An obvious way for actively managed exchange traded funds to make inroads in the ultra-competitive ETF industry is to deliver the goods when it comes to performance.

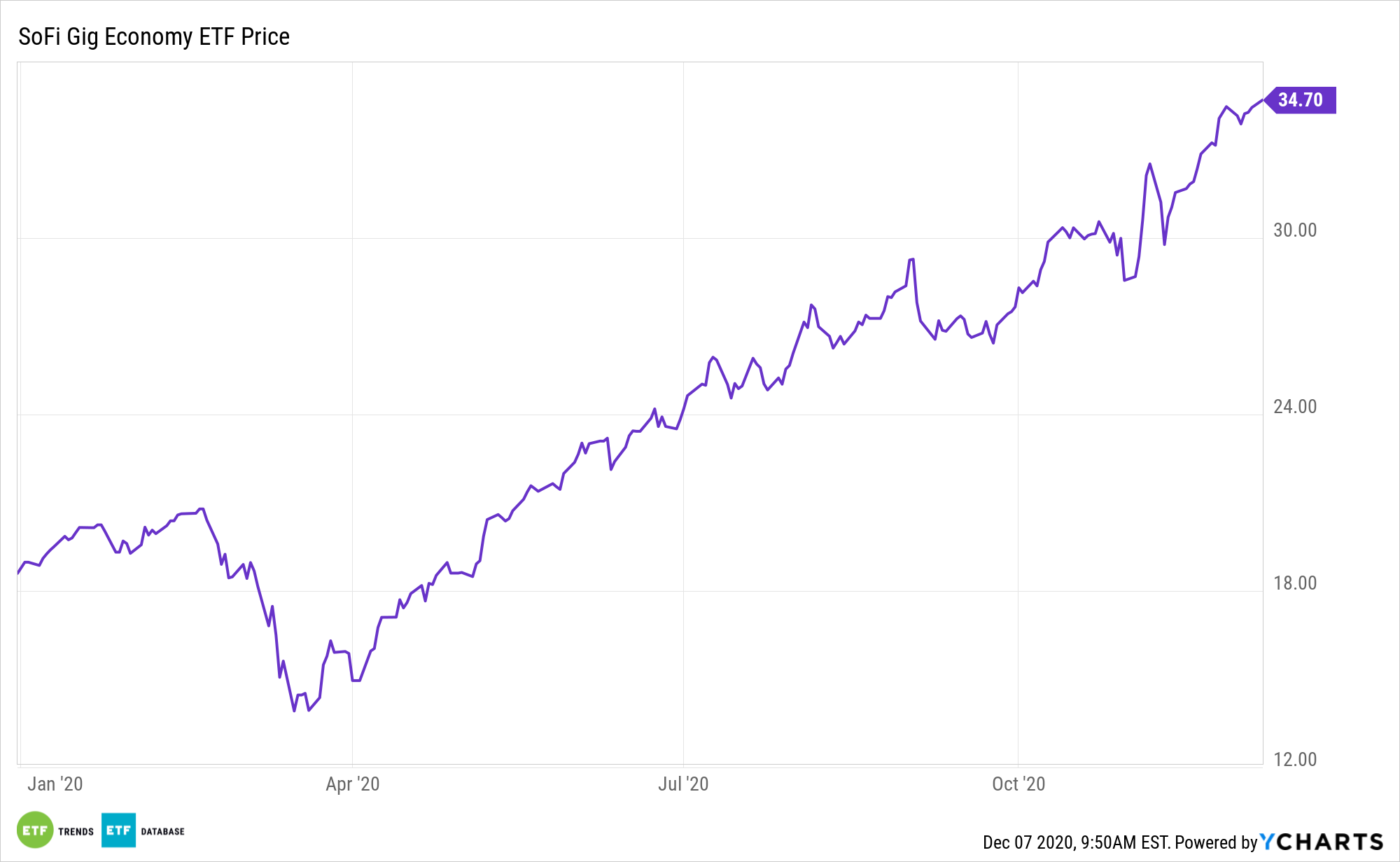

Case and point: the SoFi Gig Economy ETF (GIGE), which debuted last year.

GIGE seeks long-term capital appreciation by providing exposure to companies involved in the revolutionary shift towards a “gig” economy, a free-market system comprised of freelancers and shared resources, such as transport and real estate.

GIGE taps into important demographic elements of the gig economy investing equation. Millennials exhibit a drastic shift in the way they interact with the world economy. Most millennials buy what they know, buy what’s trendy, are sensitive to prices, and remain open to discovery.

“Launched in May 2019 by financial-technology start-up SoFi, the fund owns companies that have transformed the way people buy goods, access services, and work, including freelancer marketplace Fiverr International (FVRR) and digital-payment firm Square (SQ). Year to date, it has returned 85%,” reports Evie Liu for Barron’s.

The Gig Economy as the Frontier of Finance

The “gig economy” refers to the group of companies that embrace, support, or otherwise benefit from a workforce where independent consultants, contractors, temporary or on-call workers are empowered to crate their own freelance businesses by leverage recent developments in technology.

Looking at the Gig Economy, 37% are millennials, 28% are generation X’ers, and 35% are baby boomers. The workforce share of gig work has increased to 15.8% in 2015 from 10.1% in 2010, and it will likely continue to grow. The Gig Economy covers industries like finance, agriculture, forestry, transportation, education, healthcare, retail, construction, and more.

GIGE reflects a transformational change in how many businesses interact with customers, and the Gig Economy theme provides exposure to a trend or developing business model through the compilation of securities from multiple sectors and geographies. The Gig Economy theme can also act as an alternative source of return over the coming decade, or enhance a traditional stock and bond mix, given the slowdown in traditional assets and depressed yields in the bond markets.

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.