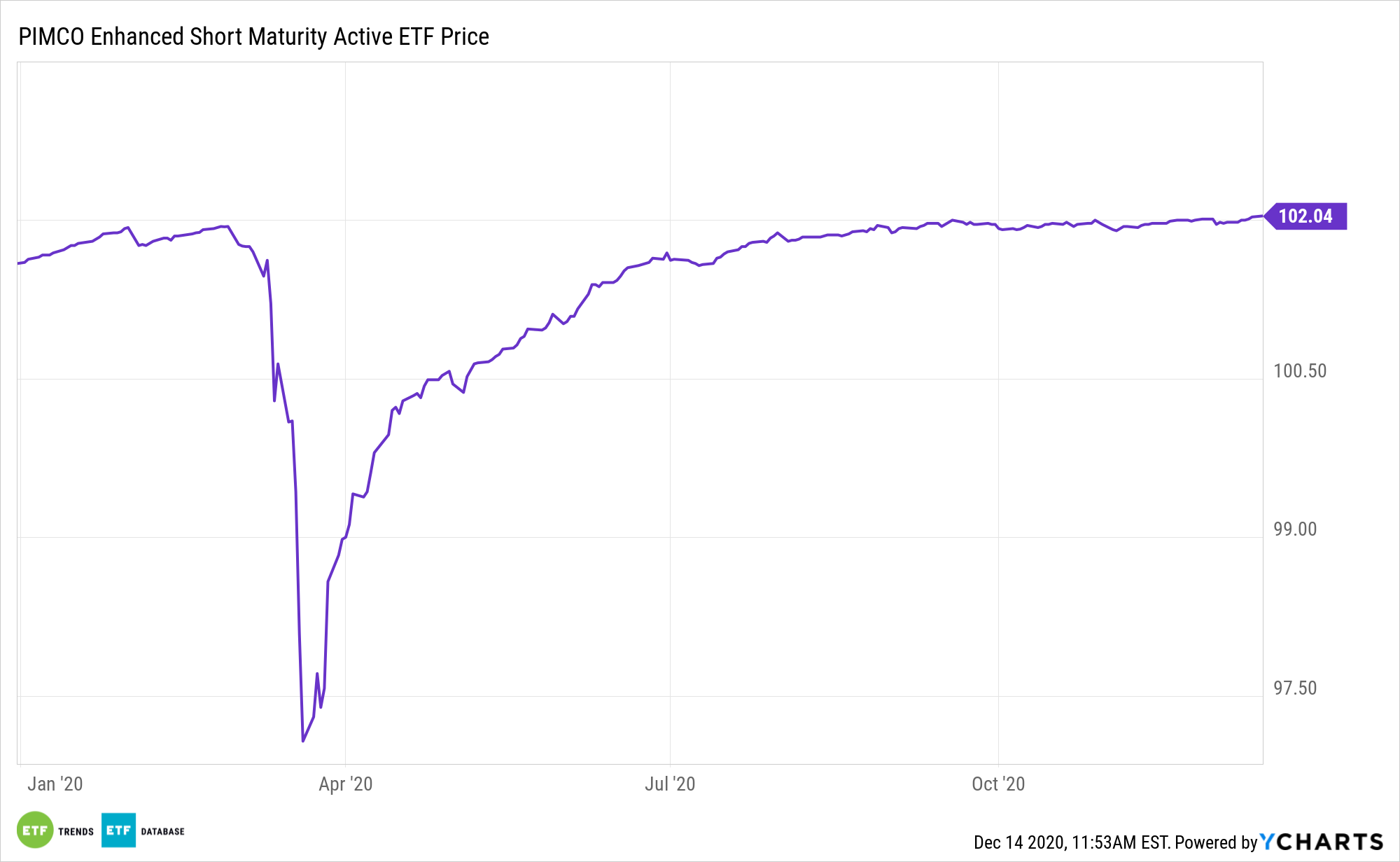

Active management is a great tool to have when it comes to a strenuous fixed income universe. The PIMCO Enhanced Short Maturity Active ETF (NYSEArca: MINT) is a practical avenue for investors seeking reduced rate risk with solid returns.

MINT seeks greater income and total return potential than cash and money market funds by investing in a broad range of high-quality short-term instruments.

Fixed income investors now have to get strategic when it comes to the bond markets as well. One area that investors can look to is investment-grade debt issues with a prime focus on quality–with MINT, this quality is inherent in its exposure to investment-grade debt.

“Exchange-traded funds focused on fixed-income securities can be excellent choices for getting exposure to bonds. For starters, many ETFs are transparent–they track indexes with very specific duration and credit-quality traits–and offer few surprises,” writes Morningstar’s Susan Dziubinski. “Moreover, they’re usually low-cost, which is even more important when investing in bonds than in equities: Every basis point paid in expenses is one less basis point in return, and returns are typically tougher to come by with bonds than with stocks.”

