Amid ample chatter about rising inflation, investors are scurrying for ideas and strategies to guard against the impact of rising consumer prices.

Although much of the talk revolves around transitory inflation, meaning a high Consumer Price Index (CPI) could be fleeting, investors should prepare for a longer-than-expected period of higher prices, and active management may be the avenue for doing just that. In fact, investors can glean important insight from how active managers are positioning portfolios to grapple with rising prices.

“The market has become increasingly worried, according to the breakeven rate for 10-year Treasuries and Treasury Inflation-Protected Securities,” writes Morningstar analyst Alec Lucas. “Since the Fed’s policy shift, the gap between their yields–a proxy for investors’ inflation expectations over the next decade–climbed from about 1.7% to more than 2.5% recently.”

An obvious area where the right active management can shine during inflationary environments is stock selection. Historically, advisors and investors gravitate toward gold and Treasury inflation protected securities (TIPS) to buffer against the ravages of a soaring CPI.

However, many of the assets market participants are programmed to believe are good inflation-fighters aren’t as intimately correlated to a rising CPI as investors are led to believe. The right mix of stocks can actually be one of the best inflation-fighting tools investors can embrace.

“Stocks, on the other hand, have consistently increased long-term investors’ purchasing power, thanks to businesses’ ability to raise prices and create new sources of value,” adds Lucas. “Over rolling 10-year periods measured quarterly, the S&P 500’s return has beaten the CPI in every era dating to the 1950s except for when high inflation reigned from the mid-1970s to the early 1980s and during the depths and aftermath of the 2008 global financial crisis.”

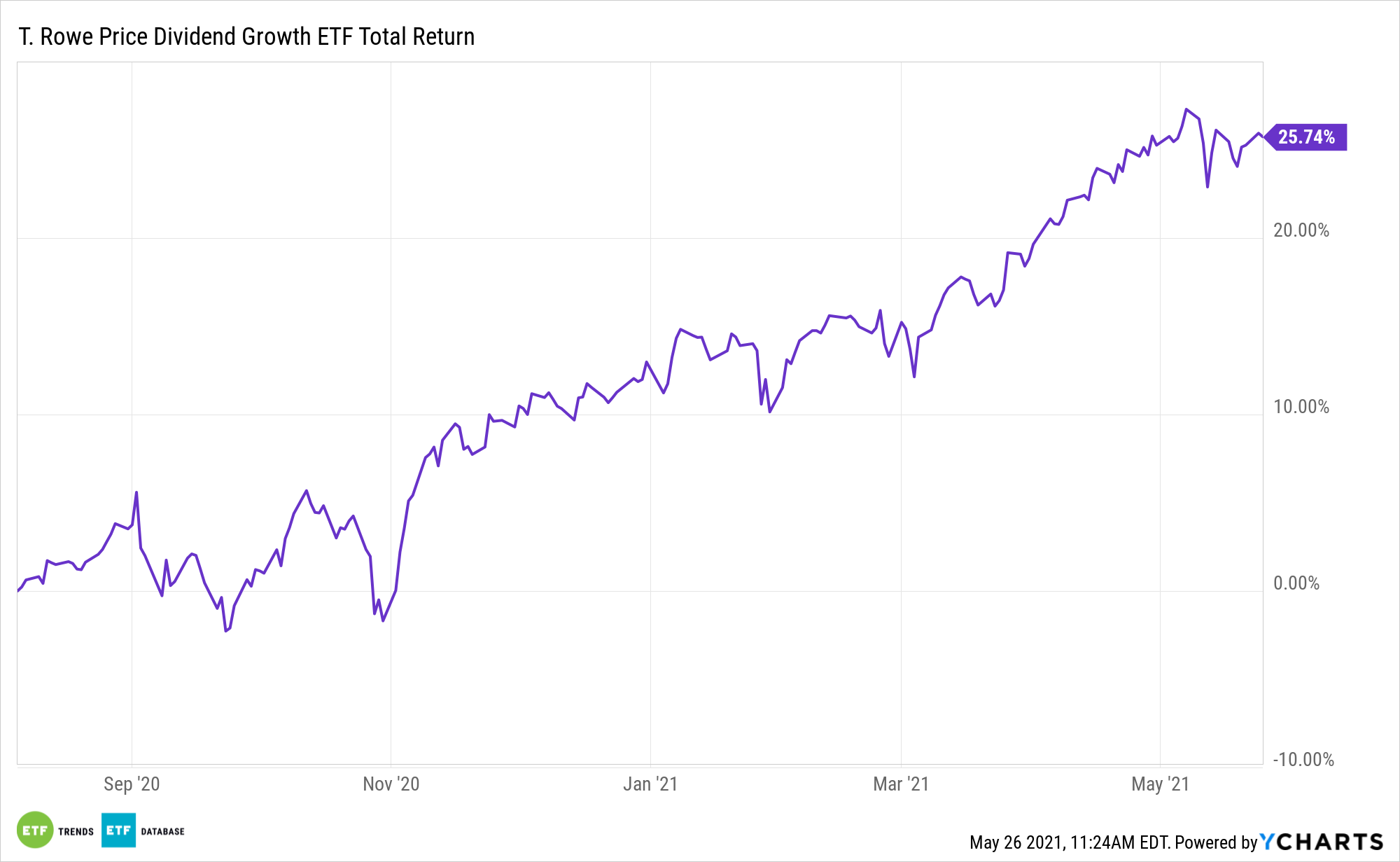

Fortunately, investors don’t have stretch into complex territory when it comes to using stocks to guard against inflation, because dividend growth strategies are usually rewarding inflation-fighting tools. One actively managed concept on that front is the T. Rowe Price Dividend Growth ETF (TDVG).

Dividend growth has a multi-decade reputation of besting inflation, but TDVG adds another benefit through its active management. Not all sectors that dominate passive payout strategies are similarly correlated to inflation, so it may be best to proactively overweight industries with pricing power when the CPI rises.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.