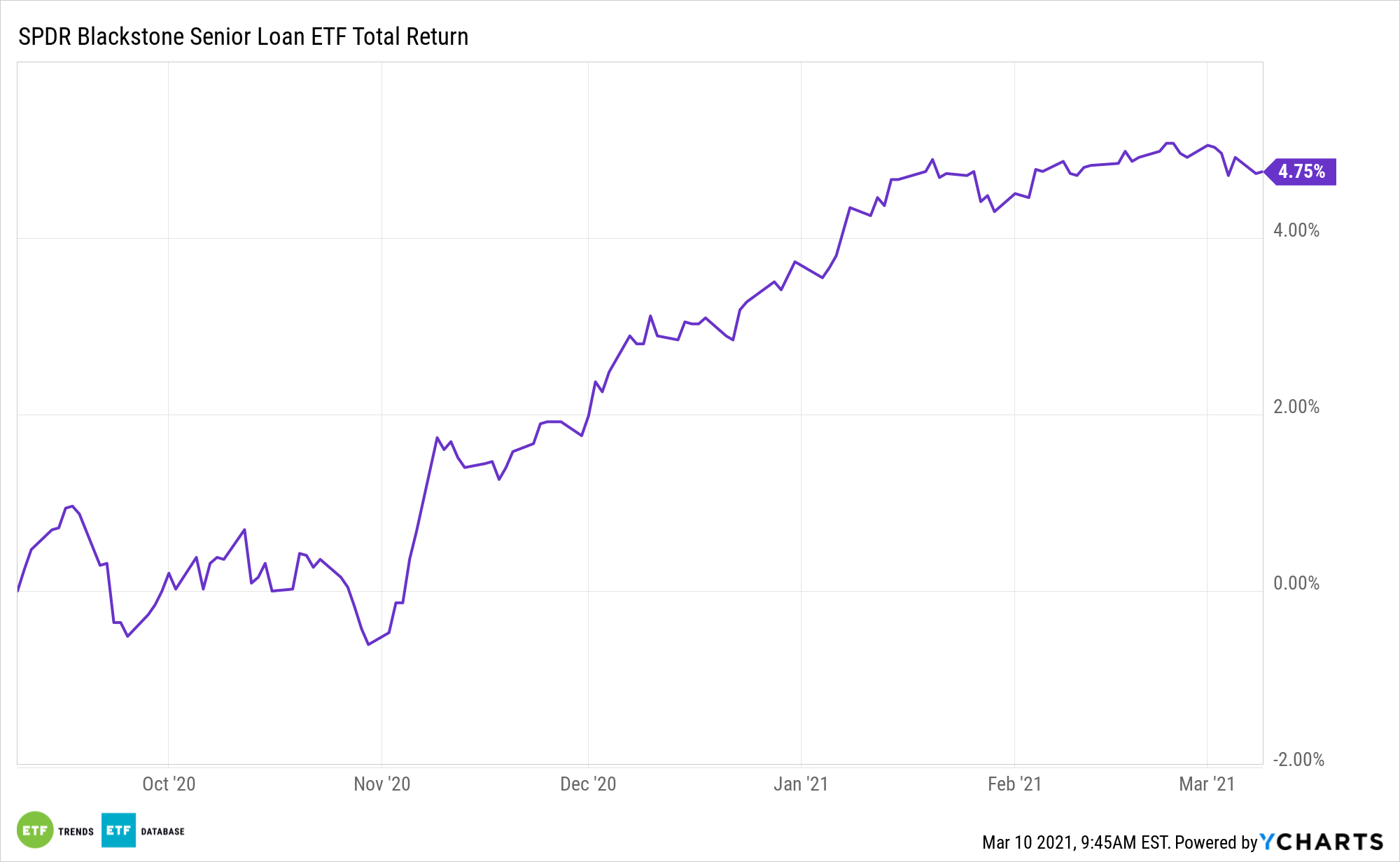

Rising Treasury yields led to predictably glum action in the bond market last month, as just two segments closed the February to the upside. One of the segments was senior loans, underscoring utility with the SPDR Blackstone/GSO Senior Loan ETF (NYSEArca: SRLN).

SRLN invests in senior loans given to businesses operating in North America and outside of North America. The portfolio may invest in senior loans through the loans directly via the primary or secondary market or via participation in senior loans, which are contractual relationships with an existing lender in a loan facility where the loan portfolio purchases the right to receive principal and interest payments.

Additionally, SRLN is actively managed, an advantageous trait for this particular corner of the bond market.

“For a credit allocation, loans have a relatively similar yield to fixed rate high yield debt at 3.7% versus 4.2%, but are more senior in the capital structure and have witnessed lower relative levels of volatility historically (5.8% versus 7.7% 60-month standard deviation of returns),” notes Matthew Bartolini of State Street Global Advisors.

SRLN: The Right Bond ETF for Uncertain Times?

Since rates are usually reset once per quarter, senior loans typically have low durations – a measure of a bond fund’s sensitivity to changes in interest rates. The floating-rate component also offers investors an alternative method of earning yields while mitigating interest-rate risk. Consequently, senior loans are seen as an attractive substitute for traditional corporate debt in a rising rate environment.

“Even with less volatility, loans, like other credit exposures, may also continue to benefit from the ongoing loose monetary and fiscal policies that have supported risk assets over the past few months during the reflation rally., Loans have outperformed the broader Agg for eleven consecutive months,” according to Bartolini.

The senior loans in SRLN’s portfolio are paid first. Higher payment priority assists liquidity in terms of the defaulting borrower having to sell assets in order to pay off creditors – in this case, senior loans within the SRLN portfolio are given higher priority – a viable option, especially during a market downturn.

At a time of rising rates, SRLN’s floating rate component is another benefit offered by the fund.

“As loans have a floating rate component to them, a rise in rates may not have as much of an adverse impact on total return as it could on fixed rate high yield– evidenced by curve change effects subtracting 142 basis points of return in 2021 for fixed rate high yield versus a negligible impact on loans,” adds Bartolini.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.