So many special purpose acquisition companies (SPACs), so little time. Active management could be the way to go with blank-check companies. Enter the SPAC and New Issue ETF (SPCX).

According to Tuttle, the most appropriate strategy for managing a portfolio of SPACs is through active management, as it can be more flexible in reacting to shifting market events. This is no place for an index fund based on a rigid set of rules. When looking at investing in a SPAC, focusing on the management team is key.

The rapidly expanding blank-check universe highlights advantages of being active with SPCX.

“SPACs have been raising funds faster than ever before. In 2020, SPACs raised close to USD 100 billion in public offerings, which is more than in the prior 10 years combined the average IPO size also doubled from 2019 (see Exhibit 2). On July 22, 2020, Bill Ackman’s Pershing Square Capital Management raised USD 4 billion in the IPO of Pershing Square Tontine Holdings Ltd., recording the largest SPAC IPO to date,” according to S&P Dow Jones Indices.

SPCX Could Be Special for SPAC Access

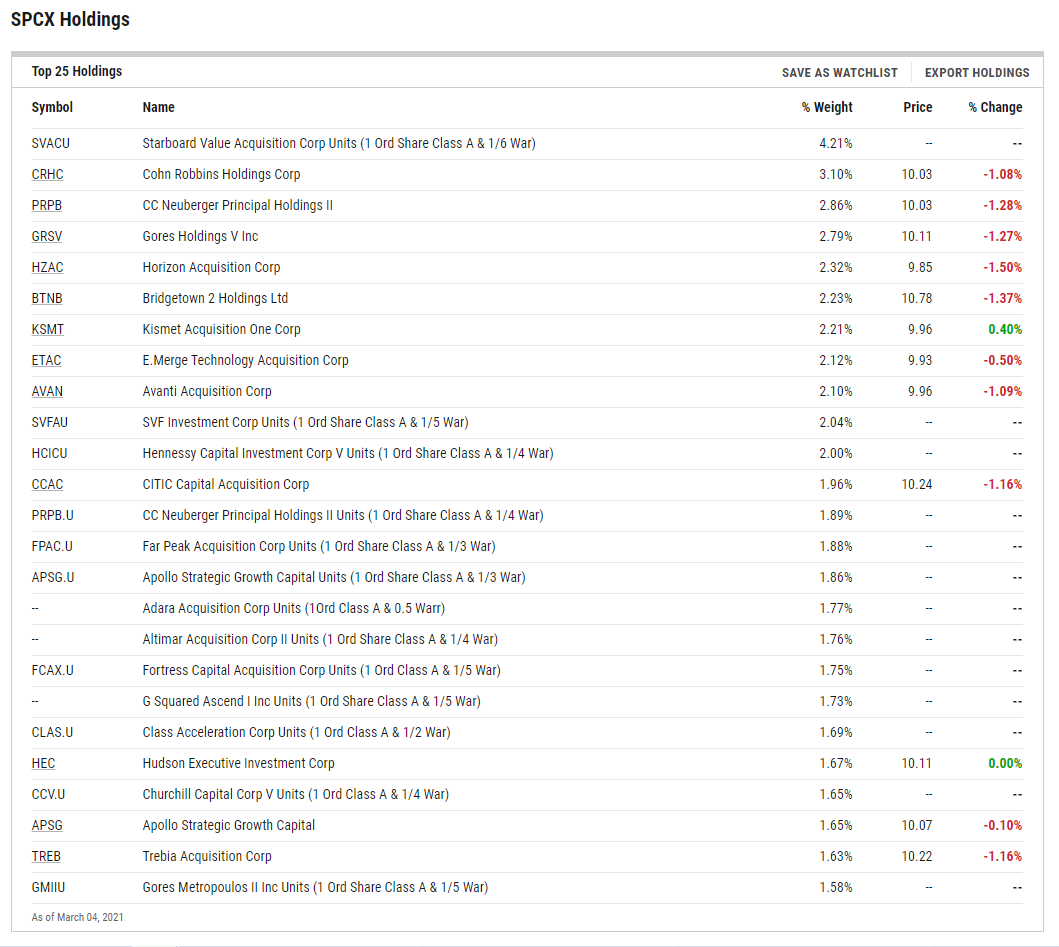

SPCX is the first actively managed ETF that gives investors direct exposure to the disruptive capital markets SPACs theme.

Blank-check firms are hot as the IPO process is institutionalized, cumbersome, and inflexible, especially in adapting to the Covid-19 reality where virtual roadshows are less effective. With SPAC, there’s an alternative route for a company to go public, which can be cheaper, quicker, and more transparent. Agreements and processes are also within greater purview and control of the company.

“SPACs are not exclusive to U.S.-based exchanges. Some countries such as Canada, Italy, and South Korea allow SPAC listings in local exchanges as well. Currently, both Hong Kong and London are considering allowing SPAC listings,” adds S&P. “However, the overseas SPACs IPO markets were quieter in 2020 compared to the ones in the U.S.; Canada was the most active SPAC market outside of the U.S by number of SPAC IPOs. Although the historical number of SPAC IPOs outside the U.S. was slightly greater than the number in the U.S., investors in the U.S. raised over 15 times more capital in SPAC IPOs than non-U.S.-based investors.”

SPACs are increasingly attracting high-worth, credible sponsors. As the quality of their founders and the success of their merger companies grow, so does their integrity in the wider investment community.

Picking the winners of individual SPACs can be very difficult. The ETF structure allows investors to access the most liquid SPAC IPOs in a diversified basket. SPCX allows both financial advisors and retail investors to participate in an IPO private equity style of investing. Those are meaningful traits because many post-merger companies struggle after SPAC deals, underscoring the potential benefits of eschewing selection of individual names and embracing the fund’s active approach.

Bottom line: SPCX’s active management is ideally suited for the current SPAC climate.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.