With a big assist from the famed ARK Invest stable, actively managed exchange traded funds are having a moment, adding assets at a brisk pace.

On the back of strong inflows to start 2021, active ETFs now have a combined $200 billion in assets under management.

“That’s how much active ETFs currently manage after taking in $17.5 billion so far in 2021 — bringing their total assets to almost double the level a year earlier, according to data compiled by Bloomberg. While those products still make up only 3.5% of the $5.7 trillion industry, they’ve been steadily growing — with inflows reaching a record of over $55 billion in 2020,” reports Claire Ballentine for Bloomberg.

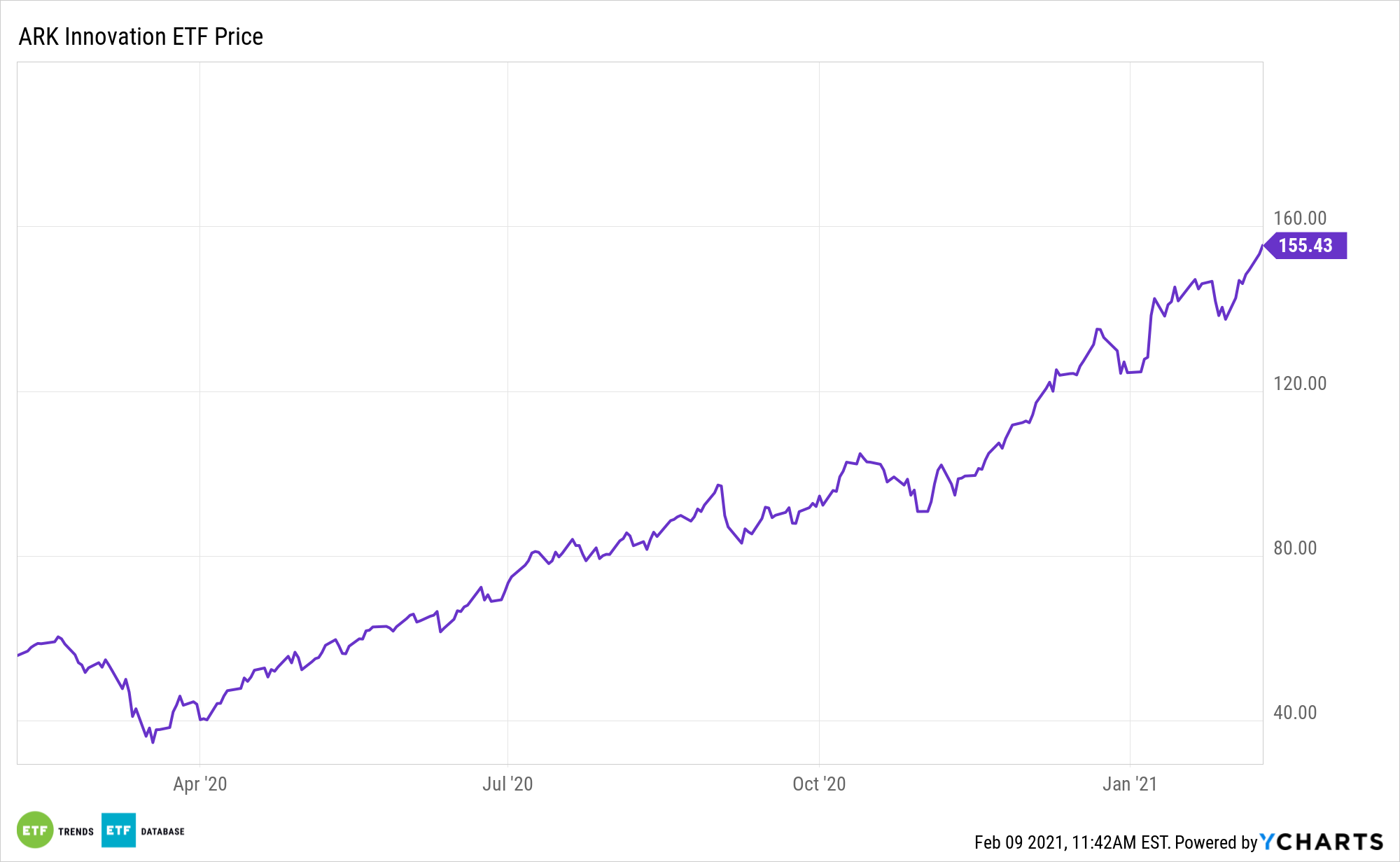

The ARK Innovation ETF (NYSEArca: ARKK) is leading the active ETF charge this year, with inflows north of $4.2 billion, a tally exceeded by just two other ETFs.

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘’Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘’Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

ARKK Dominating the Rest

ARKK is the largest active ETF of any variety – equity or fixed income.

“Actively managed funds have made a name for themselves as the next frontier of investing, with ETFs no longer confined to low-cost index-tracking and talented stock pickers delivering big returns. Cathie Wood, the head of Ark Investment Management, whose assets have soared to about $50 billion from $3.6 billion a year ago, has been the poster child for those products,” according to Bloomberg.

Further stoking inflows to active ETFs are mutual fund issuers entering the ETF space, some of which are converting established actively managed mutual funds to the better-serving ETF structure.

“Adding to the interest around actively managed ETFs are the new non-transparent funds — which shield their holdings from front-running — and were launched by firms such as American Century and T. Rowe Price Group Inc. The category could reach $3 billion in assets by the end of the year, according to Bloomberg Intelligence,” concludes Bloomberg.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.