Actively managed exchange traded funds that combine ETF and mutual fund traits may be getting a big boost.

“Natixis Investment Managers has received approval from the Securities Exchange Commission (SEC) for the use of custom baskets in actively managed semi-transparent exchange-traded funds (ETFs) that follow the New York Stock Exchange (NYSE)’s Proxy Portfolio Methodology approach,” according to a statement.

Integral to the success of semi-transparent ETFs are mechanics, such as the verified intraday indicative value (VIIV), which is calculated and disseminated every second throughout the trading day by the exchange these ETFs trade on.

The VIIV is based on the current market value of the securities in the fund’s portfolio on that day. The metric is intended to provide investors and other market participants with a highly correlated per-share value of the underlying portfolio that can be compared to the current market price.

Natixis Leading the Breakthrough

“Previously, Natixis active semi-transparent ETFs were required to disclose proxy portfolios that closely track the fund’s actual intraday portfolio performance on a daily basis,” according to Natixis. “This new approval from the SEC enables Natixis to create custom baskets that contain securities not included, or securities in different weights than are in the fund’s Proxy Portfolio when creating or redeeming shares. The use of custom baskets for active semi-transparent ETFs has the potential to reduce trading costs, increase efficiency, and improve secondary markets for the shares.”

Leveraging the New York Stock Exchange (NYSE)’s Proxy Portfolio Methodology approach, Natixis’s semi-transparent active ETFs disclose proxy portfolios on a daily basis that closely track the actual portfolios’ intraday performance. This structure allows the portfolio managers to shield the identity of stocks on which they are actively trading, while still providing market makers enough information to offer competitive bids and asks on the ETFs. Natixis’s active semi-transparent ETFs give investors access to highly skilled active managers through a tax-efficient and lower cost vehicle.

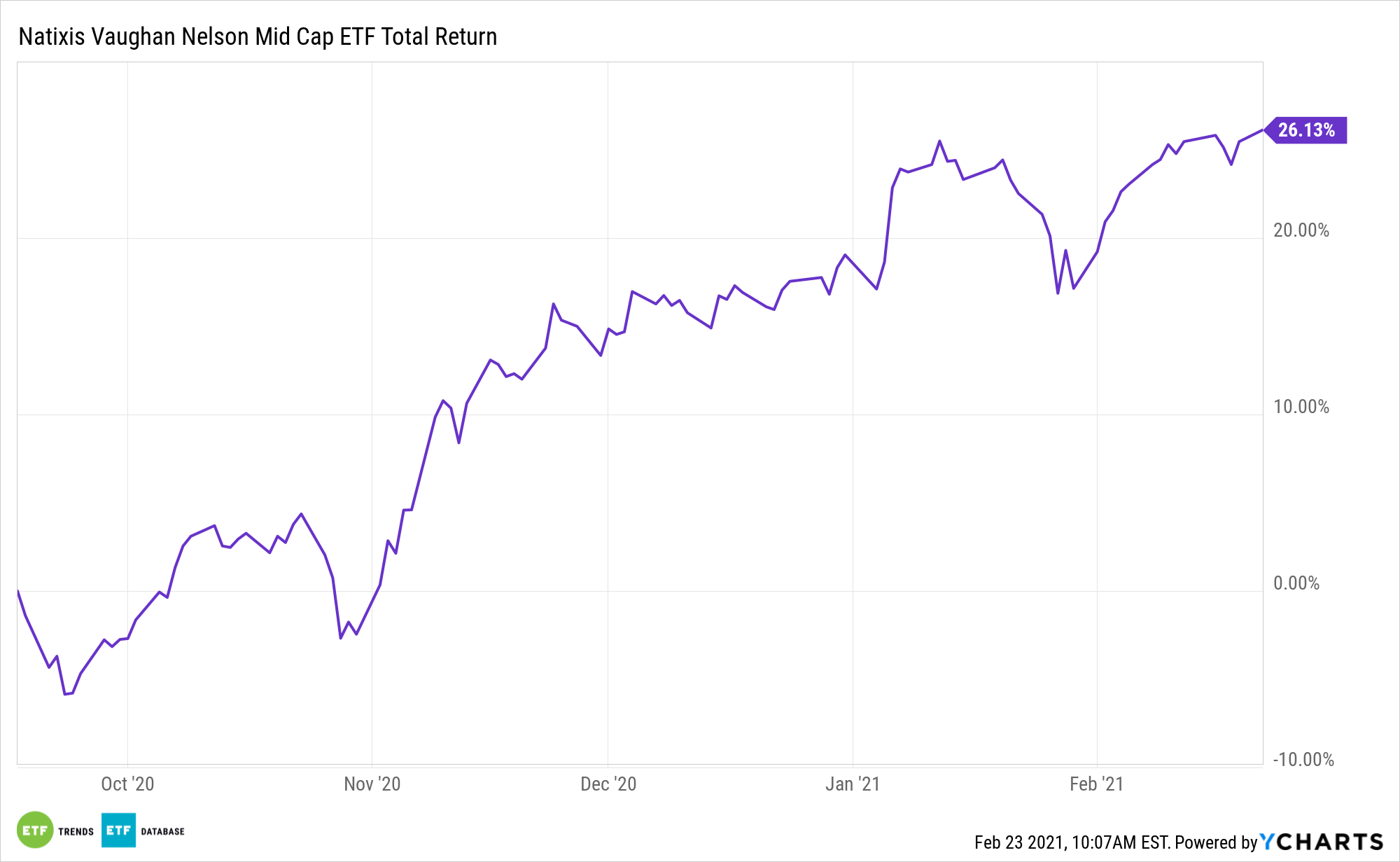

“Natixis Investment Managers entered the active semi-transparent ETF market in September 2020 with the launch of the Natixis US Equity Opportunities ETF (EQOP), Natixis Vaughan Nelson Mid Cap ETF (VNMC), and Natixis Vaughan Nelson Select ETF (VNSE), listed on NYSE Arca, Inc.,” according to the issuer.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.