The S&P 500 Growth Index is up 4.47% year-to-date, but many investors are acting as though it’s sporting a double-digit loss. Indeed, cyclical value stocks, after more than a decade of lagging, are finally getting the better of growth names.

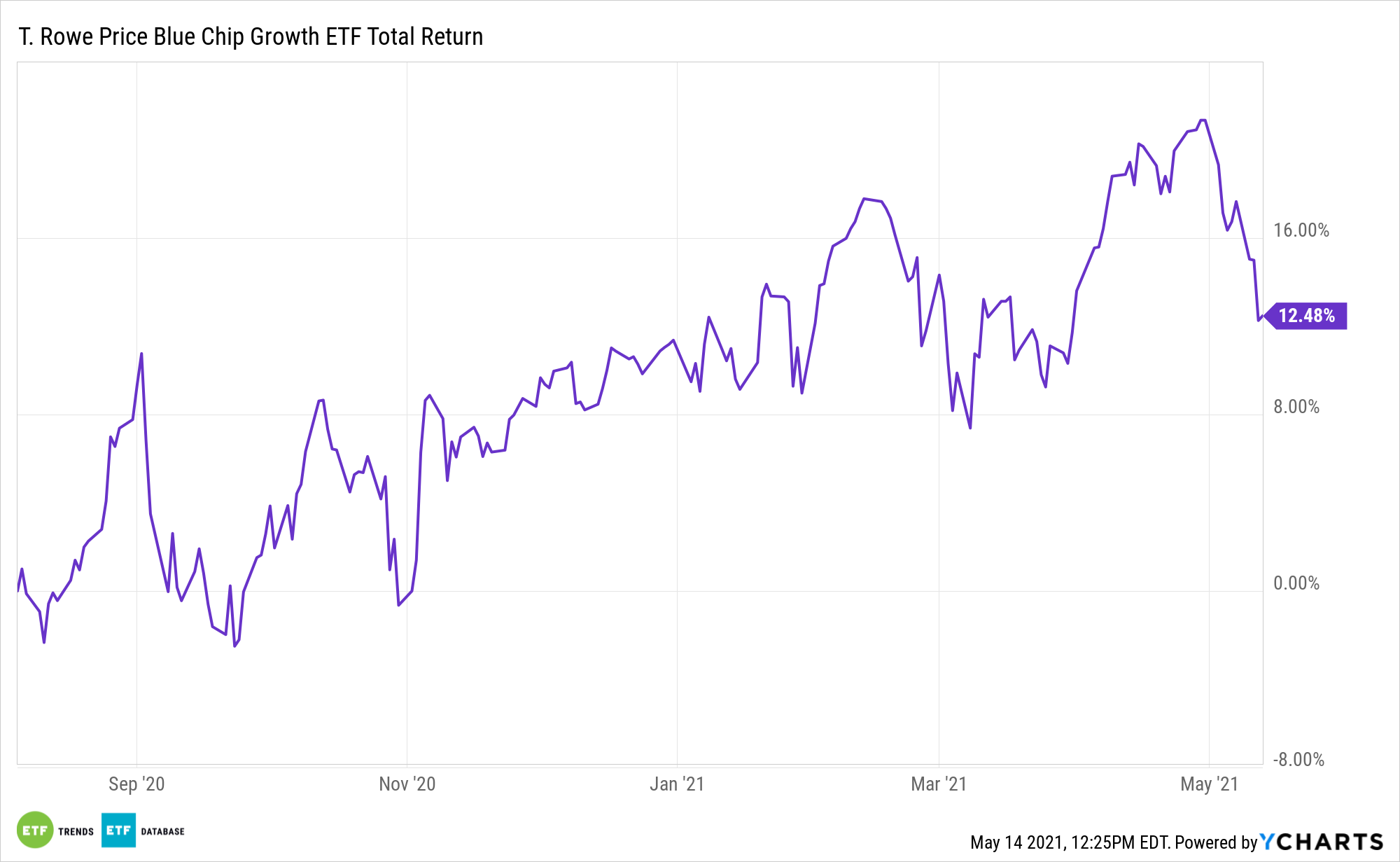

While this value run appears to have legs, it’s worth remembering that factors themselves move in cyclical fashion, meaning the case for growth may be dented today, but that may not be the case tomorrow. Patient investors wanting to wager on a growth resurgence may want to put active management on their side with the T. Rowe Price Blue Chip Growth ETF (TCHP).

Remembering that the U.S. economy is in the early stages of recovering from the coronavirus recession – a scenario that historically favors value over growth – opportunities remain with TCHP due to the managers’ focus on quality growth stocks.

There’s some fluidity regarding what constitutes “quality growth,” but standard hallmarks often include innovation, earnings quality, and secular tailwinds. Passive strategies may deliver exposure to one or two of those traits, but not all three. Conversely, actively managed TCHP can provide exposure to each of those favorable characteristics.

Speaking of earnings quality, it’s becoming clear in the current market environment that many investors have little tolerance for money-losing companies. As an active fund, TCHP can eschew cash bleeders to find those with legitimate earnings power and free cash flow (FCF) credentials.

Lower inflation and energy prices could potentially lift equity prices while pushing value out of favor, meaning TCHP could be a leader in a “deflation” scenario.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.