While there are still challenges ahead, ideally, things are on the path for recovery. New coronavirus vaccines offer a potential lift for economies in 2021. At the same time, fixed income investors will need to be creative in 2021, as low yields and tighter credit spreads could make attractive returns harder to find. Similarly, an economic improvement could shift spending patterns, leading to a potential favoring of value over growth.

Based on a global market guide from T. Rowe Price, “Managing to the Other Side,” CIOs David Giroux, Equity and Multi-Asset, Justin Thomson, International Equity, and Mark Vaselkiv, Fixed Income, put together some constructive thoughts on how the economy could be looking at an accelerated recovery, based on the vaccines, which could also lead to a boost for cyclical sectors.

“The vaccines are an unmitigated positive, and I believe the next wave of them will be as efficacious or more efficacious than the mRNA vaccines,” Giroux says. “This could allow us to get back to normal at a faster rate.”

Continued Challenges Through Recovery

It’s this attitude that speaks well to the possibility of a broader economic recovery in sectors most damaged by the virus. However, this could also affect the earnings of the technology and eCommerce companies that saw sales surge during 2020. There’s also the threat of a possible new spike in COVID‑19 cases, given the risk involving new variants of the virus and the current vaccination rollout pace.

“We don’t yet fully understand the pandemic’s long‑term impact on consumer behavior,” Vaselkiv explains. “How quickly will the affected industries recover in 2021? We may not have a full picture until 2022.”

That said, a return to a more familiar status quo could show an improvement in conditions.

“People are going to want to travel, to get back to work, to have deferred elective medical procedures,” Giroux argues. “If so, I think the second half of 2021 could look more like 2019 than like the first half of 2020.”

“For U.S. and global equity markets, a rapid economic recovery could bring an accelerated earnings recovery,” Giroux says. “Following the last three recessions,” he notes, “it took the S&P 500 Index three, four, and five years, respectively, to regain its previous earnings per share peak.”

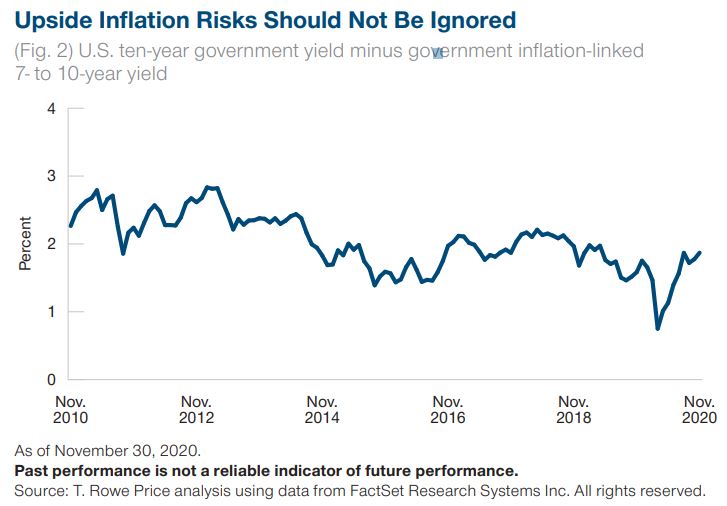

This broader recovery could also lead to an increase in inflation, which had previously decelerated as the pandemic spread. Forward‑looking measures of inflation expectations, such as spreads (differences) between nominal and inflation-protected government bonds, have rebounded sharply since mid‑2020. As Giroux explains, this may not bring about massive inflation, but there is a risk the U.S. could pierce the 2% inflation ceiling in the years to come.

Technological Adoption

In the realm of what can be considered an exciting development, the pandemic has dramatically accelerated the adoption of the technologies and business models. From video conferencing to remote medicine to home meal delivery, companies and consumers relied on various small tech-based companies to function amid a public health emergency.

Moving into 2021, a big question for equity investors is whether mass vaccinations and a rapid decline in new COVID‑19 cases could lead to a change in market leadership toward cyclical sectors positioned to benefit from a return to normal economic conditions.

“The pandemic fundamentally changed how consumers spent money and time and did it over an unprecedentedly short horizon,” Giroux notes. Spending on goods and services such as gym memberships, elective surgery, dental /care, theme parks, and restaurants fell by 50% to 80%, he says. “We haven’t seen anything like it in my lifetime, and probably not since World War II.”

Based on the presence of vaccines, Giroux adds, “I believe some of these companies could get back to 2019 earnings levels relatively quickly,”

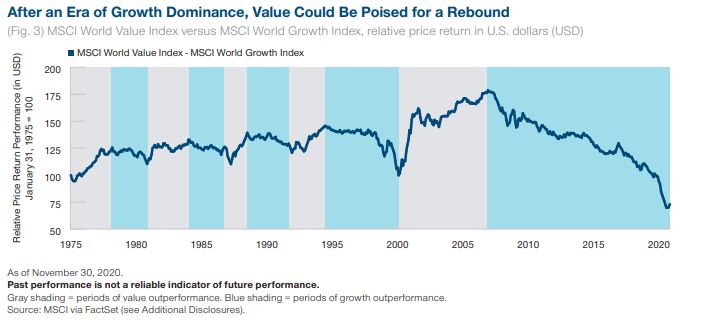

However, a spending shift toward the COVID losers could come at the expense of stocks within sectors that many equity investors bought aggressively during the pandemic. With that in mind, a more normal cyclical recovery could continue to boost value relative to growth, a reversal of the powerful trend toward growth dominance.

A return toward pre‑pandemic consumer spending patterns could further improve sectors’ attractiveness, such as financials and energy.

For financials, “steepening yield curves have improved net lending margins, and the reserves set aside to cover expected pandemic loan losses appear to be larger than needed,” Giroux says. “European banks appear especially cheap based on price/book value multiples,” Thomson adds.

With energy, “A broad collapse in capital spending should reduce excess oil and gas supplies, potentially supporting prices,” Giroux predicts. An easing of the pandemic could boost travel in 2021, reviving demand. However, the longer‑term outlook for traditional fossil fuel producers remains challenged by renewables and regulatory pressures.

“You have to be able to distinguish between businesses that can expect normal cyclical recoveries and those that face existential risks,” Thomson says. “In such an environment, skilled stock selection backed by strong fundamental research resources could be especially critical.”

For more on active strategies, visit our Active ETFs Channel.