When Diversification Loses Its Power: Correlations Rise During Major Declines

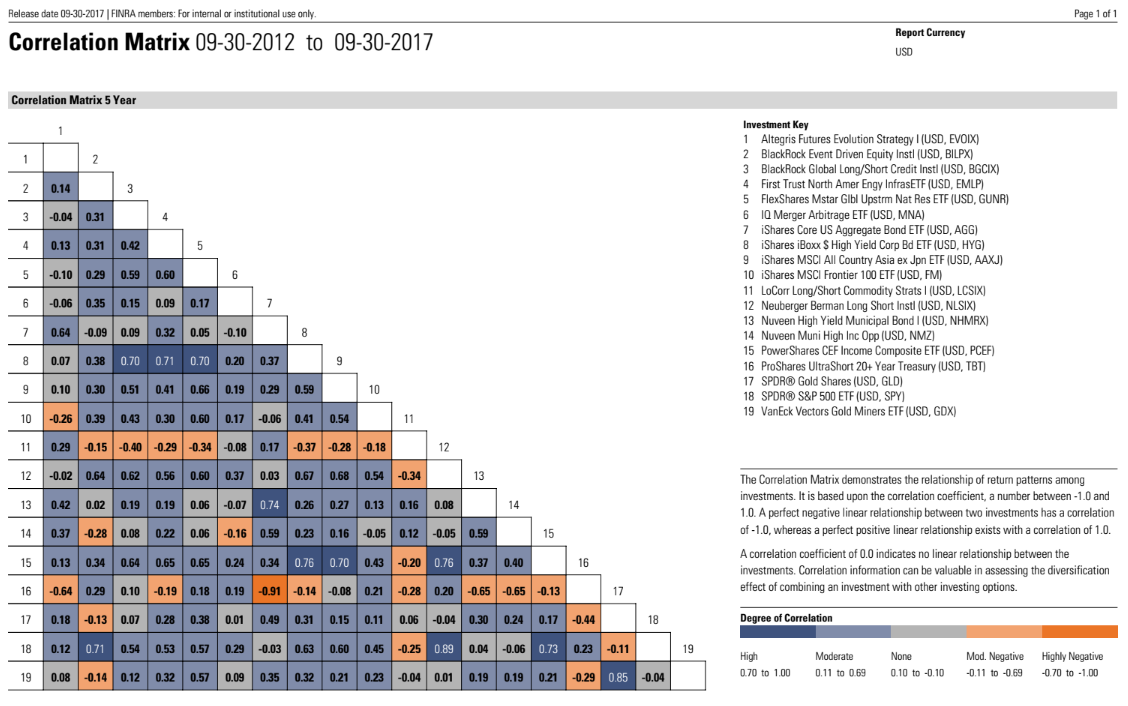

In alternatives investing there is a second, unstated but strongly held client expectation for liquid alternatives to have less correlated returns especially during times of market stress. The portfolio is expected to possibly go up, or at least go down much less than equities, during times of market strain. Given that, we would like to circle back to Morningstar’s alternatives style boxes. These style boxes are calculated over a three-year time frame, and the problem with that is that the last three years have been times of generally calm markets. When a major equity decline does develop, correlations should rise, as they have during most bear markets in the past. Thus, relying on a three-year correlation will not provide an accurate picture of correlations during the times that you most need diversification. In constructing our portfolios, we are mindful that effective diversification means constantly dedicating a large portion of a liquid alternative portfolio to lower correlations to stocks and bonds, as well as lower correlations among the holdings themselves. One cannot predict when or what will cause the next major decline, but we believe maintaining constant diversification, particularly in the alternatives portion of a portfolio, should be a primary and constant focus.

Past performance is not indicative of future results. The opinions expressed are those of the Clark Capital Management Investment Team and are subject to change without notice. The opinions referenced are as of the date of publication and may not necessarily come to pass. This material is not financial advice or an offer to buy or sell any product. Clark Capital reserves the right to modify its current investment strategies based on changing market dynamics or client needs. The material in this report has been derived from sources considered to be reliable, but Clark Capital cannot guarantee its completeness or accuracy.

CCM-910