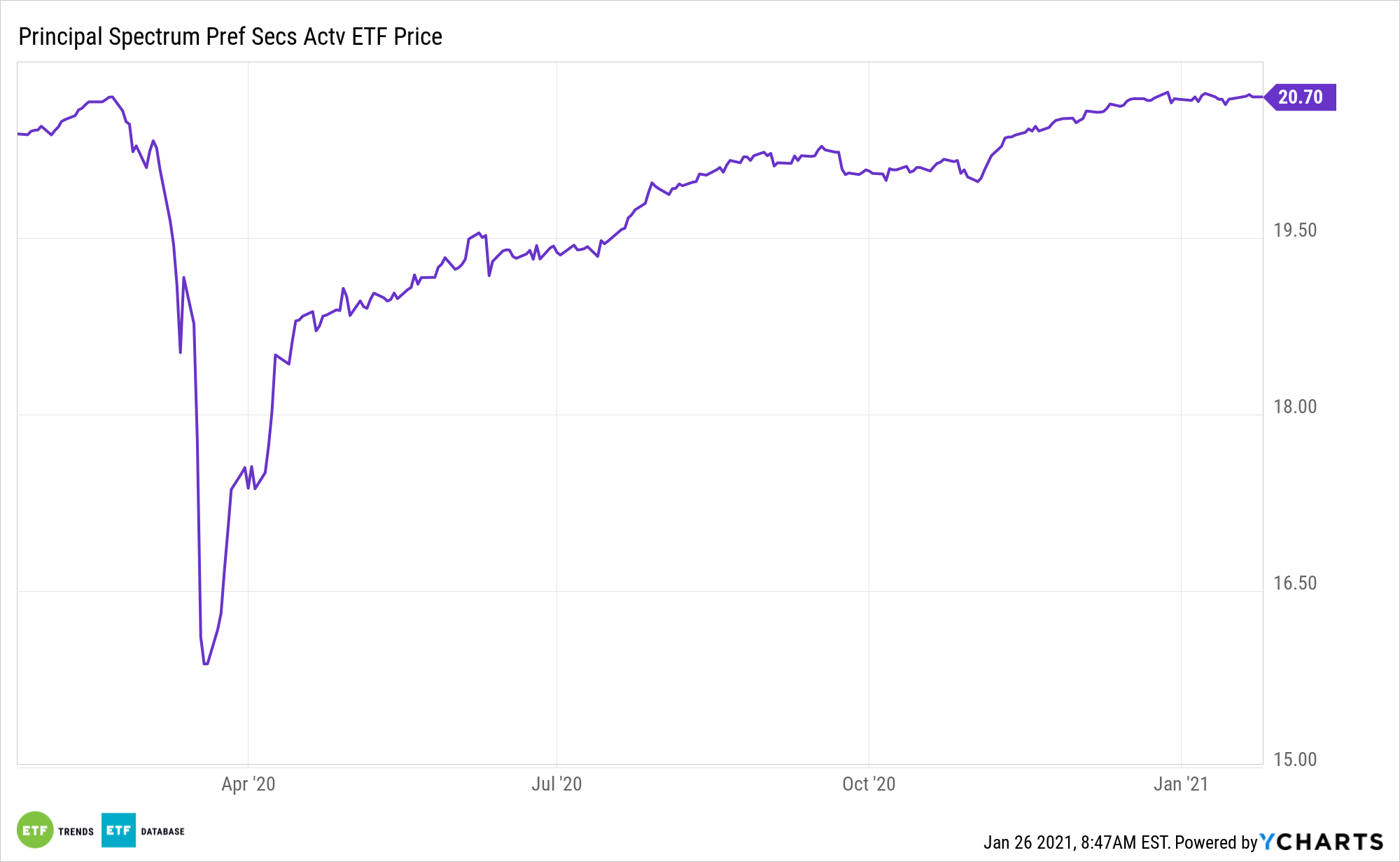

Bond yields are still low, meaning traditional income-generating assets just aren’t cutting it for many investors. Enter preferred stocks and the actively managed Principal Spectrum Preferred Securities Active ETF (NYSEArca: PREF).

PREF can act as a portfolio diversification tool and reducer of correlations. Another advantage of PREF’s active management is that the managers can look for value in an asset class that has been expensive for much of this year.

Preferred stocks are a type of hybrid security that show bond- and equity-like characteristics. The shares are issued by financial institutions, utilities, and telecom companies, among others. Within the securities hierarchy, preferreds are senior to common stocks but junior to corporate bonds. Additionally, preferred stocks issue dividends on a regular basis, but investors don’t usually enjoy capital appreciation on par with common shares.

“The preferred market had resisted Treasury yields’ ascent during late 2020 as credit spreads contracted, Frank Sileo and Barry McAlinden, senior credit strategists at UBS Financial Services, noted,” reports Randall Forsyth for Barron’s.

The PREF ETF and Active Management Advantages

As an actively managed ETF, PREF offers investors some perks relative to index-based preferred strategies. Those benefits include being able to allocate to higher quality preferreds and, in some cases, variable rate preferreds.

Along with a consistent dividend payout, preferred stocks are prioritized over common stocks in the case that a company files for bankruptcy/liquidation. This gives additional layer of safety to PREF’s portfolio.

“But, as the old Wall Street saying goes, preferreds took the staircase up and the elevator down, the UBS strategists observed. Those with a $25 par value advanced 1.9% in December after a 2.5% gain in November, but have fallen 2.7% this year, through Jan. 18. However, $1,000 par preferreds held up better, which the duo attributed to their having variable-rate dividends, while the $25 par varieties’ payouts are fixed, making them more sensitive to yield changes,” according to Barron’s.

Investing in PREF is a better way to gain attractive yields than investing in government bonds, which offer much lower yields for the amount of potential risk investors face.

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.