MINT’s actively managed liquidity in short duration allocations can preserve liquidity for spending needs, defend against volatile markets, generate added portfolio income, harvest incremental return beyond money markets and Treasury Bills, and create liquidity and purchasing power for opportunistic allocations.

The fund can serve as a standalone fixed income product in a portfolio, or serve as a complement to a broad-based, passively managed aggregate bond fund. MINT is one of 14 fixed income ETFs that earn “gold” ratings from Morningstar.

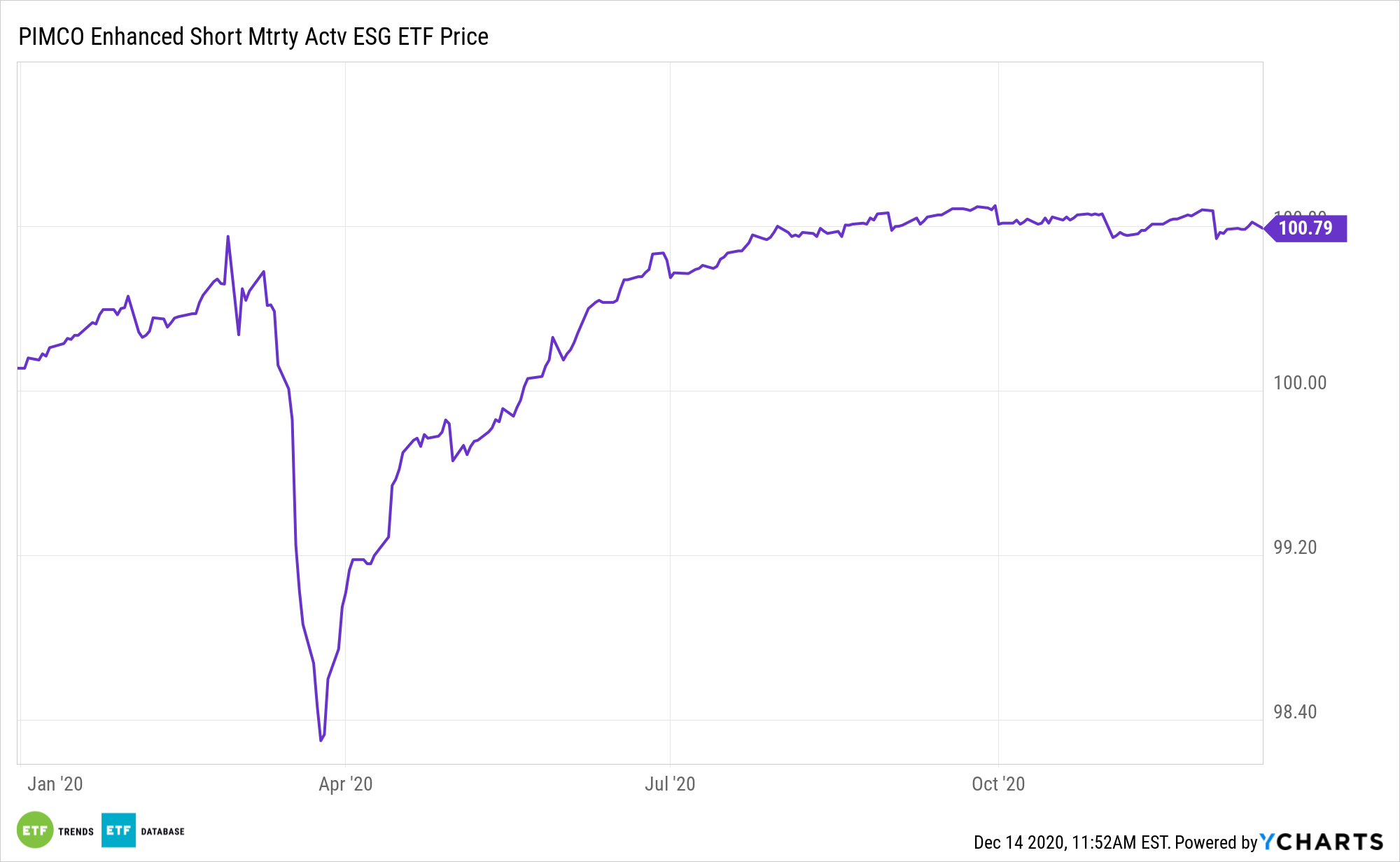

MINT’s ESG Compatriot

MINT also has an active, ESG counterpart – the PIMCO Enhanced Short Maturity Active ESG ETF (NYSEArca: EMNT).

EMNT invests in high-quality money market instruments and short-term fixed income securities. The fund blends PIMCO’s active fixed income management with its disciplined ESG investment framework. The framework favors issuers identified by PIMCO as best-in-class, with robust environmentally-conscious practices, strong corporate governance, and industry-leading social policies.

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.