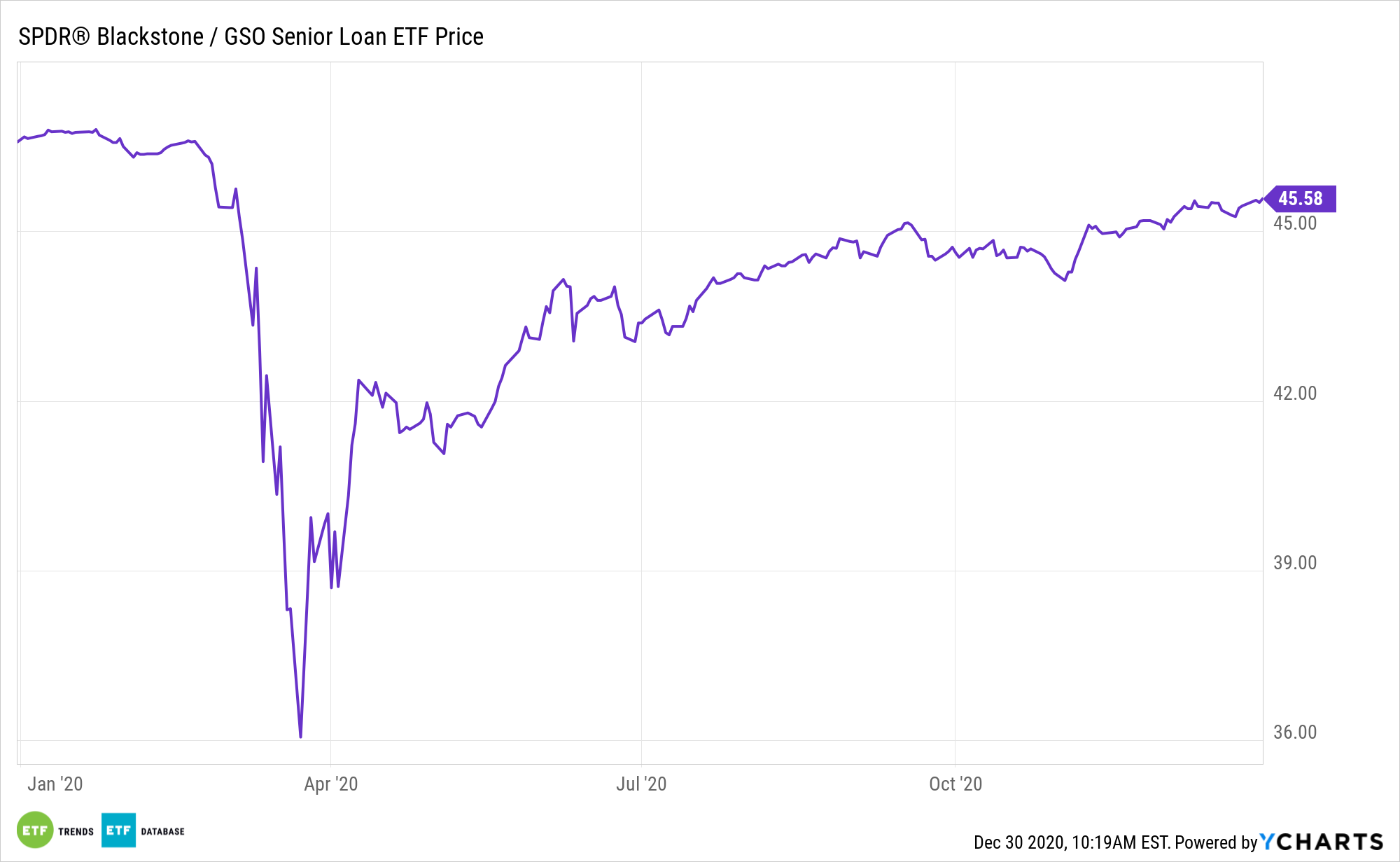

Some asset classes are ripe for active management, particularly high-yield corporate debt like senior loans or bank loans. The SPDR Blackstone/GSO Senior Loan ETF (NYSEArca: SRLN) is a strong exchange traded fund to consider for advisors and investors looking to get active with senior loans.

SRLN invests in senior loans given to businesses operating in North America and outside of North America. The Portfolio may invest in senior loans through the loans directly via the primary or secondary market or via participation in senior loans, which are contractual relationships with an existing lender in a loan facility where the loan portfolio purchases the right to receive principal and interest payments.

“Investors with a bit more risk tolerance may be interested in these fixed-income funds, which buy commercial loans,” writes Dave Gilreath, partner/founder, Sheaff Brock Investment Advisors, LLC, in an op-ed for CNBC. “Though the borrowing companies may have credit below investment grade, this risk is balanced by the loans’ status as senior debt, meaning that fund holdings’ place in line for payment is ahead of other forms of debt and stockholders.”

Beat the Low Rate Environment with the SRLN ETF

Since rates are usually reset once per quarter, senior loans typically have low durations – a measure of a bond fund’s sensitivity to changes in interest rates. The floating-rate component also offers investors an alternative method of earning yields while mitigating interest-rate risk. Consequently, bank loans are seen as an attractive substitute for traditional corporate debt in a rising rate environment.

Leveraged loans usually attract investors who are looking to generate income in a rising interest rate environment due to their floating rate component. However, central banks and agencies like the International Monetary Fund have warned that credit quality is declining – bank loans are usual for highly leveraged companies and are rated speculative-grade.

“Using these unconventional solutions may require some study, but individual investors who learn their dynamics can get substantially higher yields than those from conventional fixed-income vehicles while still having a sufficient comfort level,” according to Gilreath.

That underscores the benefits of tapping SRLN’s active management style.

By including senior loans in SRLN’s portfolio, the loans first lien priority, meaning in the event of a borrower default, the senior loans are paid first. Higher payment priority assists liquidity in terms of the defaulting borrower having to sell assets in order to pay off creditors – in this case, senior loans within the SRLN portfolio are given higher priority – a viable option, especially during a market downturn.

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.