Crypto exchange operator Coinbase (NASDAQ: COIN) commences merely its third trading day on Friday, but the highly anticipated Bitcoin equity play already resides in several exchange traded funds.

Thank goodness for active management because index-based funds are still waiting to add Coinbase equity. The earliest that will happen for most passive funds is next week.

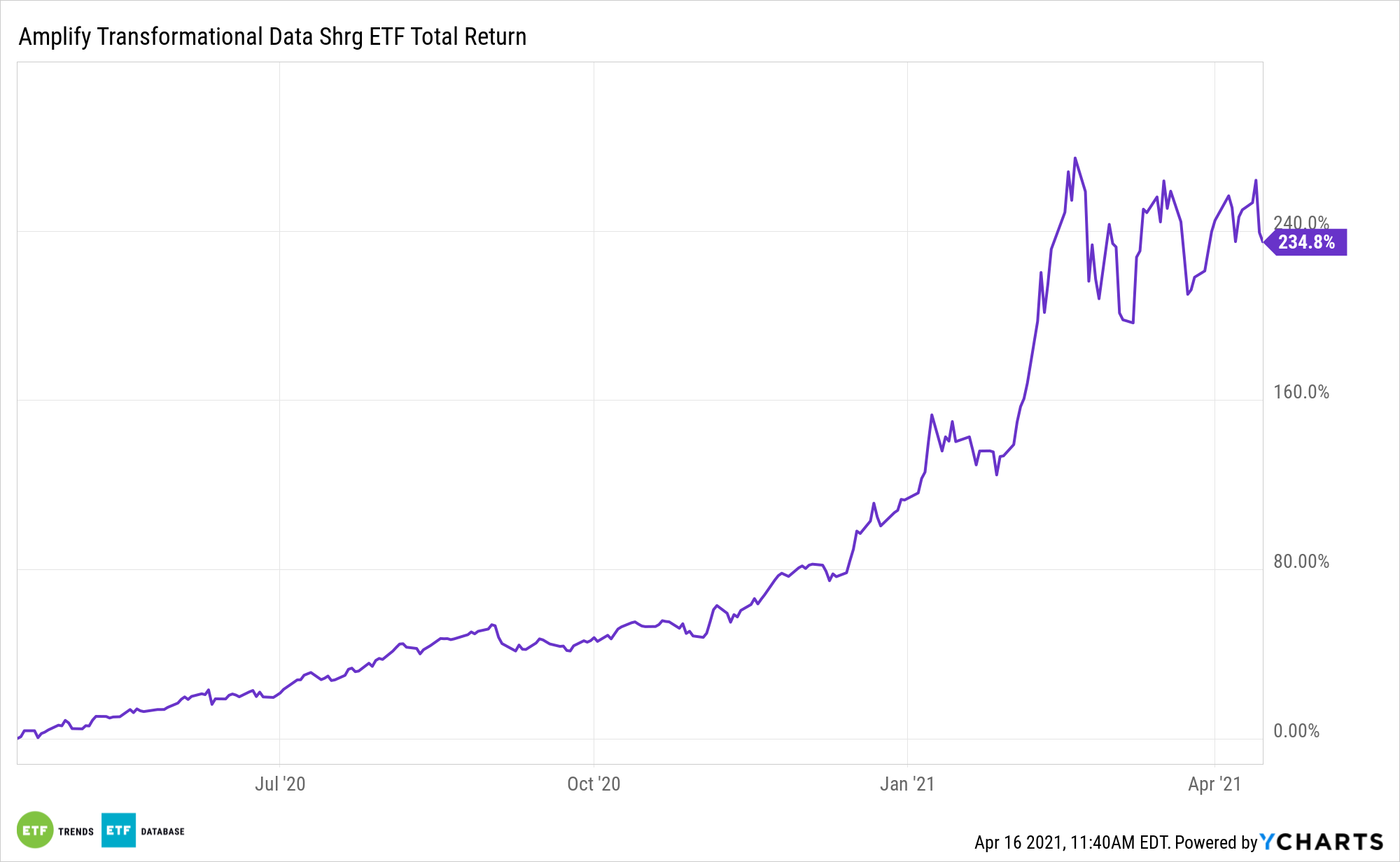

The Amplify Transformational Data Sharing ETF (BLOK) is one of the early ETF adopters of Coinbase stock.

According to Amplify, “BLOK is an actively managed ETF that seeks to provide total return by investing at least 80% of its net assets in equity securities of companies actively involved in the development and utilization of blockchain technologies.” Amplify classifies each company included in the index as either ‘core’ or ‘secondary’ based on how closely-tied the company’s business is to blockchain development.

