Low interest rates crimp fixed income investors. That much is on display this year, but the scenario can also motivate market participants to examine other income-generating asset classes, including preferred stocks.

Often referred to as hybrid securities, preferred stocks possess both bond- and equity-like properties. Issuing companies must pay preferred dividends ahead of common stock payouts, but preferred investors are taken care of after corporate debt holders. Additionally, preferred holders are ahead of common shareholders but behind traditional bond investors in the event the issuing company goes bankrupt.

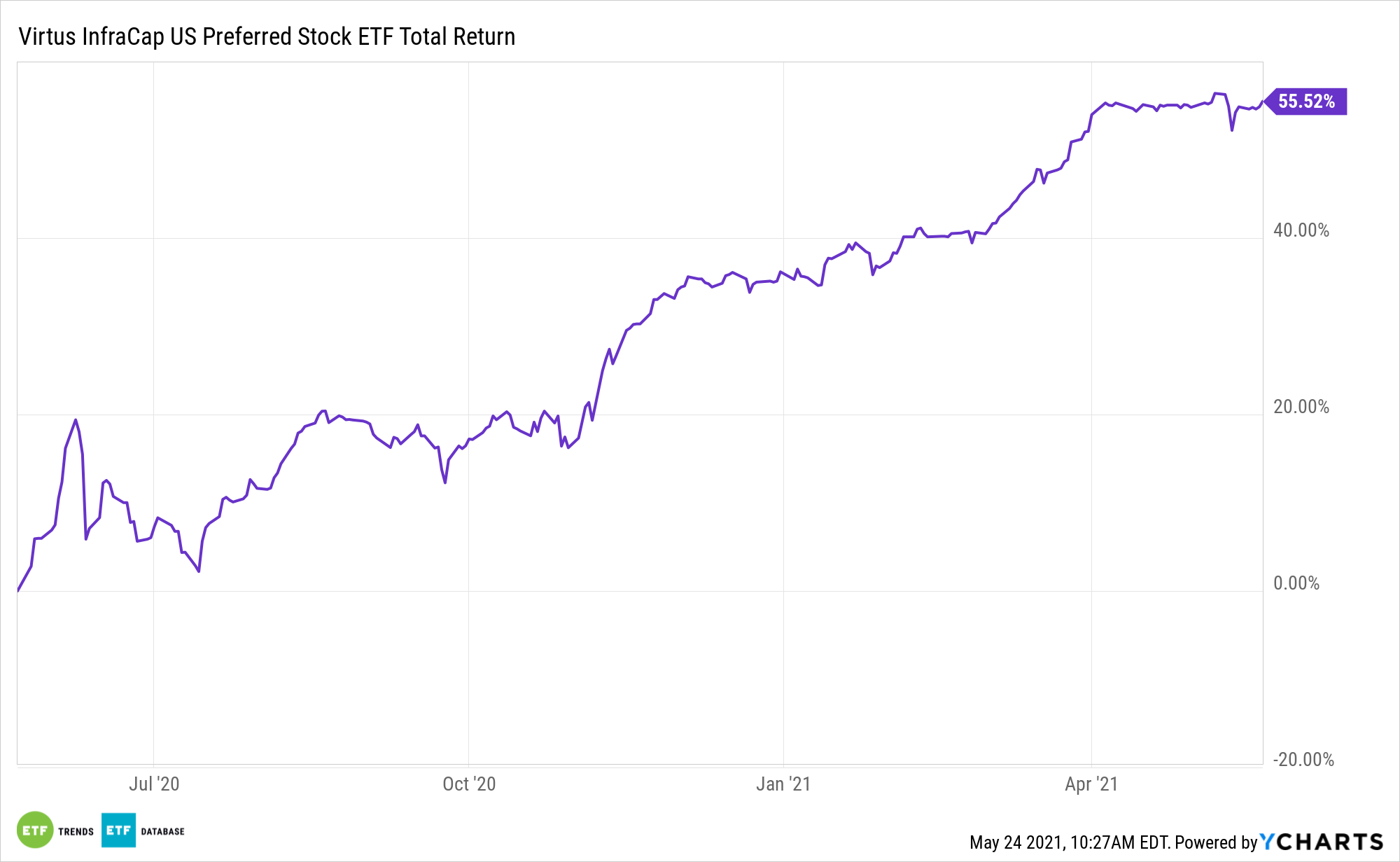

Overall, it’s a high-yield asset class with a lot to like for income investors. It’s also one that works well with active management, which is accessible via the Virtus InfraCap U.S. Preferred Stock ETF (NYSEArca: PFFA), among other exchange traded funds. There are some compelling reasons to consider an active preferred strategy, such as PFFA, over traditional index-based rivals.

“Investors in preferred stocks with a fixed-rate coupon are generally positioned to benefit from a decline in interest rates, credit spreads (i.e., risk premiums), or both,” according to Virtus research. “However, because preferred stocks are typically callable and perpetual, redemption timing is uncertain. Generally speaking, lower rates would induce an issuer to call the preferred at the first call date. Accordingly, active managers in the preferred stock space will monitor for this timing in order to act opportunistically to add value.”

