Micro cap stocks are the epitome of a high risk/high reward asset class. Their returns are amplified relative to traditional small cap strategies, but the risks are high due to a lack of information on many micro cap companies.

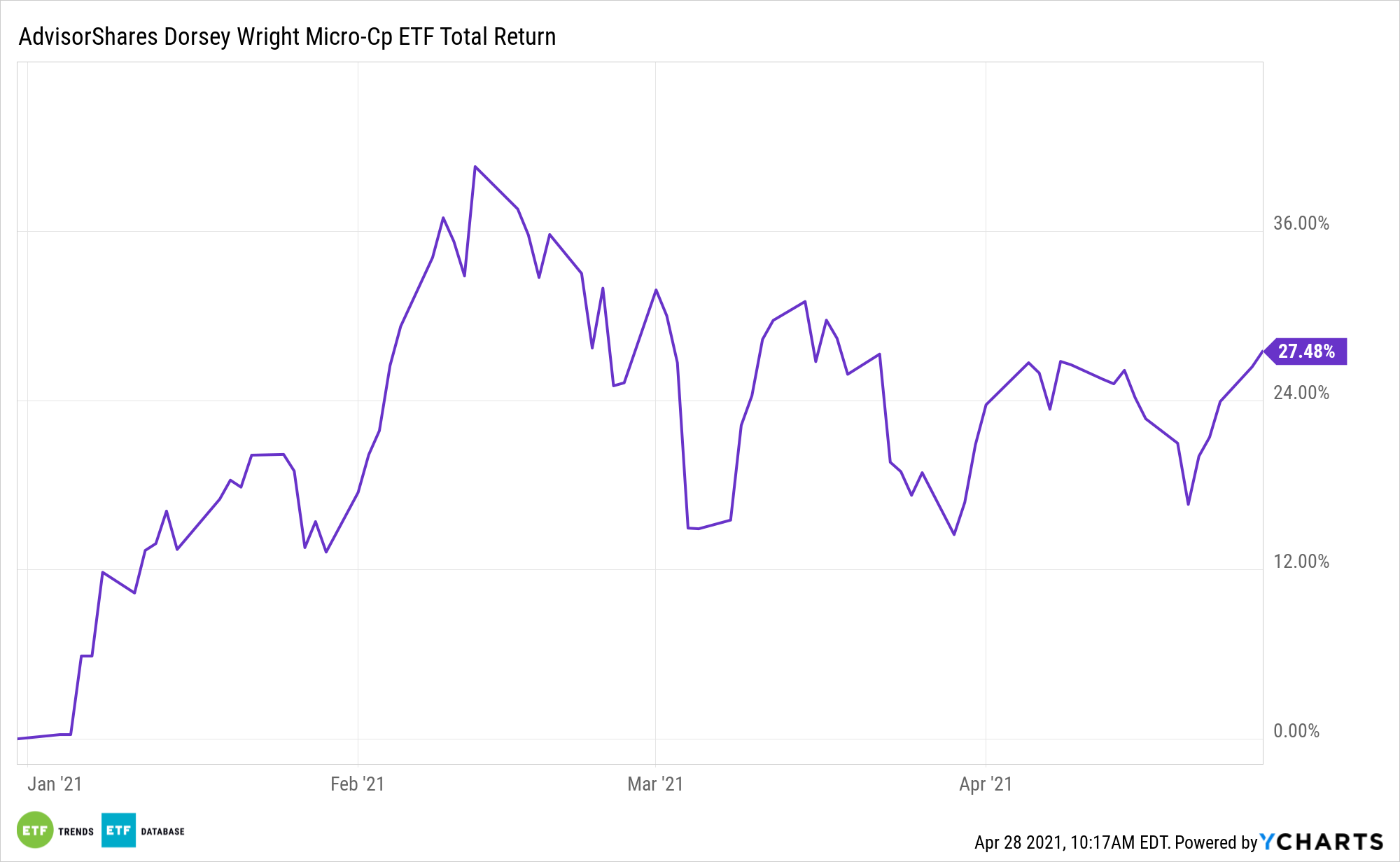

The AdvisorShares Dorsey Wright Micro Cap ETF (NASDAQ: DWMC) is an exchange traded fund that brings active management to the latter problem of information-gathering.

DWMC hopes to capitalize on companies with a market capitalization of less than $1 billion. DWMC invests in micro cap equities with favorable relative strength characteristics that meet or exceed Dorsey Wright’s proprietary methodology for selection. The micro cap portfolio will consist of 150 holdings that takes advantage of strong performers and while avoiding underperformers.

“DWMC’s investment strategy follows Nasdaq Dorsey Wright’s core philosophy of relative strength investing – a proprietary systematically-driven methodology that buys securities that have appreciated in price more than other equities within its investment universe and holding those securities until they exhibit sell signals,” according to AdvisorShares. “No company fundamental data is involved in the analysis and the systematic nature of Dorsey Wright’s process removes emotion from the day-to-day decision making. Stock selection is strictly based on the highest ranked securities as measured by the relative strength investment process.”

Making Small-Scale Investing Easier

Multiple data points highlight the utility of DWMC.

“In recent years, the level of coverage of the micro cap market by brokers and research houses has fallen, and 21% of professional investors in the US expect this trend to continue over the next 12 months. Only 10% anticipate this situation to improve,” according to MBH Corp.

One way of looking at DWMC is that it does the heavy lifting for investors. That’s notable because it appears that legwork is exactly the sort of thing some market participants simply don’t want to deal with.

“As a result of micro cap stocks receiving less attention from brokers and analysts, 24% of professional investors in the US expect the cost of obtaining information on the sector to increase over the next three years, and just 22% expect this to fall,” adds MBH.

Lastly, another point in favor of DWMC is that, broadly speaking, micro caps trade at a discount to small caps.

“MBH Corporation’s research also found that although micro caps are trading at a significant discount to the wider small cap universe, 17% of US professional investors expect this to increase over the next 12 months,” according to the research firm.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.