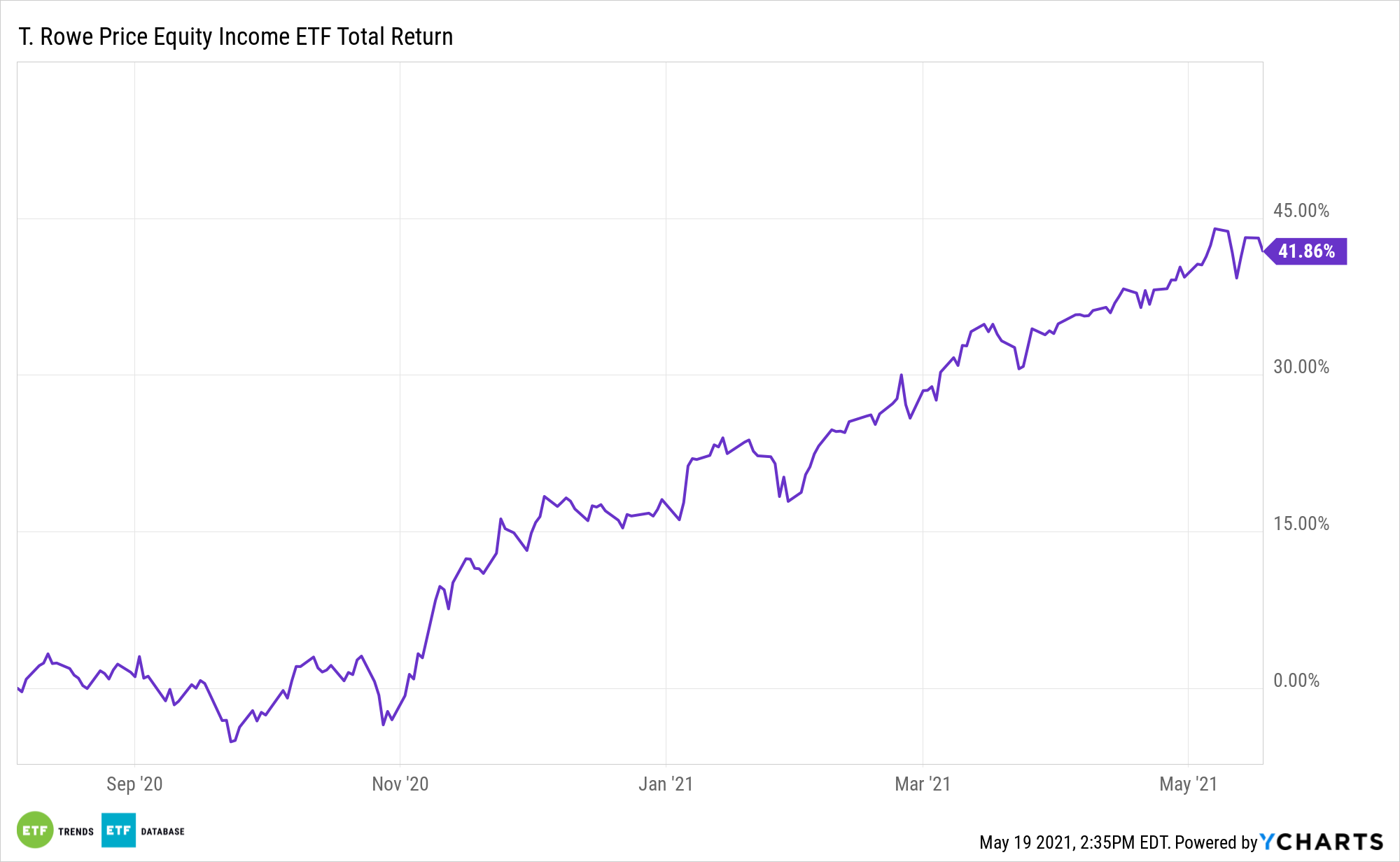

Dividends are working again. So are value stocks – they are one of this year’s best-performing investment factors. Advisors and investors can capitalize on that duo with the T. Rowe Price Equity Income ETF (TEQI).

TEQI, a semi-transparent exchange traded fund, “invests at least 80% of its net assets in common stocks, with an emphasis on large-capitalization stocks that have a strong track record of paying dividends or that are believed to be undervalued,” according to T. Rowe Price.

The ETF typically focuses on value stocks with above-average yields. Low interest rates – the scenario income investors are contending with today – are usually seen as beneficial to high-dividend names. Another point in favor of TEQI is that inflation is conducive to upside for high-yield stocks.

“Inflation may be hurting the broader market, but it also indicates that stocks paying high dividends can perform well,” reports Jacob Sonenshine for Barron’s.

Furthermore, dividend growth historically tops inflation. That’s an important point for investors considering TEQI because many passive funds are one or the other: dedicated to payout growth or above-average dividends.

As an actively managed fund, TEQI can position investors to capitalize on both concepts while steering clear of potential trouble spots in the high-dividend arena. Some companies with big yields are financially burdened by those payouts and primed for cuts and suspensions. Active funds can avoid those names, while index strategies often to wait to boot offenders.

Evercore data “also indicate that expectations for inflation and bond yields are both high enough that high- dividend stocks can keep outperforming low payers from here,” according to Barron’s.

TEQI taps into one last theme: rising Treasury yields. Its weight to financial services stocks is 23.08%, or 11.45% above the benchmark. That positions TEQI investors to not only thrive as yields rise, but also as banks step back up to the dividend booth, which is expected to occur later this year.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.