Breaking Down the PFFA Perks

The $402.54 million PFFA recently turned three years old and is one of just a few actively managed funds among the 14 preferred ETFs on the market today.

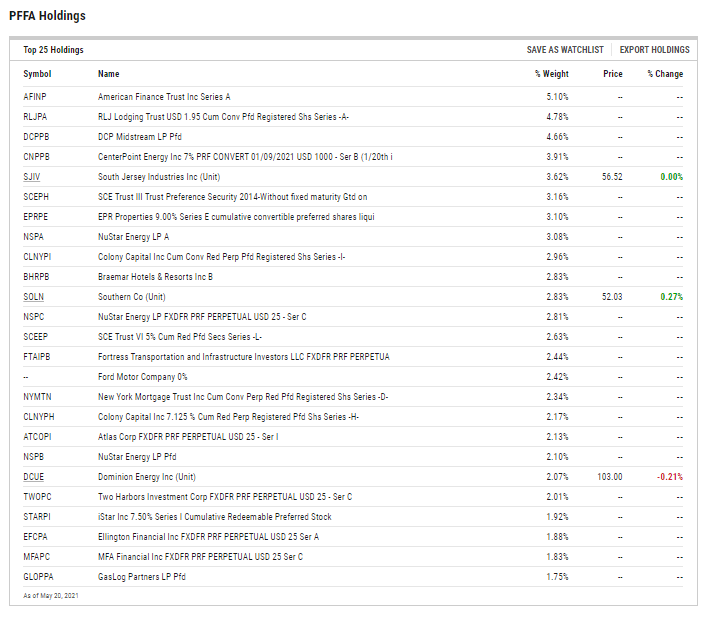

PFFA separates itself from its rivals by focusing on maximum yield-to-call, deploying modest leverage and using options overlays to boost income. That methodology pays off on the yield front. PFFA yields 7.66%, as compared to 4.88% for the ICE Exchange-Listed Preferred & Hybrid Securities Index.

There are other reasons to consider going active with PFFA. For example, active managers can better-account for credit opportunities than index funds. Additionally, active managers can sell preferreds trading above par and take those proceeds to fund purchases of undervalued preferreds.

“We continue to see that trading in high-yield preferred stocks is more influenced by idiosyncratic credit considerations than the direction of government bond yields. For example, travel, transportation, and certain real estate companies, which were impacted by reduced business and activity nationwide, have continued to show higher correlation to equity markets and have subsequently outperformed in 2021,” adds Virtus.

The proof is in the pudding. PFFA is up 14.20% year-to-date, while the ICE Exchange-Listed Preferred & Hybrid Securities Index is flat.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.