Special purpose acquisition companies (SPACs) continue to rack up attention in the media. Short sellers are increasingly shorting SPACs themselves and the companies that emerge from deals with blank-check firms.

Investors may soon be able to tap into that trend with a new exchange traded fund courtesy of Tuttle Tactical Management.

“Tuttle is preparing to launch an ETF that bets against ‘de-SPAC’ stocks of companies that have merged with a SPAC—like electric-truck manufacturer Nikola Corp. and baked-goods maker Hostess Brands Inc. —and a separate fund that invests in the stocks,” reports the Wall Street Journal.

Blank-check firms are hot as the IPO process is institutionalized, cumbersome, and inflexible, especially in adapting to the Covid-19 reality where virtual roadshows are less effective. With SPAC, there’s an alternative route for a company to go public, which can be cheaper, quicker, and more transparent. Agreements and processes are also within greater purview and control of the company.

“Postmerger companies are particularly attractive to short because they have larger market capitalizations, making their shares easier to borrow, and because early investors in the SPACs are eager to sell shares to lock in profits, analysts and fund managers said,” according to the Journal.

Tuttle Expanding Its Presence in the SPAC Space

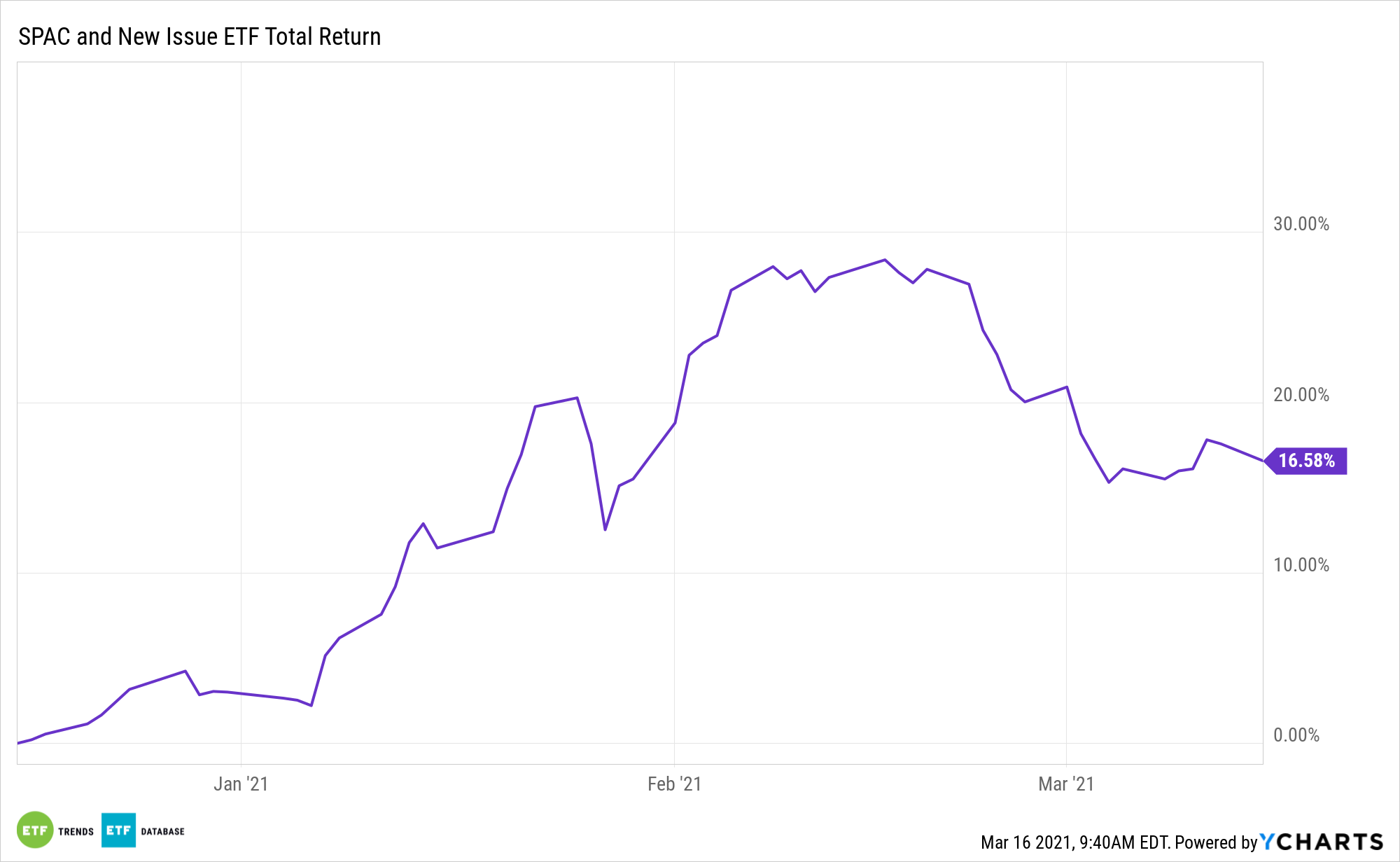

Tuttle’s plans for a ‘de-SPAC’ ETF are noteworthy to investors because the company already issues the SPAC and New Issue ETF (SPCX), which is one of three blank-check ETFs. SPCX is actively managed.

The most appropriate strategy for managing a portfolio of SPACs is through active management, as it can be more flexible in reacting to shifting market events. This is no place for an index fund based on a rigid set of rules. When looking at investing in a SPAC, focusing on the management team is key. SPCX is a long strategy, but some pros still love shorting blank-check firms.

“Veteran short seller Eduardo Marques cited SPACs and their boosting the number of U.S.-listed stocks as a short-selling opportunity, according to a pitch for a stock-picking hedge fund called Pertento he plans to launch this year. America’s roster of public companies had shrunk from the mid-1990s onward, but that trend has recently reversed, partly because of SPAC,” according to the Journal.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.