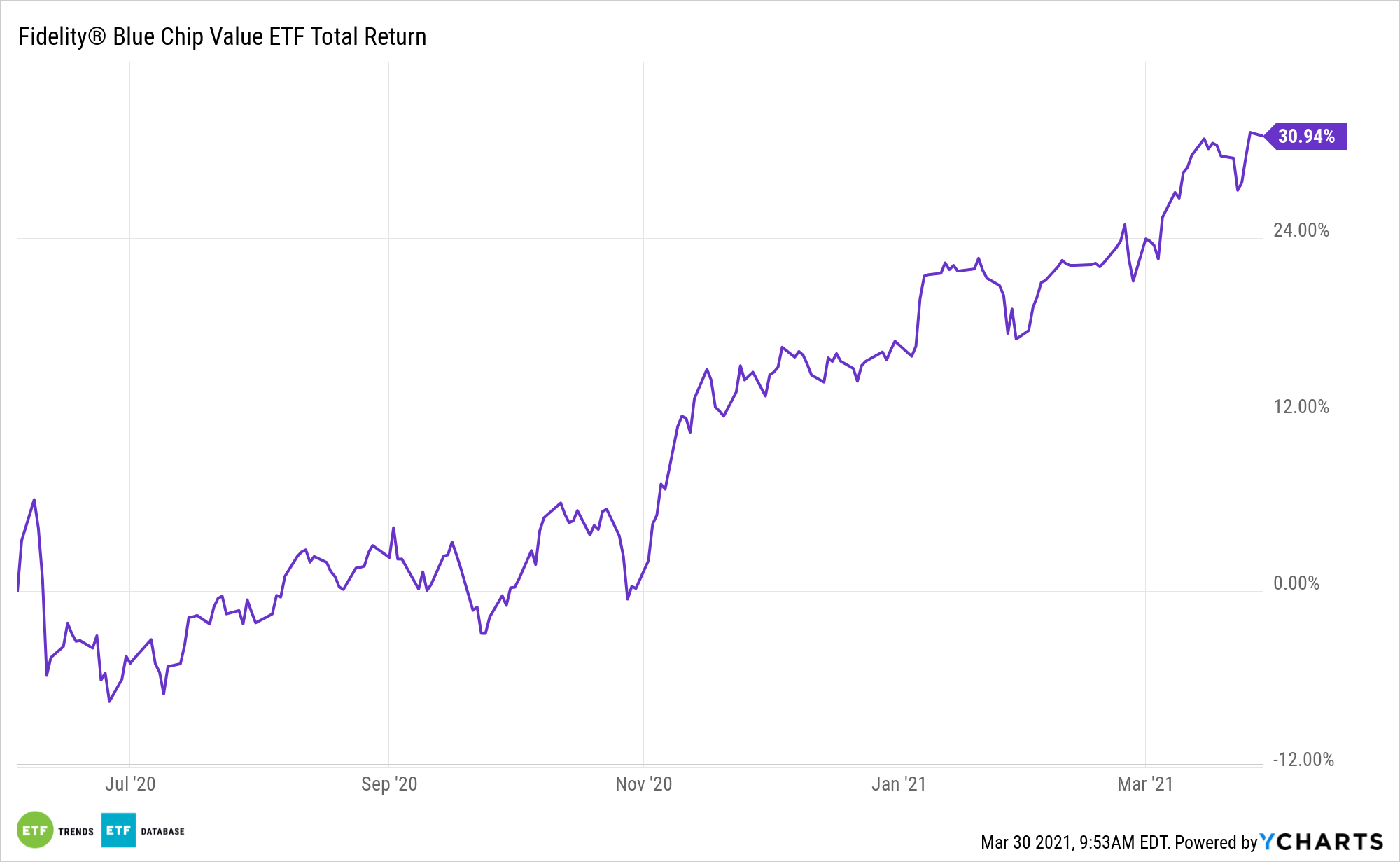

The value factor is on the comeback trail in a big way, suggesting there are some advantages to embracing active management. Enter the Fidelity Blue Chip Value ETF (FBCV).

FBCV is one of the initial trios of active non-transparent ETFs (ANTs) Fidelity launched in 2020, bringing the cache of one of the largest mutual and index fund issuers to this nifty new fund structure.

The exchange traded fund is worth acknowledging today because its active management methodology allows it be adaptive. In this vein, the value rebound could prove durable.

