Various forces could potentially shape the global markets this year and beyond, including Technology, China, Japan, and value. In T. Rowe Price’s article, “Five Forces in International Equities Investors May Be Underestimating,” author Justin Thomson, CIO Equity and Head of International Equities, explains how a range of market dynamics could have a long-term effect that may surprise investors.

These global trends focus on China, Japan, technology, value, and the resiliency of international markets. Each may provide distinct opportunities for investors seeking to shape and diversify their portfolios in the time following the effects of the Covid-19 pandemic.

The Expansion of China

China may be the world’s second-largest economy, yet investors seem unwilling to acknowledge its continued expansion. As the article states, “While China’s share of global gross domestic product ballooned from 9% to 16% between 2010 and 2019, its expansion has not been matched in global equity indices.”

A closer look shows China has emerged as a leader in a region showing large growth across various sectors for internationally-minded investors. This is interestingly a good case for those not concerned with the major names, as “those willing to explore the opportunities at the margins have the potential to discover the lesser-known stock stories of tomorrow—those with the potential to compound over time and generate real value when held over the long term.”

With these macroeconomic and market dynamics set to continue, China has enjoyed a V-shaped recovery from the Covid-19-related shock in early 2020. Policymakers are supporting innovation and rebalancing toward domestic consumption as core components. Additionally, “Investors can do more to uncover the alpha potential of China’s growing and diverse market as a possible feature of their international equity portfolios.”

Japan’s Designs Continue To Function

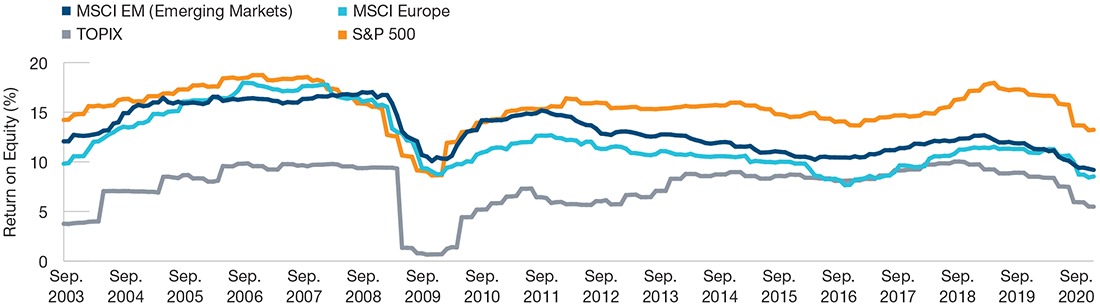

While it’s been a popular mindset to undervalue the Japanese economy, “Japan has been the best‑performing major developed equity market over the past 10 years outside the U.S.” Thanks to long-term structural changes in company governance, foreign investment, and a decrease in domestic cross-ownership, Japanese equities have been on a steady course, leading to profitability levels matching up to its global peers.

Sources: FactSet Research Systems Inc. All rights reserved. TOPIX—Tokyo Stock Exchange, Inc., MSCI, S&P (see Additional Disclosures).

This efficiency level is accompanied by improvements in capital and balance sheet management, which has led to changes in capital allocation patterns. These changes will ultimately be powerful drivers of equities over the next cycle. Yes, this means potential opportunities for investors when it comes to strategic allocation to Japanese equities, which is a big step up from past regard.

A New Tech Boom

The idea of new tech coming in and old tech going out has been a constant and rapid understanding of how markets focused around these related sectors have evolved over the past decade. There has been an interesting change in that pace recently, however. “The economic and social consequences of the coronavirus pandemic have served to accelerate the rise of some technology platforms in retail, social media, streaming content, and remote conferencing.”

While exposing the divide between the companies and industries benefiting from this disruption and those challenged by it, the constant reweighting for those siding with innovation have benefitted. There’s been a large shakeup in equity markets due to recent tech and thematic developments, which has allowed U.S. tech stocks to dominate headlines.

This applies to China and elsewhere as well. So, this innovation is not just looking at the U.S. but internationally as far as shaping markets in the months/years to come.

The Return Of Value

Global equity markets were able to make a strong comeback following the initial shock of the pandemic in early 2020. “Prior to the pandemic, “growth” as a factor had already been in the ascendency for a long time—this was then extended by the acceleration of disruptive forces brought about by the pandemic.” Now, there are signs of improving economic conditions and other factors that all contribute to a recovery in value stocks.

“With markets currently elevated and in the wake of the prolonged growth cycle, relative prices look increasingly favorable for value‑orientated areas of the market.” There’s a stronger backdrop for value stock pickers, in particular. With that in mind, it’s essential to distinguish between cyclically depressed companies and those with more underlying long-term structural concerns.

This is where emerging markets provide an opportunity, given the polarization in valuations between the growth and value segments of the market. “We believe emerging market currencies are undervalued.” These are segments with potentially good opportunities for investors, given the high exposure to cyclical sectors.

The Ascent Of International Markets

International equities are set to reverse their period of underperformance. The factors that have kept the U.S. equity market ahead are coming under pressure. “We believe that a post‑pandemic recovery in growth, fueled by consumer confidence and massive fiscal spending, is likely to feed through to inflation expectations.”

Outside the U.S., however, a weaker dollar may benefit international returns, and the dollar has weakened against every other G-10 currency since April 2020. Higher interest rates have taken their toll as well.

“Ultimately, if the tide does turn against the trend of U.S. equity outperformance versus international, investors could potentially pivot allocations to try to catch the wave, generating additional momentum for international equities.”

For more news, information, and strategy, visit the Active ETF Channel.