Market observers penning the obituaries for actively managed strategies may have been too hasty. More data is confirming that investors are embracing active ETFs in significant fashion this year.

In March, actively managed ETFs listed in the U.S. added $13.35 billion in new assets, bringing the overall assets under management tally for the group to a record $329 billion, according to ETFGI, a London-based ETF research provider.

“The S&P 500® gained 4.4% in March and 6.2% in Q1, supported by the increasing pace of COVID-19 vaccinations and continued monetary and fiscal support. Global equities gained 2.5% in March and 5.2% in Q1, as measured by the S&P Global BMI. 38 of the 50 countries advanced during the month and 35 were positive at the end of Q1. Developed markets ex-U.S. gained 2.3% in USD terms in March and 4.0% in Q1. Emerging markets were down 1.6% in USD terms in March and up 2.8% in Q1, as measured by the S&P Emerging BMI,” said ETFGI founder Deborah Fuhr in a statement.

Data also confirm that fixed income ETFs are a driving force of active ETF adoption, which makes sense at a time when passive bond strategies may not be responsive enough for a tricky bond environment.

“Fixed Income focused actively managed ETFs/ETPs listed globally gathered net inflows of $6.45 billion during March, bringing net inflows for Q1 2021 to $17.91 billion, more than the $1.14 billion in net inflows Fixed Income products had attracted in Q1 2020. Equity focused actively managed ETFs/ETPs listed globally attracted net inflows of $5.57 billion during March, bringing net inflows for Q1 to $25.72 billion, much greater than the $5.10 billion in net inflows equity products had attracted in Q1 2020,” notes ETFGI.

Among U.S.-listed active ETFs, the ARK Innovation ETF (NYSEArca: ARKK) was the top asset gatherer in March, with $1.66 billion of inflows.

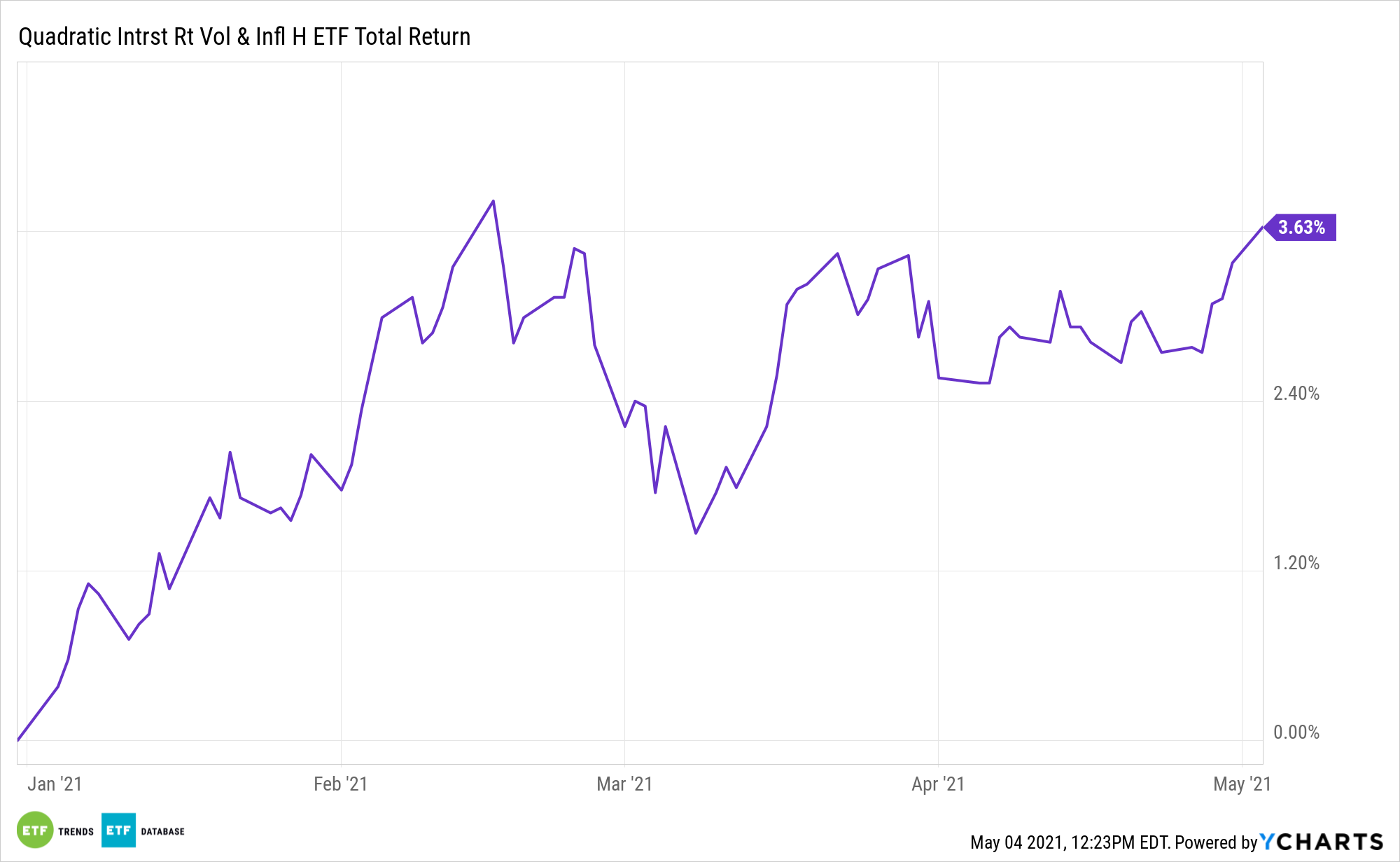

Perhaps owing to an embedded inflation hedge, the Quadratic Interest Rate Volatility and Inflation Hedge ETF (NYSEArca: IVOL) added $570.29 million in new assets in March, good for the third spot on the active ETF list.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.