“At 20 times forward earnings, the S&P 500 is in the 90th percentile of its valuation over the past 30 years, per data from Goldman Sachs’ chief U.S. equity strategist, David Kostin,” reports Nicholas Jasinski for Barron’s. “But even investors feeling valuation vertigo can still find pockets of value in this market. Financials go for a 30% discount to the S&P 500, at just the ninth percentile of their historical relative range. Energy stocks, at a 13% discount to the index, are only at their 21st percentile relative valuation. Technology stocks, which trade at a 16% premium to the index, are at their 45th percentile over the past 30 years.”

Why ‘FBCV’?

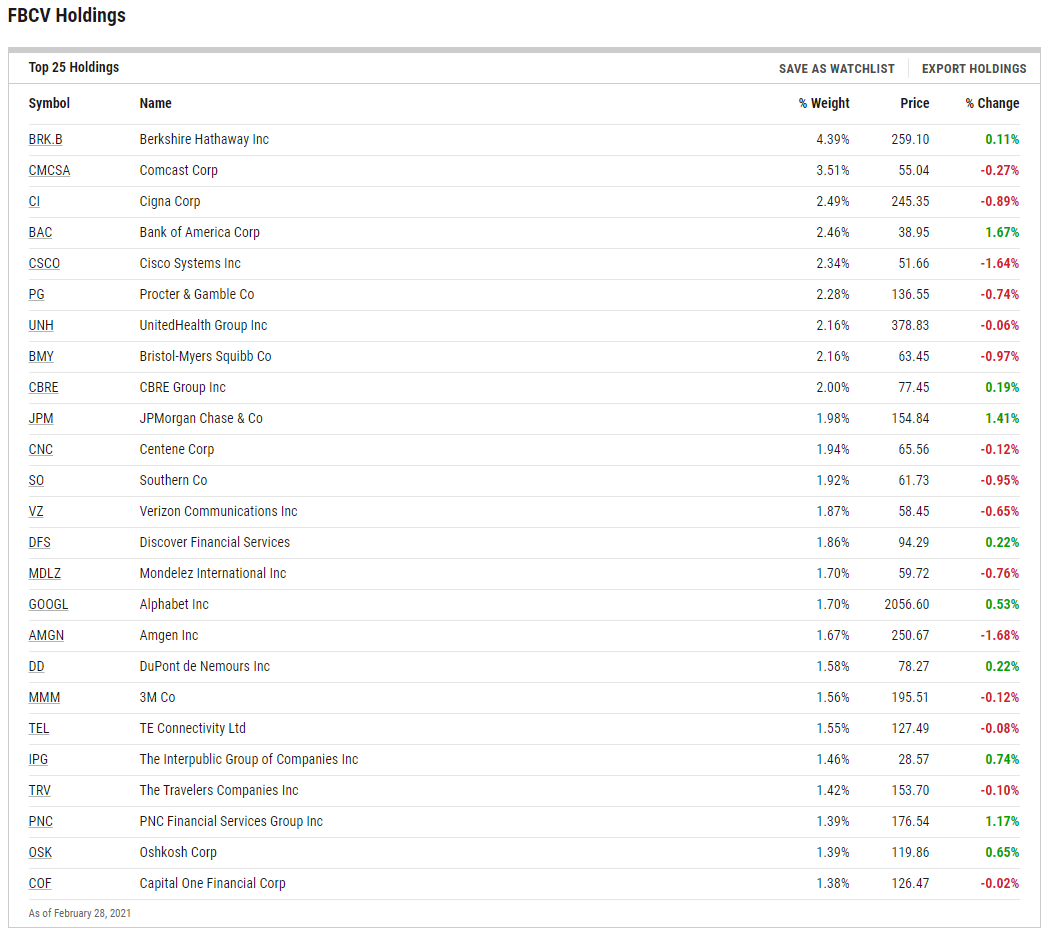

FBCV will normally invest primarily in equity securities of companies that the advisor believes are undervalued in the marketplace in relation to factors such as assets, sales, earnings, growth potential, or cash flow, or in relation to securities of other companies in the same industry (stocks of these companies are often called “value” stocks). The advisor normally invests at least 80% of the fund’s assets in blue chip companies (companies that, in FMR’s view, are well-known, well-established, and well-capitalized), which generally have large or medium market capitalizations.

FBCV components and value stocks usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets. On the other hand, growth-oriented stocks tend to run at higher valuations since investors expect the rapid growth in those company measures.

“Evercore ISI strategist Dennis DeBusschere is focused on sectors’ cash-return yields, which represent the total dividend and stock-buyback payouts to shareholders. Relative to history, industrials, materials, energy, and financials all look attractive on that basis,” adds Barron’s.

Those sectors are represented in FCBV’s portfolio.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.