The AdvisorShares Pure US Cannabis ETF (MSOS) is proving cannabis exchange traded funds and active management are a potent combination.

MSOS seeks long-term capital appreciation by investing entirely in legal, domestic cannabis equity securities. MSOS’ domestic equity strategy allows this active ETF to allocate its underlying portfolio among multi-state operator (MSO) companies as well as other U.S.-based cannabis-focused areas such a REITs, cannabidiol (CBD), pharmaceuticals, and hydroponics.

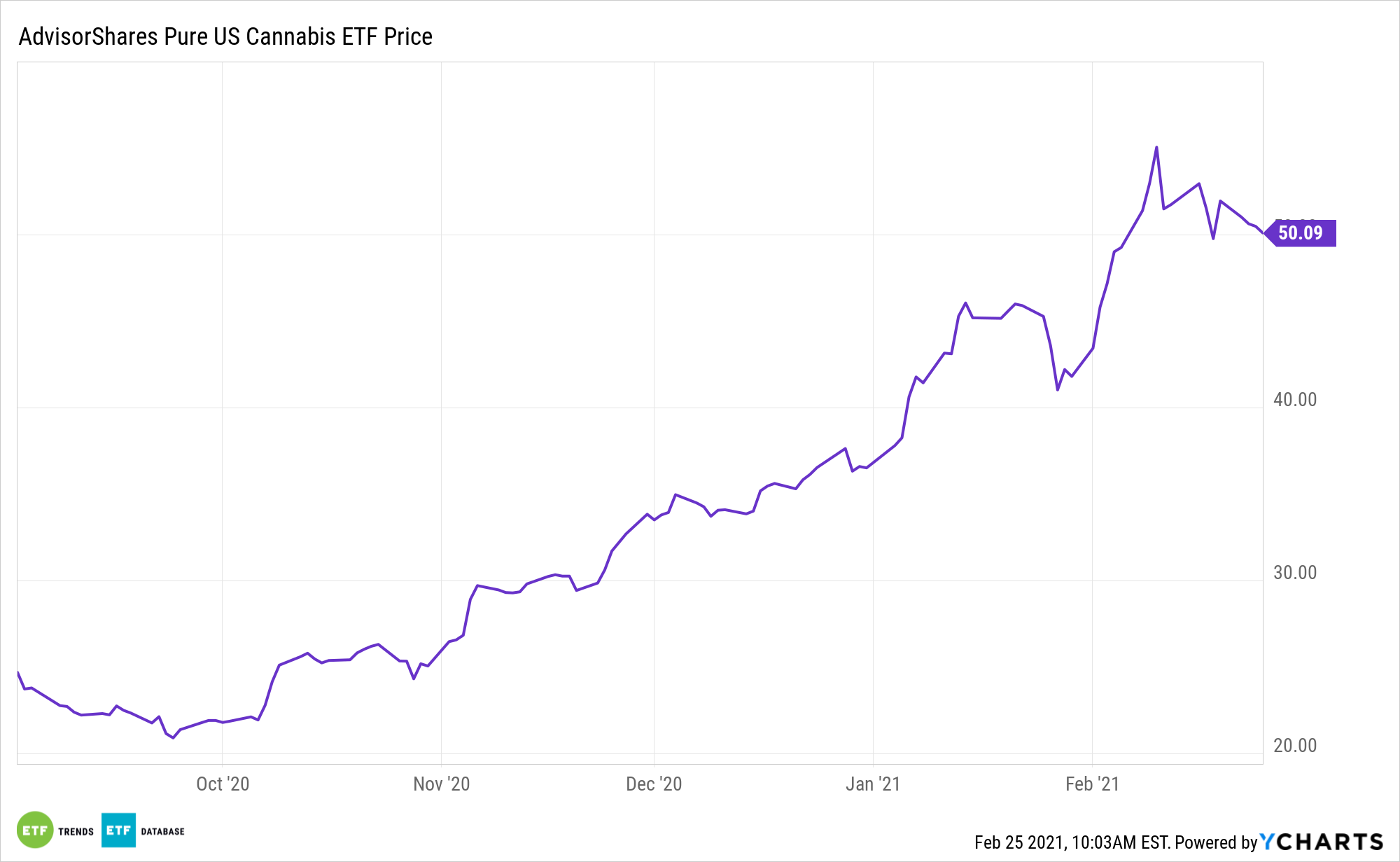

The fund debuted last September – perfect timing because it is the most U.S.-centric of cannabis ETFs and came to market just before Democrats took control of the White House and Senate, stoking talk of federal cannabis legalization.

Investors are responding in kind. MSOS recently topped $1 billion in assets under management.

“There’s a lot of excitement surrounding the cannabis investment space right now and for a variety of a reasons,” said Dan Ahrens, AdvisorShares’ chief operating officer and portfolio manager of MSOS. “We firmly believe that the U.S. cannabis market provides a compelling long-term investment opportunity that clearly differentiates itself from other areas of the globe. Investors must exercise careful due diligence when navigating cannabis and we believe MSOS’ unique, actively managed investment mandate delivers a sought-after solution to the marketplace.”

Tapping Into the American Market

MSOS is first U.S.-listed active ETF to deliver exposure dedicated solely to American cannabis companies, including multi-state operators (MSOs). MSOs are U.S. companies directly involved in the legal production and distribution of cannabis in states where approved.

The AdvisorShares ETF is the first of its kind to focus on U.S. cannabis equities. That’s beneficial seeing that the U.S. is the fastest-growing marijuana market in the world.

“When it launched on September 2, 2020, the actively managed MSOS became the first U.S.-listed ETF focused solely on American cannabis companies, including multi-state operators (MSOs),” according to AdvisorShares. “MSOs are U.S. companies directly involved in the legal production and distribution of cannabis in states where approved. This ETF with its apt ticker seeks long-term capital appreciation by investing entirely in legal, domestic cannabis equity securities. Its domestic equity strategy allows MSOS to allocate its underlying portfolio among MSO companies as well as other U.S.-based cannabis-focused areas such a REITs, cannabidiol (CBD), pharmaceutical and hydroponics. MSOS launched with $2.5 million in assets and has since grown to over $1 billion in assets less than six months after its inception.”

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.