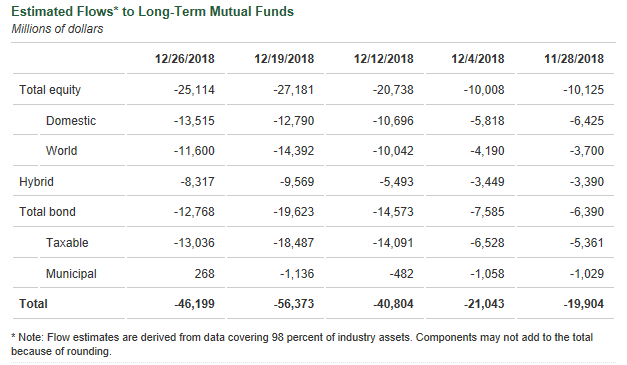

Even with a December 2018 to forget, ETFs continued to amass assets to the tune of over $51 billion while mutual fund flows suffered. Mutual funds, bond and equity funds, in December lost a record $152 billion.

According to Bloomberg, the bloodletting in mutual funds was also apparent during the month of November where mutual funds lost $98 billion, and according to more data from the ICI, those outflows are translating to inflows for ETFs.

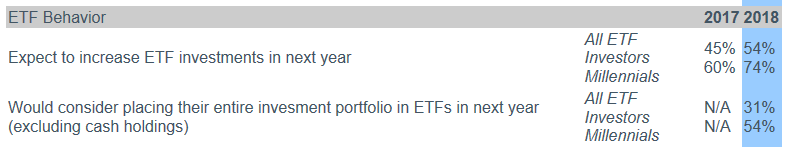

The appetite for ETFs is expected to continue, particularly among millennials who are choosing the ETF as their investment of choice based on an investor study by Charles Schwab.

The appetite for ETFs is expected to continue, particularly among millennials who are choosing the ETF as their investment of choice based on an investor study by Charles Schwab.