Some other well-known actively managed ETFs are also in the Coinbase stock game.

“Cathie Wood’s funds have snapped up about $352 million worth of shares in the biggest U.S. cryptocurrency exchange Coinbase Global Inc. over two days, as the stock’s turbulent start continue,” reports Abhishek Vishnoi for Bloomberg.

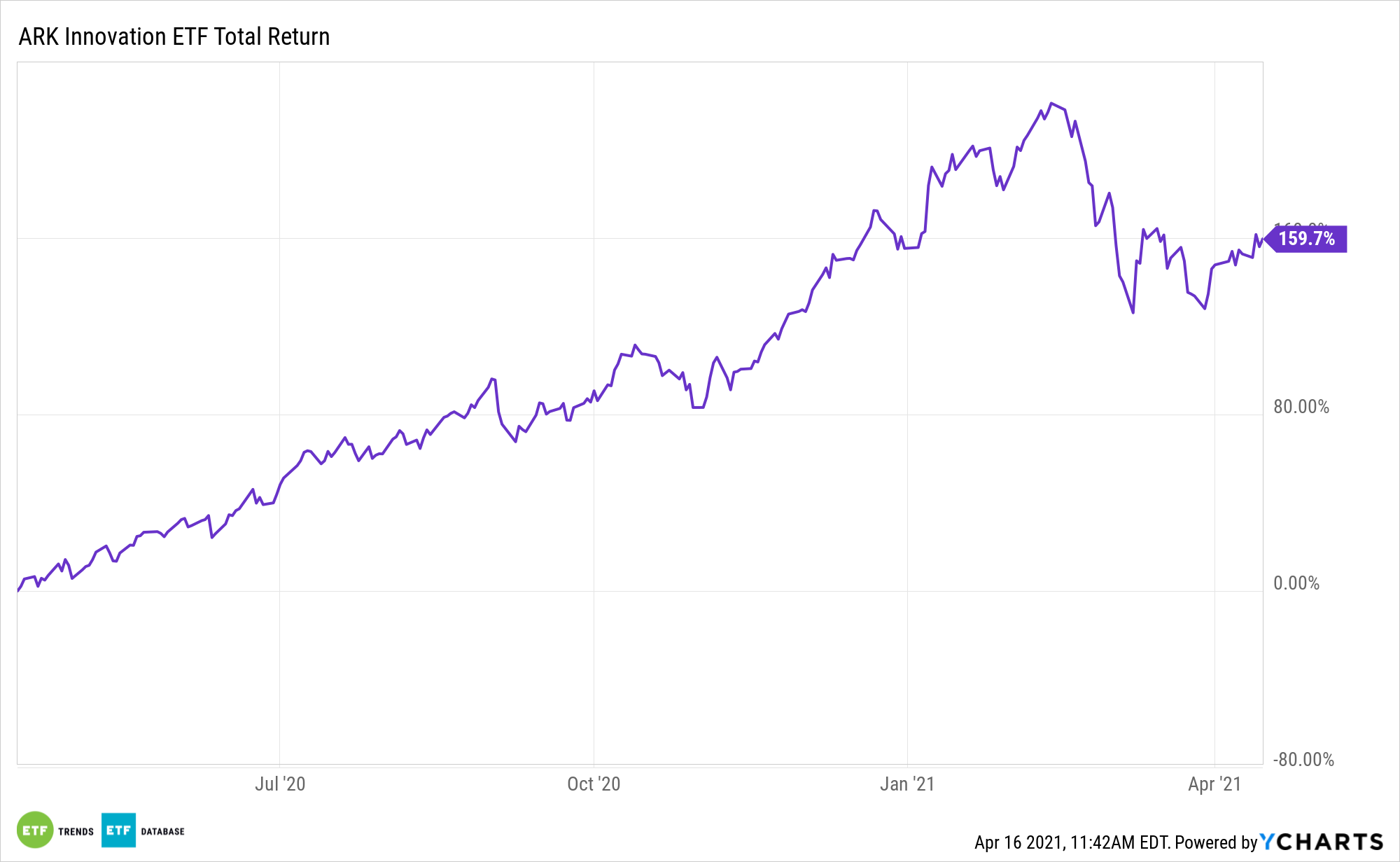

The ARK Innovation ETF (NYSEArca: ARKK) is already a sizable Coinbase owner.

