There may be a shift from growth to value in market leadership, but this shouldn’t discount certain quality growth stocks’ solid performances. In T. Rowe Price’s article, “The Long-Term Appeal of Durable Growers Remains Intact,” from Larry Puglia and Paul Greene, Portfolio Managers, Blue Chip Growth Fund, it’s made clear there’s a focus on identifying opportunities where the market may undervalue the durability of a company’s growth story.

While value stocks have outperformed their growth counterparts in recent months, that doesn’t quell the feeling of high-quality companies being able to compound value over the long run by growing their revenue. There’s a strive to develop an understanding of the companies that drive innovation. Additionally, having insights into what to factor in when shaping a long-run position means taking into account holdings in areas such as E-commerce, where strong secular tailwinds have been heading.

According to the article, “The main factors powering this regime shift do not appear to have exhausted themselves, although considerable uncertainty remains in the near term.” Much of this has to do with the progress on taming the Covid-19 pandemic. Combined with the heavy fiscal stimulus, returning to normalcy could unleash a wave of pent-up demand that would favor value stocks.

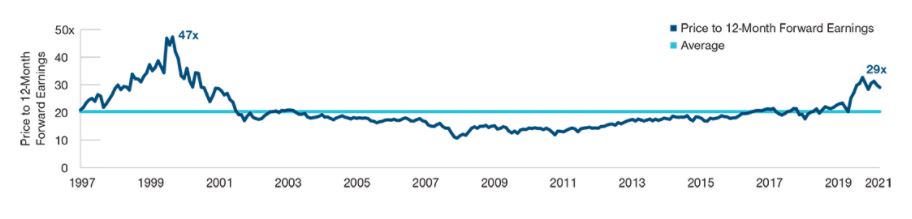

With that in mind, it’s important to note how many of the large-cap growth bellwethers now trade at valuations that do not appear unreasonable when considering these companies’ growth prospects. Additionally, the underlying business fundamentals don’t suggest these changes will prove to be durable.

Russell 1000 Growth Index price‑to‑earnings ratio

December 31, 1997, to February 28, 2021. Source: T. Rowe Price analysis using data from FactSet Research Systems Inc.

Since 2005, value’s run of relative underperformance has coincided with widespread innovation, particularly with rapidly growing tech companies. Once the cyclical forces driving the recent outperformance in value stocks start to face, T. Rowe Price believes the forces driving innovation and disruption should return to the fore.

The Nature Of Cyclicality

As stated, “In terms of relative performance, the early stages of the business cycle—when the market tends to favor stocks that offer the most exposure to accelerating economic growth—can present near‑term challenges for the high‑quality secular growers that we favor. However, as long as the high‑quality companies in the fund can execute their long‑term strategies and grow their cash flows rapidly, we remain confident in their potential to compound in value over a full economic cycle.”

This approach has resulted in a portfolio offering leverage to an acceleration in growth, even if cyclical stocks are not bought purely for the exposure to a near-term recovery.

“Our valuation discipline means that we are finding fewer opportunities in cyclical sectors that meet our investment criteria.” Still, T. Rowe Price has focused on companies they believe should emerge stronger, following the pandemic, thanks to the quality of their business and specificity of their potential growth drivers.

With that in mind, the Russell 1000 places heavy emphasis on high-quality companies believed to offer exposure to secular growth trends, particularly in the realm of digitalization of the enterprise and consumer behavior.

Large‑cap growth names have exhibited superior fundamentals

June 1, 2007, to March 31, 2020. Source: T. Rowe Price analysis using data from FactSet Research Systems Inc.

The E-Commerce Factor

As far as where T. Rowe Price believes they have an edge that could potentially add the most value over a full economic cycle, as mentioned, it’s identifying the opportunities the market doesn’t fully appreciate. As noted in the article, “E‑commerce is one area where we are finding compelling opportunities, in part, due to our differentiated insights and willingness to look beyond the near term.”

Given the health crisis, there’s been an accelerated adoption of E-commerce among households and small to mid-size businesses with no previous online presence. These behavioral shifts worked for secular growers with exposure to these trends while also raising concerns about whether this growth could shorten these companies’ growth runways.

Still, while online shopping has been more favorably adopted, penetration rates of the U.S. and Europe compared to Asia suggests the trend has room to run as consumers become more comfortable purchasing all sorts of products online that previously resisted online competition.

As pointed out, “The potential for growth stories that have a second and third chapter is part of what gives us confidence in the e‑commerce names in which we have invested.” At scale, it is believed E-commerce operations should lend themselves to ancillary opportunities in online payments and targeted ads.

With the market often overly focused on the near terms, the best opportunities to add value could actually be coming from having a deeper knowledge of the long-term and how a company’s growth story might evolve.

For more news, information, and strategy, visit the Active ETF Channel.