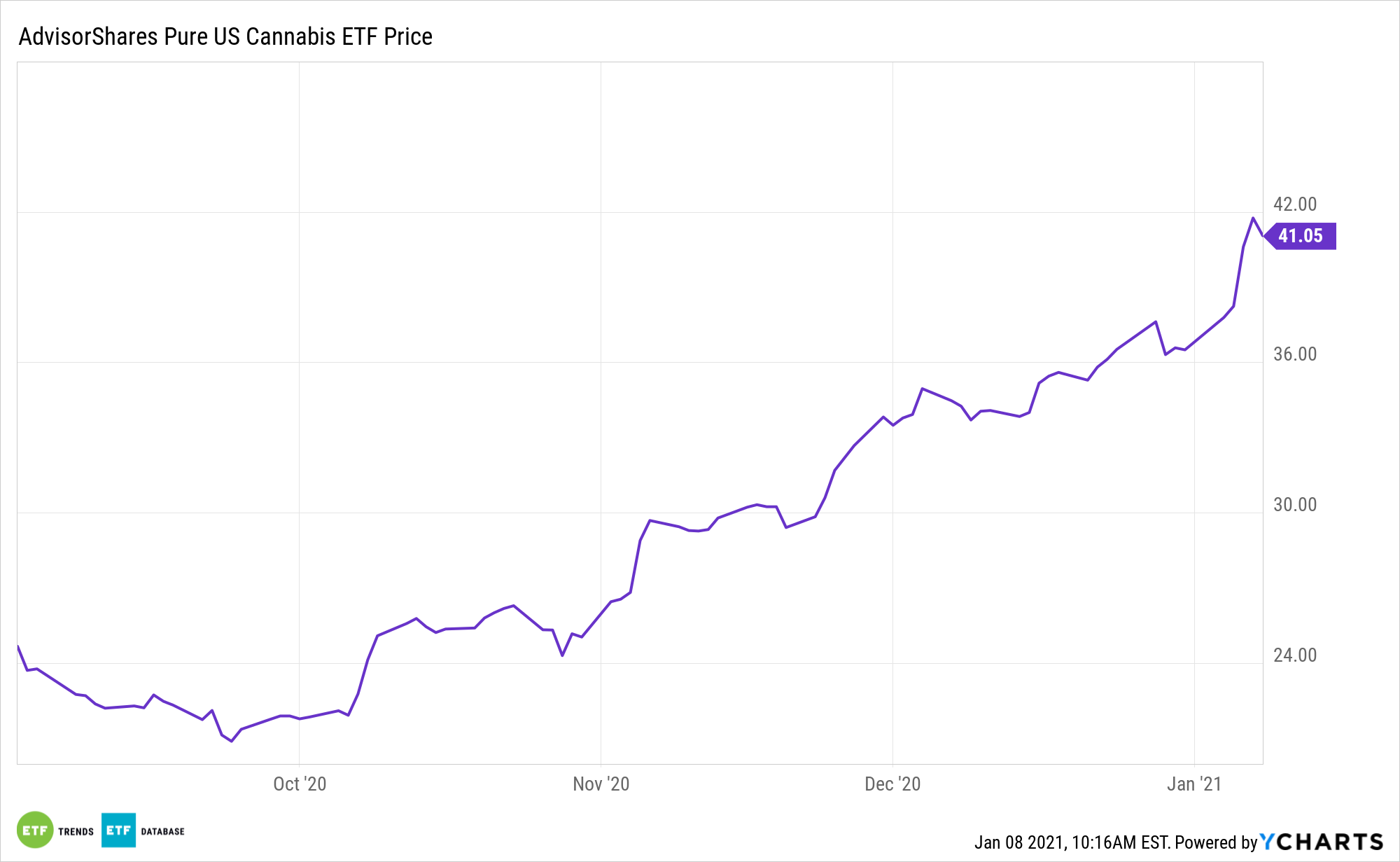

Following the Democratic sweep of the two Georgia Senate seats in Tuesday’s runoff elections, cannabis assets like the AdvisorShares Pure US Cannabis ETF (MSOS) are surging.

Cannabis sector-related exchange traded funds have been climbing on expectations that the favorable election results could push the country toward legalizing sales of recreational marijuana. The Georgia results come after state-level marijuana propositions went undefeated on Election Day.

The marijuana-related sector has been strengthening as investors anticipate the incoming Biden administration could loosen regulations. More U.S. states have legalized sales in recent proposition votes. For example, voters in Arizona, Montana, New Jersey, and South Dakota have cleared cannabis for adult use, bringing the total number of states that have approved it for that purpose to 15.

The actively managed MSOS ETF is the first of its kind to deliver exposure dedicated solely to American cannabis companies, including multi-state operators (MSOs). MSOs are U.S. companies directly involved in the legal production and distribution of cannabis in states where approved.

The Cannabis Tide Is Turning

MSOS seeks long-term capital appreciation by investing entirely in legal, domestic cannabis equity securities. MSOS’ domestic equity strategy allows this active ETF to allocate its underlying portfolio among multi-state operator (MSO) companies as well as other U.S.-based cannabis-focused areas such a REITs, cannabidiol (CBD), pharmaceutical, and hydroponics.

“While the U.S. markets remain federally illegal and each state is in different stages of the legalization process, we believe 2021 could mark the beginning of a super cycle for U.S. cannabis companies due to potential reforms,” according to AdvisorShares.

The global cannabis market is expected to grow to $630 billion by 2040, compared to just $12 billion today. The cannabis industry is expected to expand into a $22 billion hemp-derived CBD product market in 2022, up from $591 million in 2018. Looking ahead, Canada’s cannabis industry is projected to grow six-fold in market value by 2026, up from $1.6 billion in 2018.

Market observers believe industry growth and increased liberalization in the U.S. will open the door to upside for weed stocks.

“Any progress in congress on some forms of federal legalization could significantly improve the prospect of U.S. cannabis companies,” notes AdvisorShares. “Currently, cannabis companies could not list on major U.S. stock exchanges which limit their access to capital markets. Most U.S. cannabis companies still borrow at +10% interest rates, even for the largest MSOs, which could change upon federal legalization. Furthermore, cannabis companies could not deduct most operating expenses so they are essentially taxed at gross profits. A change in taxing could result in massive cash flow improvements, not to mention that many U.S. companies are already operating cash flow positive.”

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.