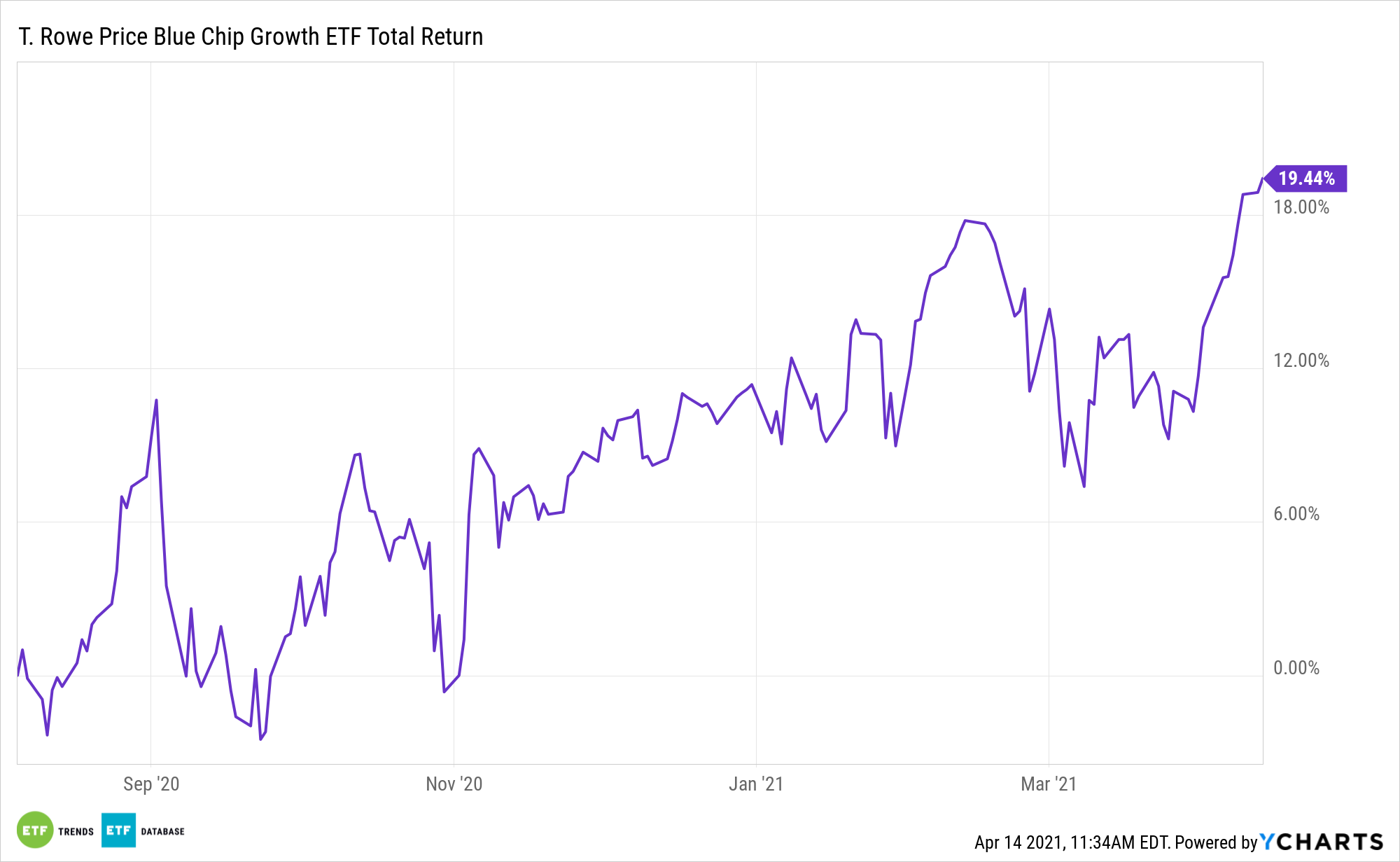

For once, value stocks are getting all adulation, but investors shouldn’t be too dismissive of growth. In fact, they can get active in preparation of a growth resurgence with the T. Rowe Price Blue Chip Growth ETF (TCHP).

T. Rowe Price active ETFs complement the firm’s traditional mutual fund offerings and deliver the key features associated with existing ETFs that some investors may prefer, including continuous daily trading, real-time market determined pricing, and tax efficiency. Over time, T. Rowe Price plans to deliver a robust ETF product lineup covering investments in various asset classes.

The economy is currently in the nascent stages of the traditional recovery cycle, and investors should not let short-term noise distract them from growth opportunities. While there are the obvious plays in large tech stocks, investors shouldn’t overlook additional growth opportunities that often fly under the media’s radar. TCHP is an avenue for capitalizing on those opportunities.

Growth vs. Value ETFs

Managed by Larry Puglia, who maintains a 26-year tenure as portfolio manager of the T. Rowe Price Blue Chip Growth Fund, TCHP seeks to provide long-term capital growth by investing in common stocks of large- and medium-sized blue chip companies that have the potential for above-average earnings growth and are well-established.

Along with expectations of a rebound in profit growth this year and a recovery in economic activity, many market observers are arguing that the foundation for further stock market gains is in place.

Growth stocks are often associated with high-quality, prosperous companies whose earnings are expected to continue increasing at an above-average rate relative to the market. Growth stocks generally have high price-to-earnings (P/E) ratios and high price-to-book ratios. Still, data suggest the growth/value premium isn’t overly elevated relative to historical norms.

Growth stocks may be seen as exorbitant and overvalued, causing some investors to favor value stocks, which are considered undervalued by the market. Value stocks tend to trade at a lower price relative to their fundamentals (including dividends, earnings, and sales). While they generally have solid fundamentals, value stocks may have lost popularity in the market and are considered bargain priced compared with their competitors.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.