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

Data indicate ARK pared exposure in another exchange operator, perhaps to make room for Coinbase.

“Separately, Ark’s funds have sold shares in New York Stock Exchange parent Intercontinental Exchange Inc. for two consecutive sessions, the emailed data showed,” according to Bloomberg.

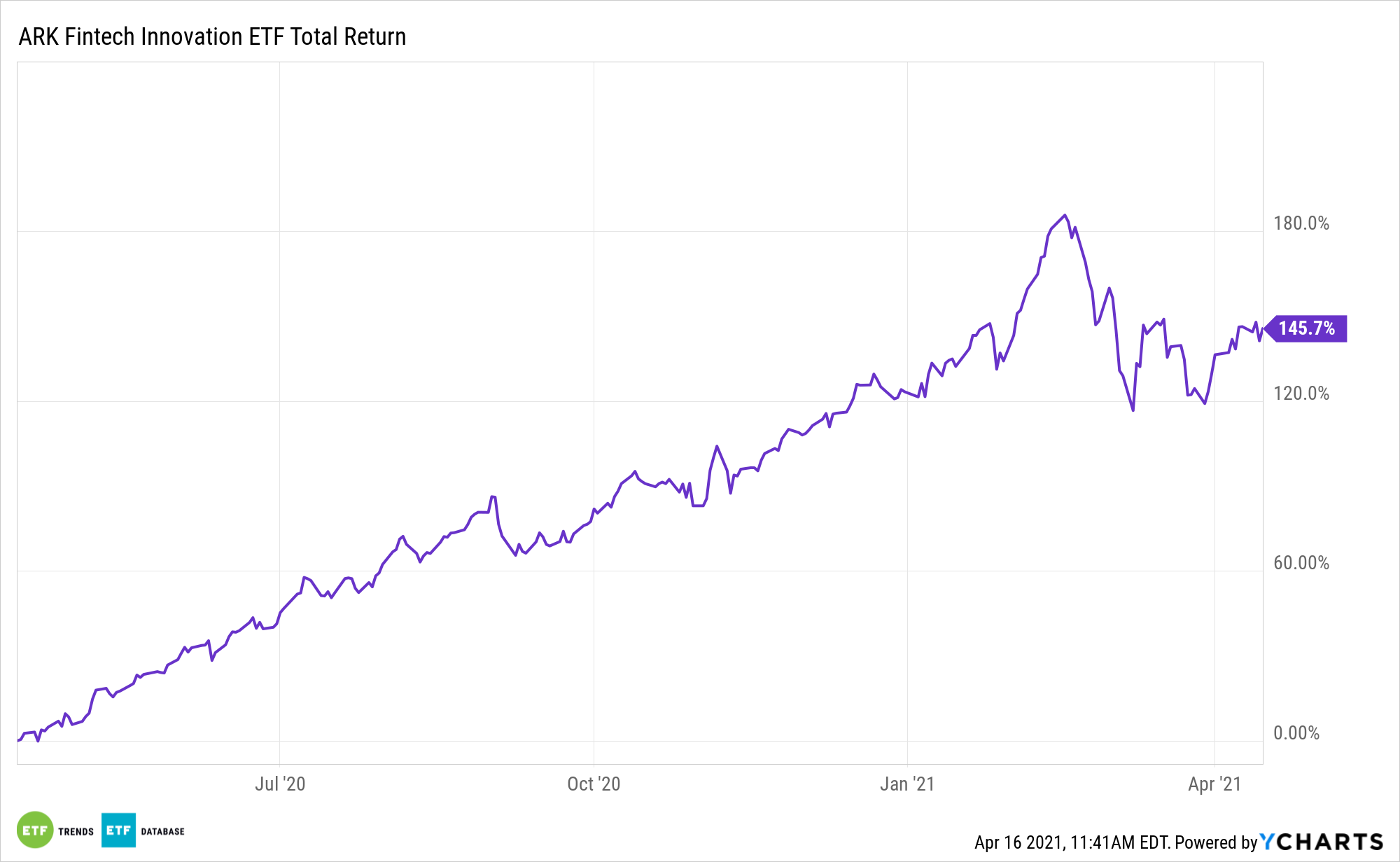

Not surprisingly, the ARK Fintech Innovation ETF (NYSEARCA: ARKF) is also an example of an ETF early to the Coinbase game.

The actively managed ARKF invests in equity securities of companies that ARK believes are shifting financial services and economic transactions to technology infrastructure platforms, ultimately revolutionizing financial services by creating simplicity and accessibility while driving down costs.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.