Among actively managed mutual funds targeting dividend growth, the T. Rowe Price Dividend Growth (PRDGX) is one of the best-known. PRDGX is also available in ETF form via the T. Rowe Price Dividend Growth ETF (TDVG).

As fans of active funds well know, manager and team stability are primary reasons behind the long-term success of T. Rowe Price dividend growth.

“Manager Tom Huber’s tenure on this fund stands out among peers. Running this strategy since March 2000 lands him in the large-blend Morningstar Category’s most experienced decile,” writes Morningstar analyst Alec Welch. “Along the way, Huber has drawn on T. Rowe Price’s first-rate analyst team and an advisory committee that provides guidance on his investment theses.”

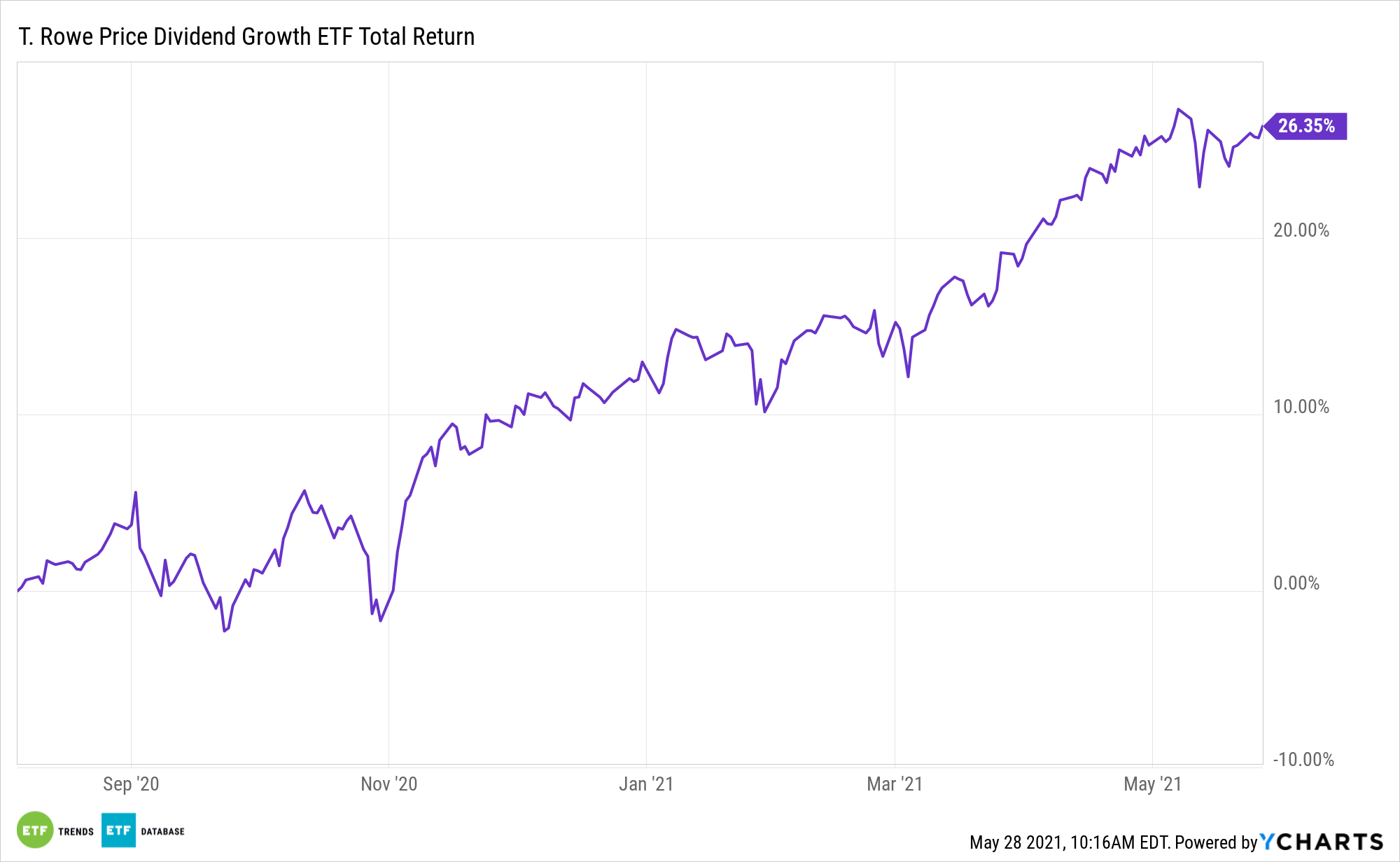

TDVG looks to allocate the bulk of its assets to dividend-paying companies with the potential to boost those payouts over time while mixing dividend payers with attractive valuations. That strategy is a big reason why PRDGX has been a success for years. Savvy income investors know that over the long-term, dividend growers are usually less volatile than high-yield names and that payout growth, particularly when compound by reinvestment, is an important driver of long-term total returns.

Financial health is a strong point of emphasis for Huber and team when considering companies that could be added to the aforementioned funds.

“Financial health, which is necessary to sustain above-average payout growth, is a prerequisite for new ideas,” notes Welch. “Beyond that, he looks for companies with durable competitive advantages, ample cash flow, and sound management teams that allocate capital with shareholders’ interests in mind, whether that’s through dividends or buybacks.”

In ETF form, TDVG is what’s known as a semi-transparent fund, meaning its holdings aren’t disclosed on a daily basis as is the case with traditional passive ETFs. At the end of April, TDVG had 3.10% percent of its assets in cash, but its sector tilts confirm the dividend growth emphasis. The fund currently devotes over 51% of its combined weight to technology, healthcare, and financial services stocks.

Tech and healthcare have been steady sources of payout growth for some time. In fact, healthcare was a prime source of first-quarter dividend growth. TDVG’s financial services exposure could be a benefit in the back half of the year if the Federal Reserve approves payout hikes by big banks after halting dividend growth in 2020 due to the coronavirus pandemic.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.